How Credit Unions Are Playing David Against Industry Goliaths

Regardless of a credit union’s size, members expect digital-first capabilities that can compete with what for-profit financial institutions (FIs) offer. While many CUs are rising to the innovation challenge, there are differences across the CU landscape. To measure CUs’ current and planned innovations, PYMNTS Intelligence developed the Innovation Readiness Index (IRI). Scores indicate how well CUs’ current products, features and planned innovations align with what members want and the products and features linked to higher satisfaction levels.

Regardless of a credit union’s size, members expect digital-first capabilities that can compete with what for-profit financial institutions (FIs) offer. While many CUs are rising to the innovation challenge, there are differences across the CU landscape. To measure CUs’ current and planned innovations, PYMNTS Intelligence developed the Innovation Readiness Index (IRI). Scores indicate how well CUs’ current products, features and planned innovations align with what members want and the products and features linked to higher satisfaction levels.

On average, credit unions earned an IRI score of 44.2 out of 100. This indicates that the average CU’s current and future portfolio matches members’ preferences approximately 44% of the time. In contrast, the most innovative CUs, or top performers, average an IRI score of 65.

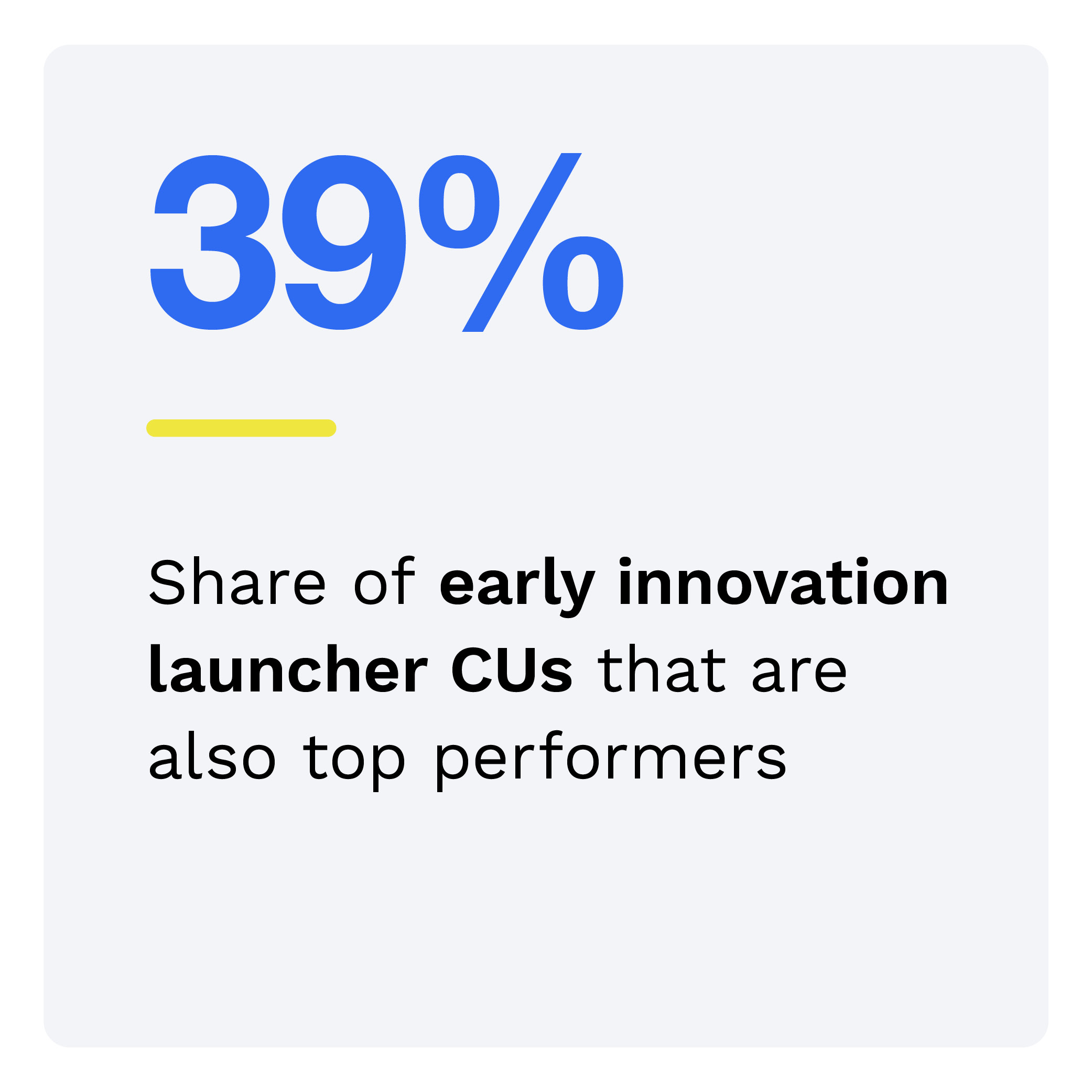

PYMNTS Intelligence data shows smaller credit unions are punching above their weight. Seventeen percent of CUs with less than $1 billion in assets are top performers. These smaller CUs are 35% more likely to be top performers than those with more than $5 billion in assets. This indicates that CU size does not necessarily correlate with high performance. In fact, smaller CUs are finding their own path to innovation.

These are some findings from the “2024 Credit Union Innovation Readiness Index,” a PYMNTS Intelligence and Velera (formerly PSCU/Co-op Solutions) collaboration. The report examines how CUs can reap the benefits of digital innovation to gain members and reduce churn. The index is based on two surveys. First, a survey of 200 CU executives from March 7 to April 2 explored CUs’ current product and feature offerings and their plans for future innovation. Second, a census-balanced survey of 4,551 U.S. consumers from Feb. 29 to April 8 investigated which products and features consumers want and expect from CUs.

Other key findings from the report include:

Even among top-performing credit unions, the roadmap to innovation can look very different.

All top-performing CUs with more than $5 billion in assets invest in payment innovation, offering a simple and intuitive digital user experience and a highly personalized user experience to attract new members. Among those with less than $1 billion in assets, 69% think less restrictive credit offerings could grow their membership. Another 62% believe offering a simple and intuitive user experience is an important innovation to drive growth.

Four in 10 smaller credit unions face budgetary and technological constraints in their innovation process.

Smaller CUs are three times more likely than larger CUs to cite budgetary constraints as their biggest obstacle to innovation. Interestingly, 16% of smaller CUs say technological challenges are their biggest obstacle to innovation, compared to 26% of larger CUs. This comparison highlights that CUs have different innovation roadmaps based on their asset size. The report explores the relationship between asset size and innovation priorities.

External collaborations enable smaller firms to expand their innovation readiness.

Virtually all smaller credit unions agree that collaboration is essential to their payment innovation process. In fact, nearly all top performers also point to collaboration as crucial. Smaller and larger CUs have developed an average of 3.7 products and features fully or partially with the help of third parties, suggesting that working with partners is an essential innovation strategy for CUs, independent of asset size.

Despite innovation challenges, smaller CUs are more likely to be top performers than larger ones. The help of external partners is just one factor the report explores. Download the report to learn how credit unions are leveraging innovation to provide the banking experience digital-first consumers expect.