There might be a long way to go before we buy things with bitcoin without a second thought, where Ripple’s XRP is right up there with debit cards, and top of mind, when we go to check out online or at the register. Cryptocurrencies — bitcoin and the hundreds of alternatives (or altcoins) that seem to dominate headlines — are gaining traction as a means of transacting, and are moving beyond merely being traded on exchanges.

In the Cryptocurrency Payments Report: How Consumers Want to Use It to Shop and Pay, done in collaboration between PYMNTS and BitPay, there’s evidence of a growing awareness of cryptos’ availability to be used in everyday commerce – and a growing desire to take advantage of that availability. The survey of more than 8,000 U.S. consumers — defined as current and former crypto owners — allows us to extrapolate how the population at large feels about using crypto as a payment option.

First off, we’re talking about a relatively small cohort that actually has crypto in hand, with familiarity in how it works and how it can be used. As many as 84 percent of consumers have never owned cryptocurrency — leaving a sizable greenfield opportunity for crypto companies and exchanges to actually get their tokens into users’ digital wallets.

Crypto ownership has indeed been growing quickly, up 63 percent year on year. Income levels are at least one determinant of ownership, where individuals making at least $50,000 to $100,000 are among the “most prevalent” demographics who have owned crypto in the past (5.8 percent) and currently own it (15.6 percent).

Break it down a bit further, and we see that ownership skews a bit younger: 19 percent of millennials currently own cryptos, while more than 27 percent of all millennials and bridge millennials own — or have owned — crypto, outpacing the 16.7 percent of Generation X consumers. Only about 5 percent of Baby Boomers and seniors own or currently own cryptos.

Interest And Action

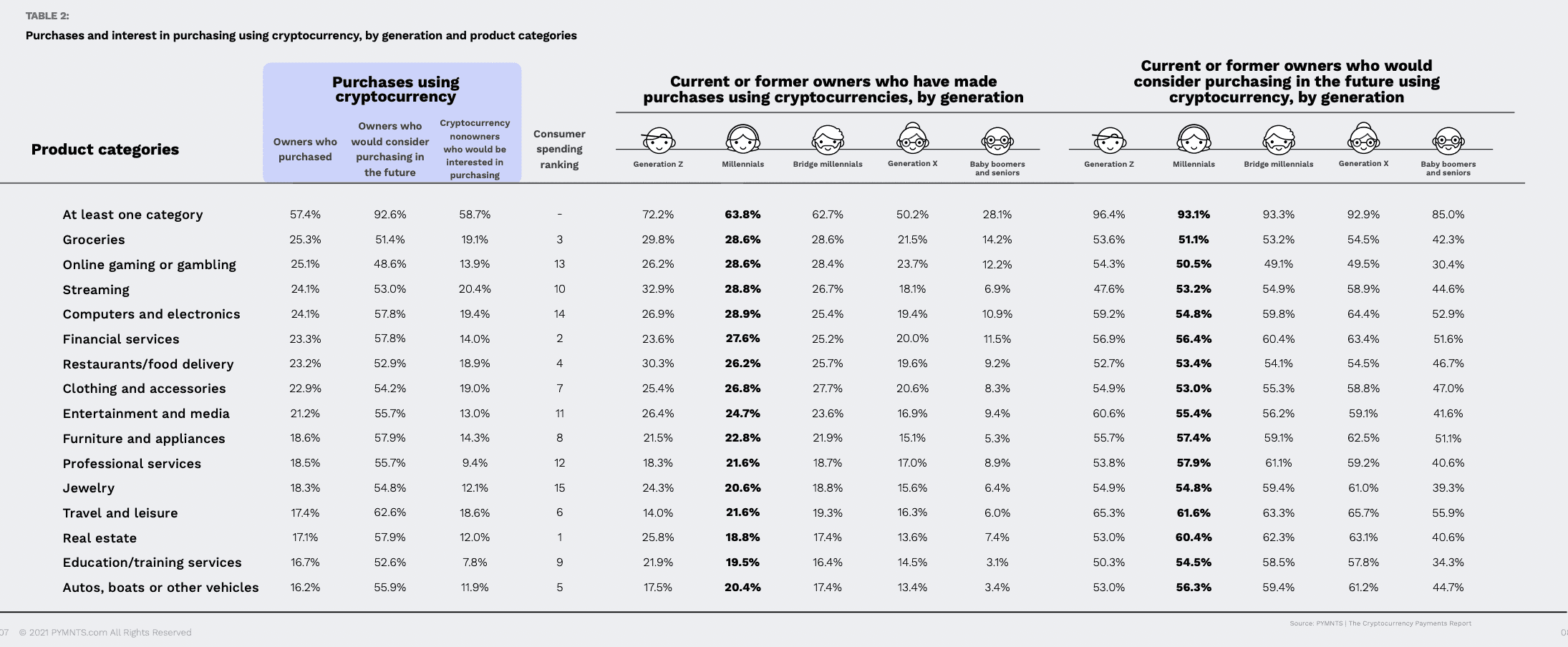

When it comes to paying with cryptocurrencies, there’s interest and then there’s action, as we’re seeing roughly equal measures in both owners and non-owners. PYMNTS found that 57 percent of former or current crypto owners made at least one purchase with those digital tokens last year. And roughly 59 percent of consumers who have never owned crypto would be interested in using it to make purchases in the future.

And drilling down a bit, where they want to spend cryptos is noteworthy: As many as 46 million consumers — about 18 percent of the total population — would consider using crypto in a retail setting, regardless of whether they own the digital offerings at present or not. And volatility remains a bit of a headwind, perhaps not surprisingly, as a quarter of those who have never bought cryptos worry about volatility.

If past is prologue, then there are several categories where consumers have already paid with crypto, and where they would consider purchasing with it in the future. Broadly speaking, 57 percent of owners who purchased crypto have actually used it for at least one purchase of a good or service; almost 93 percent of those who own crypto would like to buy something with their crypto stash in the future. The top category seems to be groceries, which is where about 25 percent of crypto owners actually spent some holdings, and where 51.4 percent of owners holding cryptos would like to transact.

If past is prologue, then there are several categories where consumers have already paid with crypto, and where they would consider purchasing with it in the future. Broadly speaking, 57 percent of owners who purchased crypto have actually used it for at least one purchase of a good or service; almost 93 percent of those who own crypto would like to buy something with their crypto stash in the future. The top category seems to be groceries, which is where about 25 percent of crypto owners actually spent some holdings, and where 51.4 percent of owners holding cryptos would like to transact.

There’s at least some evidence that such smaller-ticket, everyday purchases such as groceries might be the “sweet spot” for spending cryptocurrencies: 48.3 percent of those who transacted in the last year spent on average less than $100. Another 31 percent spent $100 to $1,000. Only about 19 percent spent more than $1,000.

Bitcoin is the de facto holding of choice, as 80 percent of current holders own that marquee name in the space. As bitcoin goes, then, so too goes “spendability,” as we’ve seen from recent announcements from the likes of PayPal, which said earlier this year that it will let customers buy goods and services with cryptocurrency through a “Checkout with Crypto” option (though the merchants are in fact paid with fiat).

Bitcoin is the de facto holding of choice, as 80 percent of current holders own that marquee name in the space. As bitcoin goes, then, so too goes “spendability,” as we’ve seen from recent announcements from the likes of PayPal, which said earlier this year that it will let customers buy goods and services with cryptocurrency through a “Checkout with Crypto” option (though the merchants are in fact paid with fiat).

Next Up: Digging Into The Differences: Cryptos Vs. Stablecoins Vs. CBDCs