Retail banking, indeed. In the most literal sense.

In a move that is not a surprise — but is a seismic shift in financial services, nonetheless — Walmart is branching into bank accounts.

And, by extension, bringing the banking branch into the retail aisles.

Bloomberg reported on Wednesday (Sept. 14) that the commerce juggernaut is set to begin offering — through its backing of FinTech One — bank accounts and related services to its 1.6 million employees. That rollout will start with a beta test.

The startup took shape with the acquisitions of Even Responsible Finance and One Finance. The startup is a neobank; checking and basic banking offerings will, ostensibly, pave the road for Walmart to offer investing and credit. In terms of the mechanics, One offers a digital banking account; Even Responsible Finance enables workers to access wages as they are earned.

Read more: Walmart’s FinTech Hazel Acquires Even and One to Build Finance Super App

And in terms of the initial roadmap, Bloomberg reported that there would also be discounts on purchases, as the One app offers 2% back on money spent at drugstores, gas stations and in-store.

Against that backdrop, we can posit a future where an employee (and eventually the public) could have paychecks deposited directly into Walmart-centered accounts, funds spent from those accounts and cash back from transaction making its way back into linked savings accounts — or funneled into investment holdings.

The app then becomes a super app, a digital front door through which linked activities flow, sometimes simultaneously.

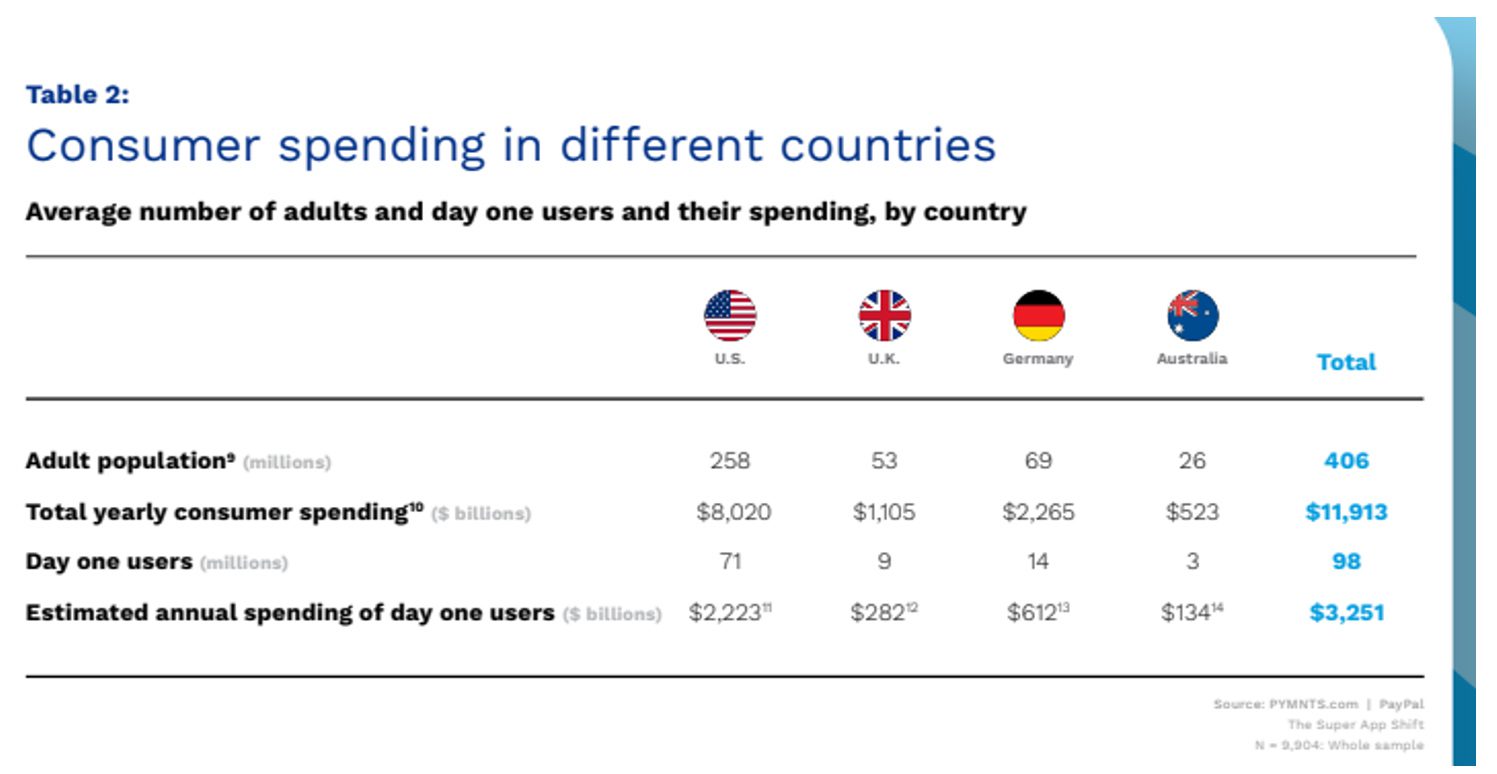

In a recent PYMNTS/PayPal report on the state of and consumers’ desire for super apps, 41% of consumers reported they likely would increase their banking activities if they had access to a super app. And 50% of respondents said they use connected devices to make shopping more convenient. And, in further data that should pique the interest of would-be super app providers (Walmart among them), we’ve estimated that there would be 98 million “day one” users, as measured across Australia, Germany, the United States and the United Kingdom.

The impetus is there, especially, for retailers to bring super apps to market, as these same consumers wield significant spending power. As seen in the research below, the annual spending of these “day one” users top $3.2 billion annually. By feeling more comfortable about their financial wellness, with transparency rendered in real time, the urge may be there to spend more time — and money — in the aisles.