Smart Automation: The Invisible Force That Improves Credit Union Member Experiences

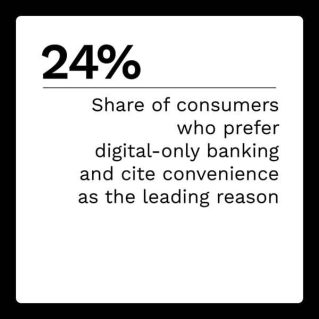

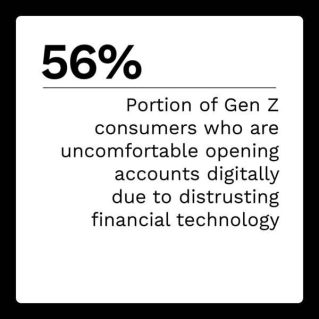

The trend away from in-person banking that began for reasons related to the pandemic has continued as consumers have grown comfortable with doing more of their banking through non-physical channels. Financial institutions’ (FIs’) physical branches are becoming increasingly specialized or closing altogether, with remaining locations often providing services that are either tailored to individual communities or which consumers simply prefer to engage with in-person.  But transitioning to digital-first banking does not have to mean a less personal experience, and smart automation can actually create better non-physical consumer experiences than was previously possible.

But transitioning to digital-first banking does not have to mean a less personal experience, and smart automation can actually create better non-physical consumer experiences than was previously possible.

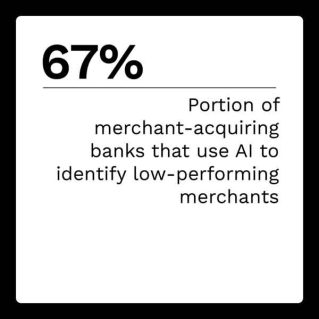

Back-end deployments of artificial intelligence (AI), machine learning (ML) and other forms of smart automation, complemented by more seamless and integrated communications between systems enabled by application programming interfaces (APIs), are helping FIs to serve customers more efficiently and in a manner that feels more personal. Whether it is preventing legitimate transactions from being flagged for fraud or speeding up wait times for customer service, smart automation invisibly improves the customer experience in ways that are still directly felt by customers.

In the latest Digital-First Banking Tracker®, PYMNTS examines how FIs can realize savings in time and resources while offering customers an improved experience by deploying smart automation.

Around the Digital-First Banking Space

The move toward more efficient digital processes has 75% of surveyed companies across all financial sectors saying that they now employ some form of high-performance computing, deep learning and ML to accelerate core computing. Additionally, 43% of survey respondents who are implementing AI to improve their processes said that they are getting more accurate models, while 38% said AI provides a competitive edge over rivals. Twenty-nine percent said they have realized operational efficiencies due to implementing AI, and 28% attributed improved customer experiences to their implementations.

As consumers continue to turn more and more to digital channels for their banking needs, FIs around the globe are adjusting how they employ physical branches. In the United Kingdom, less than half of HSBC’s customers are currently actively engaging with physical branches, and the FI plans to close 69 branches across the U.K. after closing 82 branch locations in 2021. Many of the closures are in larger cities, and some physical branches will be replaced with ATMs and pop-up banks to continue to provide customers in those communities with physical touchpoints. HSBC also plans to take a new look at how customers use physical branches, with plans to tailor services to the local communities, as well focusing on services customers prefer to engage with in-person.

For more on these stories and other digital-first banking developments, check out the Tracker’s News and Trends section.

Veridian Credit Union on Improving Member Experiences With Smart Automation

Smart automation, whether it falls under AI, ML or any other name, is now an essential part of ensuring seamless, reliable consumer experiences.

In this month’s Feature Story, Brett Engstrom, chief information officer at Veridian Credit Union, talks about how smart automation reduces friction and creates efficiencies that translate into better member experiences.

PYMNTS Intelligence: Saving Money and Keeping Customers Happy Through Back-End Innovation

The digital transformation has placed FIs in an increasingly competitive financial services space, emphasizing the need to deploy back-end digital innovations that both make their operations more efficient and provide a better customer experience. From fraud prevention to identifying opportunities or potential liabilities, smart automation with AI and ML can improve an FI’s bottom line and lower its risk profile, all while turning mountains of data about customer habits and preferences into actionable intelligence that helps to build stronger customer relationships.

This month’s PYMNTS Intelligence takes a look at how smart automation is reshaping the world of finance and giving FIs an edge against a growing list of competitors.

About the Tracker

The Digital-First Banking Tracker®, a PYMNTS and NCR collaboration, examines the latest trends and developments shaping the digital-first banking space and the impact of smart automation on FI efficiency and customer satisfaction.