Banks are fast-tracking digital-first banking solutions, but customers used to walking into a branch struggle to adapt, says CarrieAnne Cormier, senior vice president of retail operations and strategy for Avidia Bank. In the Digital-First Banking Tracker, Cormier explains how a cross-channel approach can help these customers get comfortable with banking in a digital-first world.

The pandemic has led to massive changes for banks, which have had to radically adjust their operations despite generally being deemed essential businesses. FIs around the world have accelerated the deployment of digital banking programs to cope with social distancing orders, and bank branches that remained open took steps like offering appointment-only visits to reduce transmission risks.

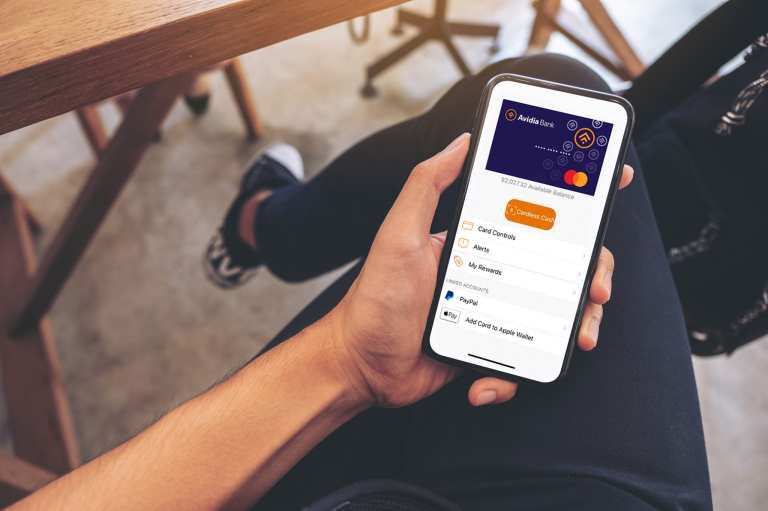

One FI navigating pandemic-related challenges is Massachusetts-based Avidia Bank, which was founded in 2007 and currently has $1.9 billion in assets. Avidia — like other banks around the world — has been forced to make numerous changes to its brick-and-mortar and online services to provide proper safety precautions while serving customers. The FI has ultimately tried to stay in tune with its customers’ needs and swiftly react to them, said CarrieAnne Cormier, senior vice president of retail operations and strategy at Avidia.

“You hear a lot about the new normal and stuff like that, but I really see it as banking at the speed of life,” she said. “Financial institutions in general have had to adapt at our consumers’ and our business clients’ paces and how they’re conducting their lives and how fast or slow that’s going.”

Cormier recently offered PYMNTS an inside look at how Avidia has handled the pandemic’s game-changing effects and why open communication is critical to FIs’ continued digital-first success.

In-branch Changes

Avidia’s pandemic adaptations were first devoted to keeping its customers and staff members safe, as was the case with bank branches globally. Its brick-and-mortar locations shifted to appointment-only visits to limit the number of employees and customers indoors at any given time, and all back-office staff who could work from home were required to do so.

“It’s been funny how much we used to rely on certain old practices, and [we] have used this pandemic as a way to spring into action on things we could have done so long ago,” Cormier said. “We hadn’t had a huge focus on working from home before, but we were able to focus on improving our internal workflows, which, in turn, has had an effect on our customers. We also saw about a 50 percent savings in our on-site energy usage, which is significant with 10 locations.”

Some FIs have been unable to pivot to digital as quickly as Avidia, and customers around the world have suffered the consequences. Difficulties at a single FI often gave the impression that the entire industry was having the same difficulties, resulting in decreased customer satisfaction even at banks that were taking the proper precautions.

“There was a local credit union [near us] that shut [its] doors in March for lobby access and their digital tools weren’t as strong, so they had customers waiting for over two hours,” Cormier said. “The lines would be literally 25 to 30 cars long, and that creates that perception of scarcity and feeling nervous.”

The best way to connect with anxious customers, Cormier said, was through digital channels, with even corporate customers benefiting from increased digital outreach.

Online innovations

Mobile banking has experienced a steady increase in users over the past several months, but Cormier pointed out that this growth has been mostly gradual. She attributed this to steady adoption before the pandemic began, which had prompted most customers who preferred digital banking to begin using it before March. Corporate banking was a different story, however.

“We probably saw a 40 percent increase in new mobile business users right off the bat, and that’s continued to trend upwards,” Cormier noted. “That tells me that, although consumers were very focused on mobile tools in the past, businesses weren’t as much, and the pandemic has helped them make that shift.”

She said that the FI’s biggest challenge during the digital shift has been maintaining constant contact with first-time digital users. Many customers who were used to conducting in-person transactions had difficulty verifying their identities with the bank while digital natives were accustomed to two-factor authentication and other security measures.

“When customers banked with us [in person], they were able to use their money wherever they needed to, but when it came to interacting with the bank, a lot of it was still manual,” Cormier explained. “We were able to set a way to connect with customers over the phone and verify them that way.”

Customers consistently report that their new digital engagement habits are here to stay, which means the various online tools that have been developed during the pandemic will likely serve banks well into the future. It will be incumbent on FIs to ensure that customers have smooth and secure experiences as their financial lifestyles become more digital.