Stablecoin regulation in Europe is, in theory, mostly settled under the EU-wide crypto regulatory framework that has largely been agreed upon.

The Markets in Crypto Assets (MiCA) legislation is in the final stages of the negotiation process. Nonetheless, provisions overseeing stablecoins have been particularly controversial, most notably when it comes to a cap on the use and issuance of large, non-euro-denominated stablecoins.

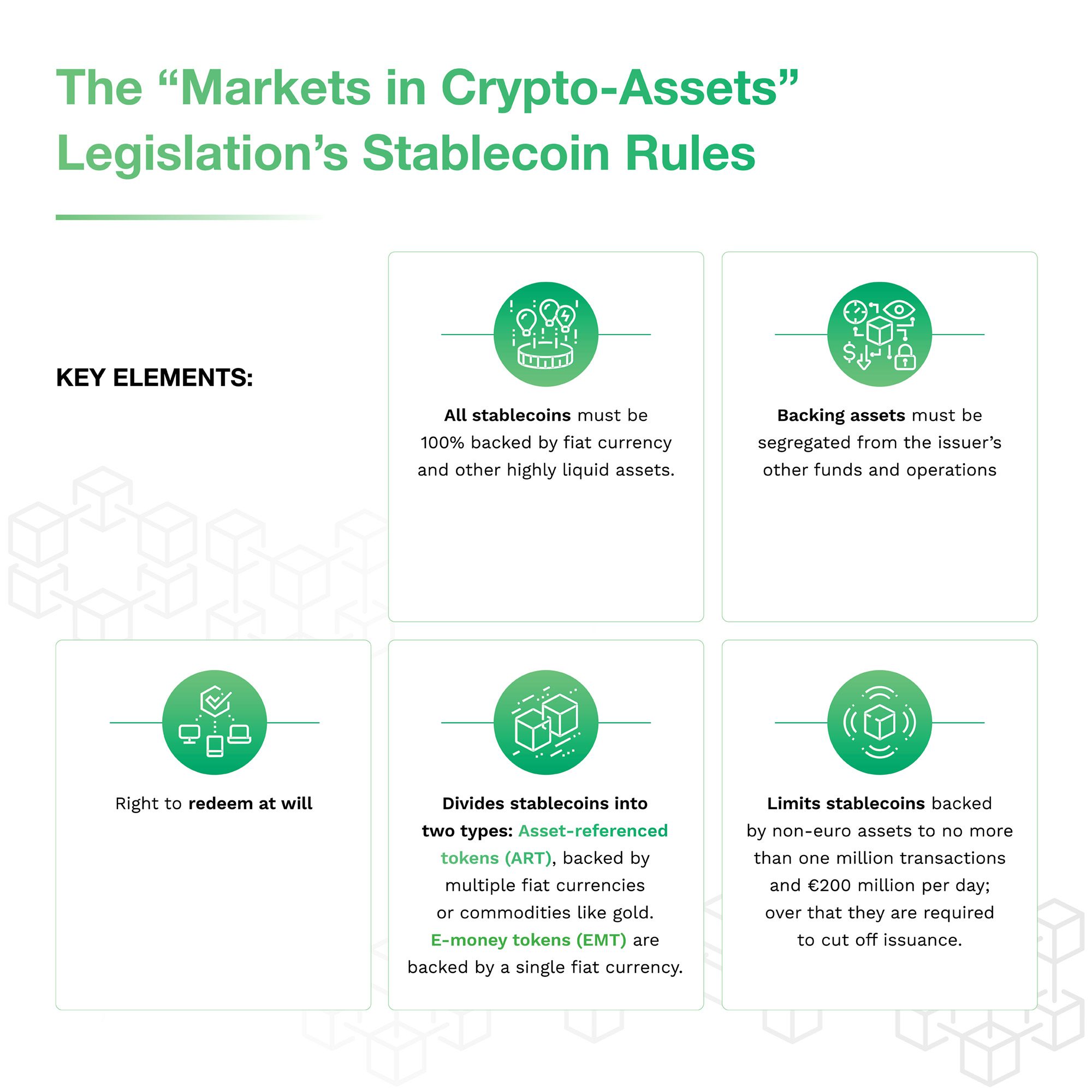

That aside, one basic principle is not too dissimilar from U.S. proposals: Stablecoins will have to be backed 100% by reserves of fiat currency or highly liquid assets. Under the EU’s terms, these will be “operationally segregated and insulated in the interest of the holder, and will be fully protected in case of insolvency,” according to a widely cited June 30 Twitter thread by Ernest Urtasun, a European Parliamentarian closely involved in MiCA negotiations.

3/13 Large stablecoins will be subject to strict operational and prudential rules, with restrictions if they are used widely as a means of payment, and a cap of 200€millions in transactions/day.

— Ernest Urtasun (@ernesturtasun) June 30, 2022

Stablecoin holders will have the right to redeem them, free of charge, from the issuer at any time, the European Council said.

That point is one that European Central Bank President and stablecoin critic Christine Lagarde has been hammering for some time. “That needs to be checked, supervised and regulated so that consumers and users of those devices can actually be guaranteed against potential misrepresentation,” Lagarde said during the MiCA process.

Accusing stablecoins of “pretending” to be currencies, she is a backer of a central bank digital currency (CBDC), or digital euro, that would make stablecoins’ less desirable in payments.

Two Coins

Stablecoins are broken into two categories: asset-referenced tokens (ARTs), which are backed by more than one fiat currency and/or commodity, such as gold. E-money tokens (EMTs) are backed by a single fiat currency, such as the euro or dollar.

Beyond that, asset-referenced tokens based on non-European currencies are divided by size, with severe usage limitations placed on any stablecoin that grows large enough to be “significant.”

See also: Crypto Regulation Weekly: EU’s Landmark MiCA Legislation Hits Stablecoins Hard

Specifically, Urtasun revealed, “large stablecoins will be subject to strict operational and prudential rules, with restrictions if they are used widely as a means of payment, and a cap of 200€millions in transactions/day.”

This will apply to EMTs backed by non-euro fiat currencies as well as ARTs. The goal is to protect and encourage the use of euro-denominated stablecoins, rather than the dollar-denominated coins that currently dominate the market. At that level they would be required to stop issuing tokens and take unspecified steps to reduce their use.

While crypto-assets — the official name of cryptocurrencies under MiCA — broadly will be supervised by the European Securities Market Authority (ESMA), “significant” stablecoins will be regulated by the European Banking Authority as well. This means stablecoins with more than 10 million users or €5 billion in circulation.

Issuers of non-euro backed tokens will be required to have a presence in the EU.

A Not-So-Tiny Problem

The biggest problem with the proposed stablecoin regulations is the impact they will have on existing stablecoins. The market capitalization of three largest — Tether’s USDT ($67.5 billion), Circle’s USDC ($52.4 billion) and Binance’s BUSD ($19 billion) — is nearly $140 billion at this writing.

While it isn’t clear how the €200 million transaction volume cap will be measured. Blockchain data firm Chainalysis said that even if that only measures transaction activity in the EU crypto market — for example only transactions by European residents — it “would drastically change the way stablecoins are used,” the company said on June 30.

A pair of European blockchain and crypto industry associations, Blockchain for Europe and the Digital Euro Association, were a lot less subtle, releasing a letter saying the limitations would effectively ban the use of the three largest stablecoins.

USDC-issuer Circle’s chief strategy officer and head of global policy, Dante Disparte, had a much more collegial response, saying that MiCA’s provisions “may on the surface seem onerous and anti-innovation to MiCA’s detractors, but deeper down it offers a pathway for Europe to emerge as a competitive region for the safe, sound development of an always-on financial system.”

He added that Circle would make its Euro Coin stablecoin, EUROC, “MiCA-conforming.”

For all PYMNTS Crypto coverage, subscribe to the daily Crypto Newsletter.