PYMNTS Data Show Jump in Crypto Ownership, Willingness to Spend It

With nearly one quarter of U.S. consumers having bought or held cryptocurrencies last year, merchants have 59.6 million reasons to make it both possible and easy for them to spend it.

That’s about 18 million more Americans with crypto in their pockets than in 2020, according to PYMNTS newly released survey, “The U.S. Crypto Consumer: Cryptocurrency Use in Online and in-Store Purchases.”

Read more: Cryptocurrency Use in Online and in-Store Purchases

Having jumped from 16% to 23% of the population in 2021, and with crypto-buying preferences finally expanding beyond the not-quite-as-dominant bitcoin, it’s clear that the market has grown far beyond the crypto-savvy tech fans who built the industry on the basis of speculation.

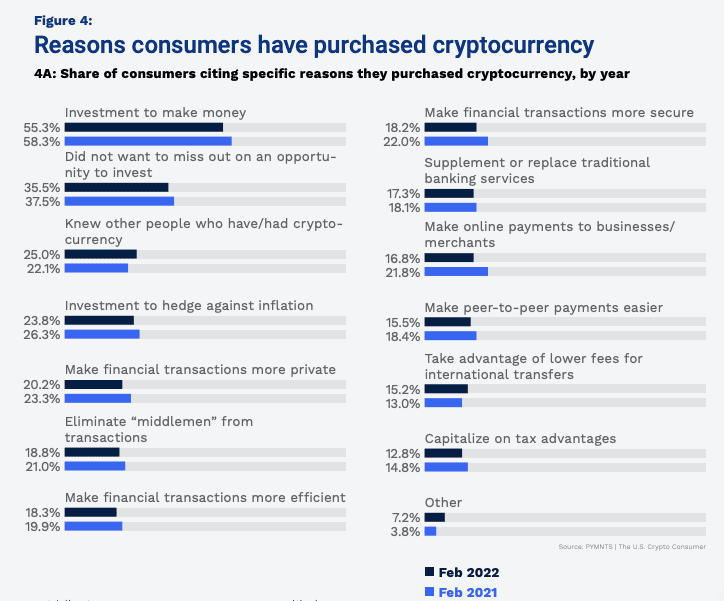

Serving the crypto consumer starts with understanding who they are and why they got in. According to the report, although the share of U.S. consumers who currently own cryptocurrency has grown in the past year, the reasons they purchase it have remained the same: They see it as an investment, not a payment method.

That doesn’t mean consumers don’t want to spend it — they do. The data also show that once they’ve bought that crypto, they don’t necessarily hold onto it all.

Will They Spend?

While many existing crypto owners have embraced using it to pay, with 66% using crypto debit cards or gift cards to make a purchase and 14% saying they actively bring business to merchants who accept crypto, there are still clear signs of trepidation.

In all but one of the eight categories that people said were reasons they buy crypto — improving international payments — there are actually fewer respondents who said they are interested in using crypto to pay in 2021 than there were in 2020.

Indeed, the percentage of consumers who told PYMNTS they bought crypto for the eight payments-focused reasons declined by about 2% to 4% in each category.

You’ll note one outlier: “Take advantage of lower fees for international transfers” was the only category that saw an increase over 2020, up to 15% in 2021 versus 13% in the prior year.

That means remittance spenders are starting to embrace crypto for its lower costs and speedier transactions, which using traditional methods also come with fees as high as 5% to 7% — more in some places — and several days wait time.

Given a Reason

Another obvious reason people might shy away from spending crypto is that in the case of the dominant bitcoin, they just weren’t ready in 2021. But that’s changing. Or, at least, it’s being overcome.

Bitcoin’s problem as a coin is its too slow and expensive to use for small purchases, with transaction fees running in the $2 to $4 range, sometimes spiking higher. And with a 10-minute block time — how often new transactions are written onto the blockchain and completed — the blockchain designed as a peer-to-peer (P2P) online payments currency is just too slow.

That’s something that looks like it could be changing this year, as so-called Layer 2 blockchains like the Lightning Network that sit on top of bitcoin’s blockchain are able to offer far faster and cheaper transactions. It will soon be usable on top global point-of-sale (POS) terminal maker NCR’s devices.

See more: Bringing Bitcoin Firmly Into Payments, Strike Partners With NCR, Shopify, Blackhawk

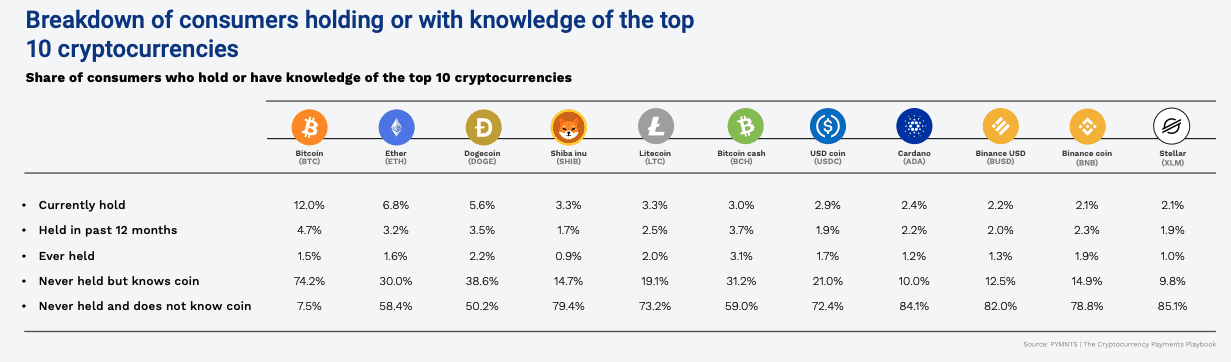

That’s happening in another way as well. The report clearly shows that crypto consumers who already own crypto have diversified — the six top altcoins cited were held by 25% to 50% of those holding bitcoin.

That diversification is even greater among consumers who have already used crypto to make payments. In the past 12 months, that fairly small group had used more than two dozen cryptocurrencies to make a purchase. And each of those digital assets was used by between 20% and 45% of the respondents.

So, the willingness to buy with crypto is there, and it can be eagerness once crypto owners have a simple way of spending.

And with both Mastercard and Visa embracing crypto, NCR making POS terminals accessible and the tools giving merchants the ability to accept crypto, growing the opportunity is there.