PYMNTS Intelligence: The Importance of Digital Accessibility in Enhancing Loyalty and Brand Reputation

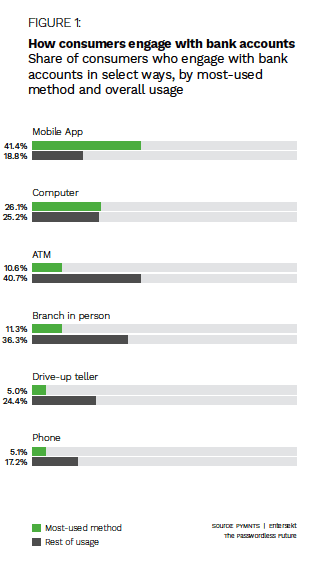

Although 48% of banking customers still use branches for some business, just 11% bank primarily at branches. Meanwhile, 41% use a mobile app as their primary means of banking, and 82% do some o f their banking digitally. The digital transformation is in full swing, but despite all the positives it has brought, it also had created the potential for financial institutions (FIs) to overlook some of the most vulnerable customer populations if they are not careful. Digital accessibility standards have both practical and regulatory implications for FIs, and it will be imperative for FIs to balance speed to market with innovation to ensure all their channels are compliant.

f their banking digitally. The digital transformation is in full swing, but despite all the positives it has brought, it also had created the potential for financial institutions (FIs) to overlook some of the most vulnerable customer populations if they are not careful. Digital accessibility standards have both practical and regulatory implications for FIs, and it will be imperative for FIs to balance speed to market with innovation to ensure all their channels are compliant.

Approximately one out of every four adults in the U.S. has a disability, including 5.9% of adults who are deaf or have serious difficulty hearing and 4.6% who are blind or have serious difficulty seeing. Additionally, 11% of U.S. adults have serious difficulty concentrating, remembering or making decisions, so they may see long sentences or complex wording in a digital banking channel as a signficant hurdle. Approximately 40% of adults age 65 and older, who already show a strong preference against digital banking, have a disability. This month, PYMNTS examines digital channels’ accessibility and their critical role in helping FIs gain and keep primacy with their customers.

Setting the Standard

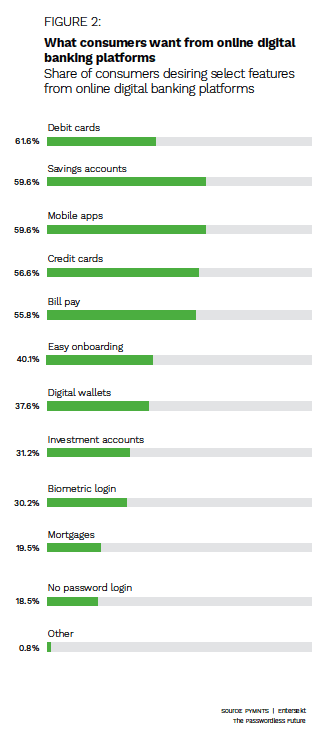

Digital-first banking has become the new normal for most banking customers in the U.S. This shift has underlined the importance of ensuring digital banking channels are accessible to as many people as possible, including those with dyslexia, cognitive disabilities or other physical impairments, as well as difficulties such as reading comprehension. The average bank website’s reading level sits between five and seven years above the average U.S. reading level.

A recent survey of websites belonging to 30 of the largest U.S. banks found that none meet the Web Content Accessibility Guidelines (WCAG), an international reference for developing accessibility legislation. In addition to seeking compliance with the Americans with Disabilities Act (ADA), FIs can employ the WCAG to help ensure their digital channels are inclusive of all their customers. The WCAG are often cited in ADA rulings, so compliance with the WCAG can have definite legal implications.

Beyond legal compliance, adherence to the ADA and WCAG can impact an FI’s bottom line both directly and indirectly. Compliant digital channels are more accessible to more people, which means they likely will attract more customers, yet there is deeper impact. After all, if customers cannot engage fully with materials promoting additional services or products, they will be unlikely to grow their relationship with an FI by engaging with those offerings.

Indirectly, acce ssible digital channels can also build up an FI’s reputation with customers who have no impairment. Social responsibility is an important factor in brand reputation, and 62% of consumers prefer working with brands that they consider purpose-led. Ensuring digital channels are accessible also sends a message to all customers regarding their FI’s priorities and increases the likelihood that they will continue banking with that FI throughout their lives and during any change in their personal circumstances.

ssible digital channels can also build up an FI’s reputation with customers who have no impairment. Social responsibility is an important factor in brand reputation, and 62% of consumers prefer working with brands that they consider purpose-led. Ensuring digital channels are accessible also sends a message to all customers regarding their FI’s priorities and increases the likelihood that they will continue banking with that FI throughout their lives and during any change in their personal circumstances.

Finding Solutions to Digital Accessibility

Many FIs are looking to hybrid banking solutions that merge the best aspects of digital and physical channels, and 38% of banking executives say they are doing so to provide more inclusive customer experiences. For other industries, such as insurance, part of developing a hybrid solution has meant simply ensuring channels, such as phone banks and in-person interactions, still are available for those who need them. Technological solutions such as voice assistants, while more popular with younger demographics, can also help make digital channels more accessible to those with cognitive, visual or hearing impairments.

FIs will have to think beyond regulatory compliance and conduct their own research to meet their customers’ needs. Direct feedback coupled with investigation of customer habits can help FIs develop proactive solutions. Such an approach can prevent expensive litigation and the cost of making sweeping changes to banking channels to reach compliance. The digital transformation has created high expectations for FIs to create useful, intuitive and informative user experiences. By exceeding those expectations for all customers, FIs can differentiate themselves from competitors and foster their reputations as trusted financial partners for life.