From in-person retail to digital options, the decade-long shift in how consumers send money abroad has expanded possibilities for cross-border remittances, and people are now favoring cheaper options that allow them to transfer funds easily, securely and conveniently across borders.

That explains why out of the 16% of United States consumers who send a total of $76 billion annually in remittances, the majority of those who own cryptocurrencies have found it to be a viable method for cross-border payments — and a more attractive alternative to traditional forms of payment.

Read more: The Digital Currency Shift: The Cross-Border Remittances Report

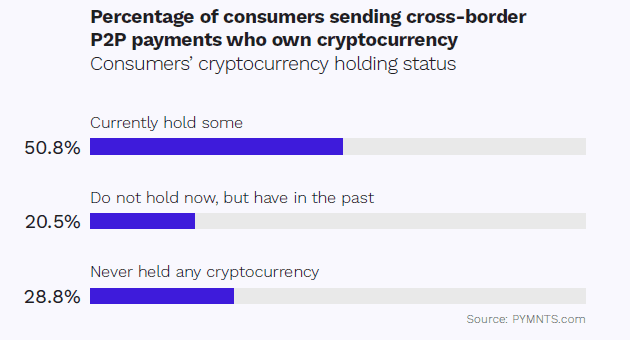

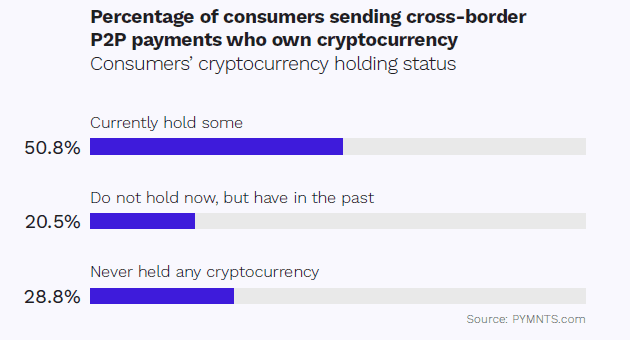

This is backed by data gathered in a recent PYMNTS report on cross-border remittances, which shows that half of all consumers (51%) using remittance services own cryptocurrencies, compared to approximately 12% of the general U.S. population — and they also are the most likely to use it to send money across borders.

Published in collaboration with the Stellar Development Foundation, the research found that many consumers increased the frequency with which they sent funds overseas in the wake of the pandemic, and their need for cheaper, more convenient alternatives led them to turn to virtual currencies for cross-border remittances.

Moreover, cryptocurrency has become an accepted payment method at many retailers and is available through many payment service provider (PSPs), making it easier for cryptocurrency owners to use it instead.

Advertisement: Scroll to Continue

The research, which is based on findings from a survey of more than 2,000 adult consumers representative of the U.S. population, also revealed that nearly a quarter (23%) of consumers surveyed — representing eight million adults — who made online payments to friends or family in other countries used at least one kind of cryptocurrency, while 13% of respondents said that digital currencies were their most used payment method for online cross-border remittances.

And cryptocurrency users tend to prefer innovative payment methods like mobile wallets, the study found, with 46% of them more likely to send funds directly into a mobile wallet, which offers the convenience and speed they desire.

In comparison, among consumers who send cross-border remittances and have never used cryptocurrencies, mobile wallet use remains low, with only 30% of those who make bank transfer remittances sending them to mobile wallets.

See also: Risk of Regulatory Overshoot Threatens Blockchain, Crypto Innovation and Growth

Cryptocurrency: Nigeria Leads the African Pack

In developing regions like Africa, the market for crypto-based remittances is rapidly expanding, given how cost-effective it is to transfer money across borders.

And Nigeria blazes the trail for cryptocurrency use on the continent, ranking third globally in terms of countries with the highest bitcoin trading volumes last year, behind only the United States and Russia, per the BBC.

Transactions worth more than $400 million were generated in the West African nation in 2020, with more than 1.1 million cryptocurrency trades registered per month on the global cryptocurrency trading platform, Paxful, that same year.

Related news: Bitcoin Daily: Nigerian School to Take Crypto for Fee Payments; JPMorgan Bearish on Bitcoin

In June, a private school in Kano State, New Oxford Science Academy, even said it had started accepting school fee payments in cryptocurrency, in defiance of repeated government attempts to curb its use in recent months.

On the business side, players like the pan-African cryptocurrency exchange Yellow Card are capitalizing on Nigerians’ demand for cryptocurrency to tap into the growing market.

Since launching in the country in 2018, the U.S.- and Africa-based FinTech has since pivoted into a crypto-based agency banking business, with plans to enable Africans to send remittances using its crypto service. Yellow Card’s goal to make cryptocurrencies like bitcoin, Ethereum and USDT Stablecoin accessible to anyone on the continent has been successful so far, recording a nearly 30X increase in users across Africa since the start of the pandemic.

The firm recently announced a $15 million Series A funding, led by key foreign investors including Jack Dorsey’s Square and Coinbase Ventures, to continue expanding beyond the 12 African countries in which it currently operates.

Commenting on the raise, Yellow Card’s Chief Bitcoin Officer Munachi Ogueke said the round was “validation that Africa has a major place in the crypto industry,” adding that “with the access that Yellow Card brings, powered by this raise, we can now let crypto proliferate and be a reliable enabler for people across the continent.”