PayPal is an island in crypto no more.

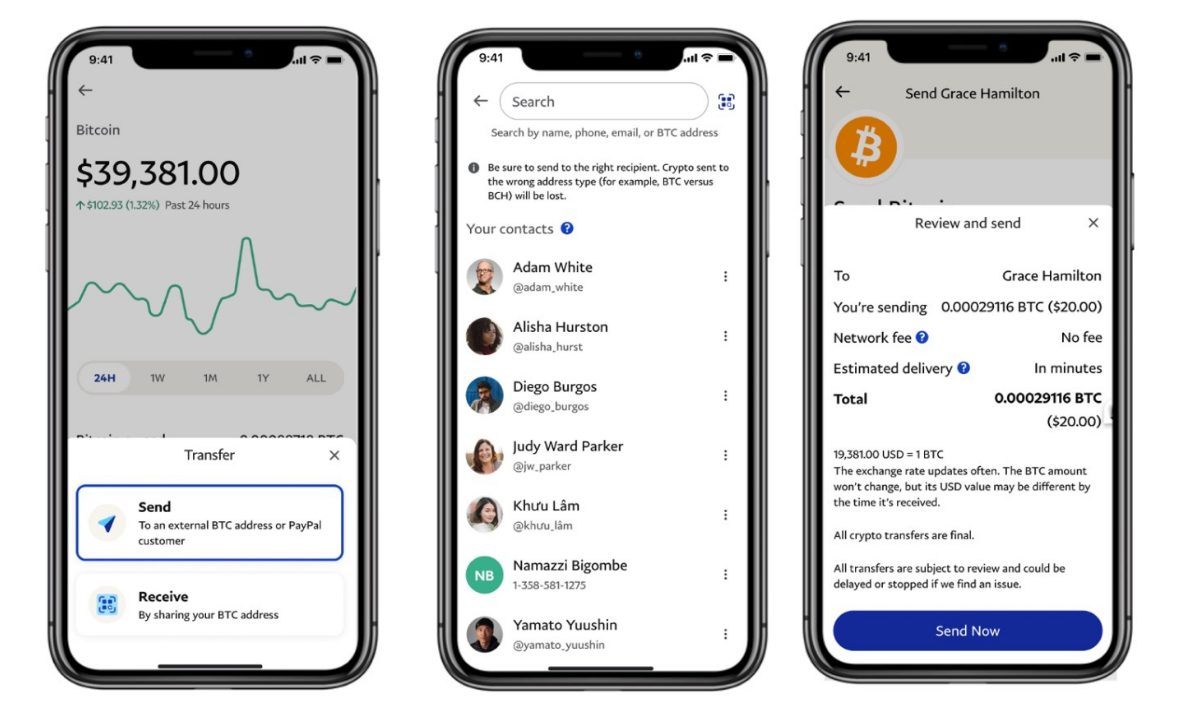

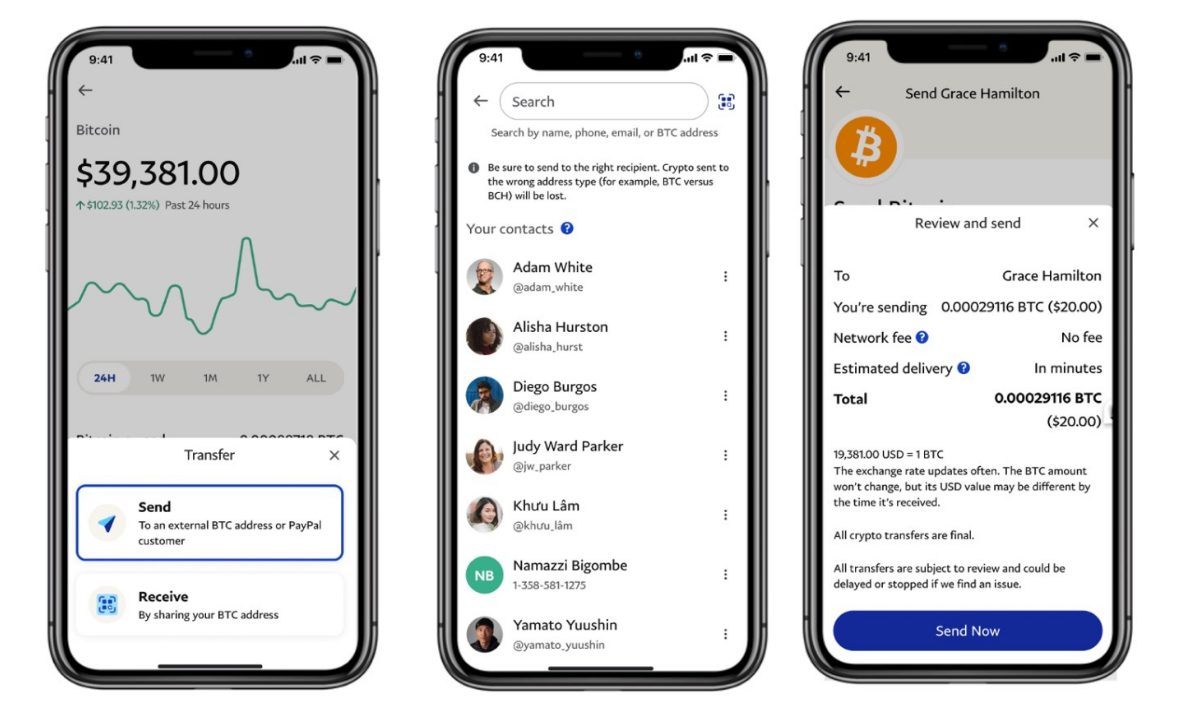

The company announced on Tuesday (June 7) that people who hold cryptocurrencies in their PayPal account wallets will now to able to send and receive digital assets via external wallets and exchanges.

Until now, PayPal had been a closed system, with customers only able to buy and sell crypto from PayPal itself and spend it only within PayPal’s 32 million-strong Merchant Network.

See also: PayPal’s Scale Drives Crypto’s Utility

“This feature has been consistently ranked by users as one of the most requested enhancements since we began offering the purchase of crypto on our platform,” Jose Fernandez da Ponte, PayPal’s senior vice president and general manager, blockchain, crypto and digital currencies, said in the announcement.

Advertisement: Scroll to Continue

This step moves PayPal deeper into the crypto payments and investments fields, as its customers are no longer landlocked within its ecosystem. PayPal only supports four cryptocurrencies: bitcoin (BTC), ether (ETH), bitcoin cash (BCH) and litecoin (LTC).

The access is now available to a limited set of PayPal users and will roll out to all U.S. accounts in the coming weeks.

New Possibilities

One of PayPal’s key contributions to the use of bitcoin and other digital assets as true currency replacements was accepting it for purchases at its Merchant Network.

“Customers who transfer their crypto into PayPal can extend the utility of their crypto by spending using our Checkout with Crypto product at millions of merchants,” Fernandez da Ponte said.

By opening to outside wallets, existing crypto owners who want to spend at those merchants do not have to sell their bitcoin and buy it back on PayPal — requiring two transaction fees and, on the selling side, an exchange fee.

Beyond that, transfers from one PayPal account to another are fee-free, unlocking interesting possibilities for payments within it borders. In February, PayPal began charging flat fees for crypto trades, on top of network fees.

Read more: PayPal, Venmo Unveil New Charges for Crypto Trades

However, the lack of internal fees is a big boon, especially within the Bitcoin and Ethereum blockchains, where transaction fees paid directly to the network are high — generally several dollars. In addition, crypto exchanges also charge fees that can reach as high as 2.5%.

Those can add up very quickly, both for small transactions and large ones. As of June 7, the average transaction fees on the Bitcoin blockchain average $1.50, and have soared above $10 in the past year. Ethereum’s average transaction fees run $1.08, and have breached $10 and even $20 several times in the past year. They rise and fall depending on transaction volume, so it is cheaper to make transactions at certain times of day.

So, for instance, people who do business regularly could handle payments between PayPal accounts on a day-to-day basis, only on- and off-ramping their digital assets at fixed intervals, or at times when network fees are lower.

Equally, sending crypto to a group of people would be cheaper for the sender by on-ramping it onto PayPal and sending payments to each person’s PayPal account.

Scaling Up

With 392 million users worldwide at the beginning of the year, PayPal’s very user-friendly interface has made it a comfortable starting point for people who want to test the crypto waters.

Previously, if a PayPal crypto owner wanted to expand their cryptocurrency trading beyond the four tokens it supports, the only way to do so would be to sell the bitcoins to PayPal and buy them again from an outside wallet.

While the company made no mention of adding more cryptocurrencies to the list of those it supports, Fernandez da Ponte said PayPal will continue to add more crypto features in the coming months. The company also announced that it will enact additional know your customer (KYC) personal identification data requirements of anti-money laundering (AML) laws.

In addition, PayPal said it has received a full Bitlicense from the New York Department of Financial Services, upgrading from the conditional one it received in October 2020 by partnering with an existing holder, crypto custodian Paxos.

The Bitlicense is by far the toughest certification required to do crypto business in any state in the U.S., making it something of a regulatory gold standard. Many in the crypto community argue that it is an overburdensome blockade to doing business in New York. A fair number of exchanges operating in the U.S. exclude New York residents.

PayPal said it was the first to receive a conditional Bitlicense and the first to successfully upgrade to a full license, which Fernandez da Ponte said signals “our commitment to responsible innovation and expanding the accessibility and utility of digital currencies while fully complying with regulatory guidelines and best practices.”