The embedded finance platform Railsbank is working with the personal finance company Status Money to launch a cash-back credit card that invests rewards in cryptocurrency.

“By partnering with Railsbank, Status Money is evolving from being a financial advice platform to a true financial services company to meet the investment pain points of its customers, providing its customers with an automatic way of turning their everyday spending habits into cryptocurrency investments,” the companies said in a news release on Tuesday (Aug. 31).

“By partnering with Railsbank, Status Money is evolving from being a financial advice platform to a true financial services company to meet the investment pain points of its customers, providing its customers with an automatic way of turning their everyday spending habits into cryptocurrency investments,” the companies said in a news release on Tuesday (Aug. 31).

According to the companies, the card was brought to market “in record time” thanks to Railsbank’s Credit-Card-as-a-Service product, which lets partners offer credit cards without needing to become a bank themselves.

Cardmembers earn 2% in cash-back rewards on each purchase, automatically investing those rewards in cryptocurrency. This allows members to get a return on their investment “without having to deal with the headaches and tax burden of owning crypto,” the companies said.

“Credit cards are one of the most commonly used spending mechanisms, but over 80% of cards are issued by just the top 10 banks,” said Dov Marmor, COO of Railsbank’s North American operations. “There are simple reasons for this. Until now, issuing credit cards was an extremely complex and expensive business requiring vast technological infrastructure that meets heavy regulatory compliance.”

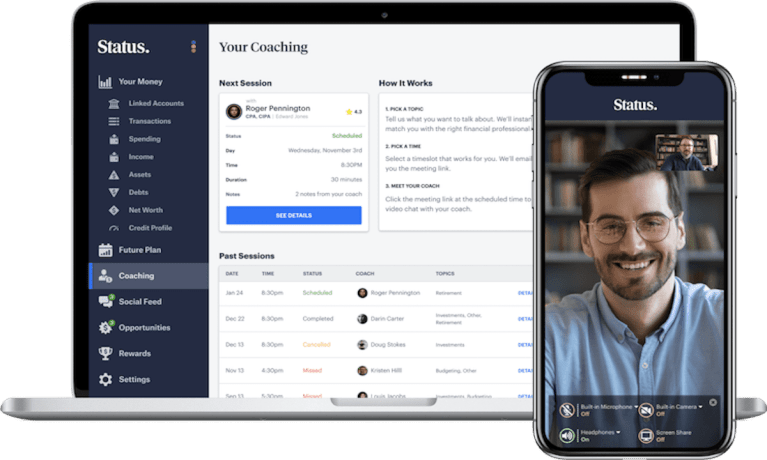

The companies say cardholders will get access to Status Money’s financial management tools, which include the ability to track and compare their net worth, and an opportunity to have a monthly video chat with a financial advisor.

“We’re giving everyone who spends money the ability to become an investor automatically,” said Majd Maksad, co-founder and CEO of Status Money. “If cryptocurrencies continue their skyward adoption, a member who spends $1,000 a month on this card will have rewards worth over $60,000 in five years. This is life-changing money for most of us.”

Learn more: Railsbank Nets $70M to Expand Embedded Finance Platform

Last month, Railsbank announced it had raised $70 million to help expand its embedded finance platform worldwide. In addition to Cards-as-a-Service, the London-based company’s products also include Credit-as-a-Service and Banking-as-a-Service.