Speed, convenience and ease of use are driving interest in a growing variety of payment options and digital technologies. Consumers have become accustomed to seamless digital solutions while shopping, banking and conducting their daily affairs, and innovations that can provide or improve on these experiences are in top demand.

Contactless payment options are a prime example. Because consumers find the tap-and-go nature of contactless to be quicker and more convenient than inserting cards into readers, contactless use has proliferated. PSCU found that the number of credit union (CU) members using contactless cards increased 14% in 2022, with 82% of those who had a contactless card saying they used it at least a few times a year. When asked why, users reported ease of use, convenience and speed as the top three reasons.

Younger consumers drive digital demand

Though there is interest in digital payments choice across the board, younger consumers are by far the most interested in this innovation. According to a recent survey, 38% of millennials reported using mobile wallets to make a payment in the past month, compared to 31% of Gen X and only 22% of baby boomers.

PSCU’s most recent “Eye on Payments” survey yielded similar findings, with 75% of younger millennials reporting use of their mobile wallets a few times a year. The survey also found that 81% of Gen Z respondents used their phones to make payments or conduct banking, compared to only 54% of the entire population. This should come as no surprise, as younger generations are the most familiar with — and reliant on — new technology.

Younger consumers are also the most interested in buy now, pay later (BNPL) solutions. PSCU found that 55% of younger millennials are likely or extremely likely to use a BNPL program, an increase of 57% from 2021, making them the generation most likely to leverage BNPL. The survey noted that this is consistent with younger consumers’ desire to build credit as well as the unfortunate fact that younger consumers have been hard-hit economically, with 19% of Gen Z respondents having lost their jobs in the past year.

CUs can do more to innovate

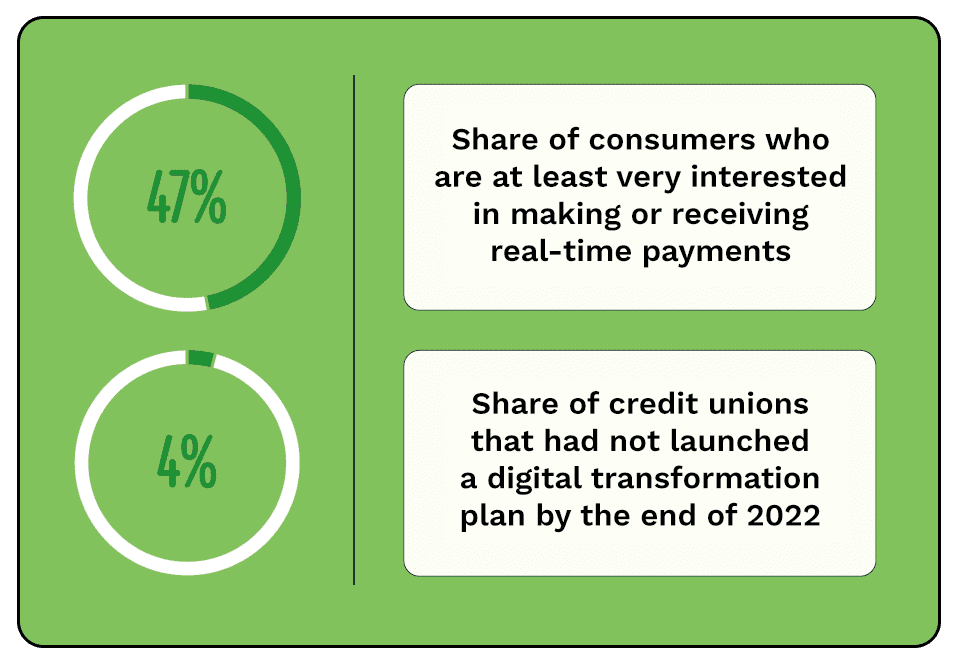

Credit unions have an opportunity to meet the growing desire for digital payments while ensuring their own future by appealing to key demographics. One study found that only one-quarter of CUs had plans to offer real-time payments in 2022. With PYMNTS research estimating that nearly half — 47% — of consumers are at least very interested in making or receiving real-time payments, CUs not already doing so should explore real-time payment capabilities as well as instant approvals and denials for credit card applications.

Many CUs are already taking steps to meet these preferences. Of those regarded as early launchers — the CUs quickest to release new products — 74% are offering mobile banking solutions, 74% are providing contactless cards and 68% support BNPL, according to PYMNTS. The industry is clearly shifting toward digital innovation. In fact, only 4% of credit unions had not launched a digital transformation plan by the end of 2022.