For the cryptocurrency industry to grow, sector foibles can’t keep looking so avoidable in retrospect.

This, as a recent class action lawsuit filed in California against failed crypto exchange FTX’s blue-chip venture backers posits the claim that it’s inexcusable everyone involved didn’t know better.

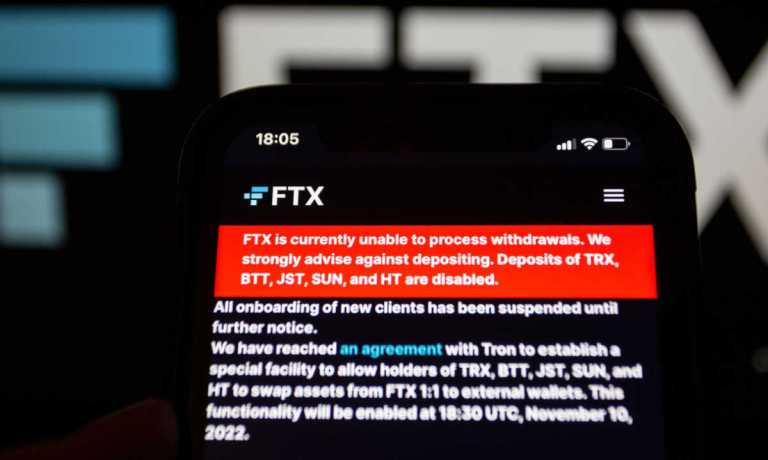

After all, FTX’s exchange, along with other former billion-dollar crypto enterprises including FTX peers Genesis and Celsius, was brought down by a combination of alleged executive mismanagement of funds internally, and misrepresentation of business practices externally.

Venture capital (VC) firms are supposed to back the businesses they invest in — but none have so far stepped up to help those businesses’ customers, leaving millions of creditors, collectively out billions of their hard-earned dollars, with little recourse but to chase down what they can from wherever they are able.

“A hundred fifty million dollars out of a $6.3 billion fund, if you lop off some zeros, one zero, it’s $15 million out of a $630 million fund,” is how Alfred Lin, the partner responsible for leading Sequoia Capital’s investment in FTX, described his firm’s view of their loss on FTX.

“If you look at it that way, which is how we looked at it from a risk management perspective for Global Growth Fund III, we can take a $15 million loss on a $630 million venture fund.”

This cavalier approach likely isn’t the same tune being sung by FTX’s 9 million creditors.

Some of whom who were no doubt lured in by another Sequoia partner calling FTX founder Sam Bankman-Fried quite possibly “the world’s first trillionaire.”

The curious cases of evaporated customer funds have become dire enough that the former founders of failed crypto hedge fund Three Arrows Capital (3AC) are themselves starting a new crypto exchange platform that will let users trade bankruptcy claims from insolvent crypto businesses, per a Wall Street Journal (WSJ) report Monday (Feb. 13).

Claims from 3AC’s own customers are among those that can be traded, alongside claims by creditors of FTX, Genesis, Celsius and others.

While U.S. residents are ineligible for the platform, the WSJ article notes it already has several thousand signups from other countries.

A lengthy report by the independent examiner appointed to oversee the Celsius bankruptcy decried the former crypto lender’s business model as being “conducted in a starkly different manner than how it marketed itself to its customers in every key respect,” and made particular note of employees’ own disbelief of their employer’s operations.

Celsius executives reportedly kept an internal list of company CEO Alex Mashinsky’s false or misleading statements, per examiner’s findings, even going so far as to edit the CEO’s comments out of promotional video recordings without issuing corrections to inform audience members who may have heard the misstatements in real time, much less inform regulators.

PYMNTS was not immediately able to reach Celsius or Mashinsky for comment. Mashinsky has previously denied the allegations against him.

Over at FTX, bankruptcy filings from the “personal fiefdom” of Sam Bankman-Fried, who in the face of eight criminal charges maintains his innocence from under house arrest, show that the defunct digital exchange was regularly misappropriating and commingling customer funds across its enterprise group of companies to plug ongoing holes in its own balance sheet.

Beware the crypto customer acquisition flywheel, even when its hype cycle is supported by likes of Sequoia Capital, Thoma Bravo, Paradigm, or even Tom Brady and Larry David.

Regulations around financial services apply to any business offering those financial services in markets where they are regulated, and this includes crypto — as certain industry actors are starting to find out.

Still, that hasn’t stopped the world’s biggest exchange, Binance, from claiming that “while the company wants to hire an auditor, big accountants are still getting a handle on the crypto sector.”

The deflections around operational transparency come at a time when many leading accounting firms including both Deloitte and Grant Thornton regularly perform audits for public crypto firms like Coinbase and CoinShares.

As a whole, the rules the crypto industry is being asked to comply with are not new rules — although some are evolving — and it is becoming apparent that crypto businesses hoping to continue to operate within the U.S. need to beef up their legal and compliance teams in order to rebuild trust.

Especially if they want to regain the confidence of key banking partners who have grown increasingly spooked by the government’s regulatory crackdown and the crypto industry’s poor track record of leading companies staying in business longer than a few years.

In these challenging times, where it very well may take multiple business failures to convince the crypto industry to engage more seriously with its emergent regulatory reality, a little good faith can go a long way.

For all PYMNTS crypto coverage, subscribe to the daily Crypto Newsletter.