The best-laid plans, wrote the poet Robert Burns, oft go astray.

We’re paraphrasing here, of course. But the poetic sentiment remains apt, given the recent reports that Wall Street giant Goldman Sachs could be reorganizing for the fourth time in three years — and as part of that effort, will be reconfiguring its retail banking efforts and ambitions.

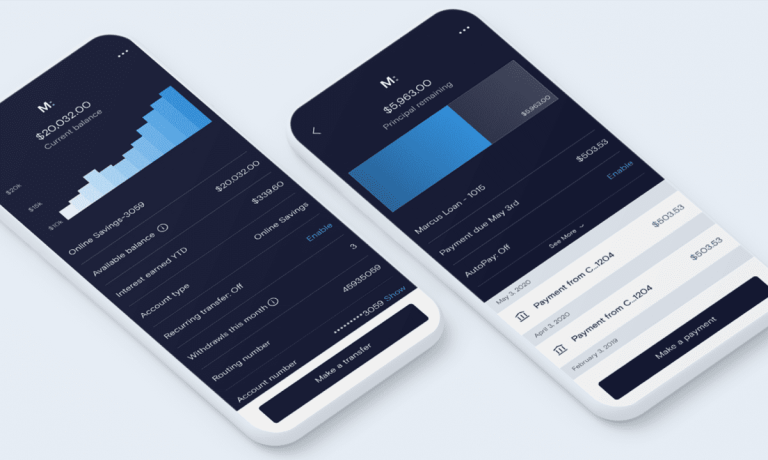

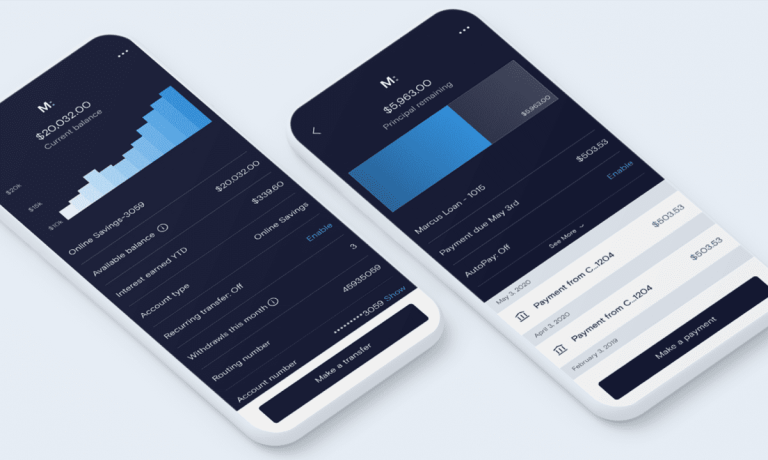

There’s no indication that Marcus, the digital-only bank that has sought to bring the Goldman imprimatur to Main Street, is being shuttered.

But a pullback may be in the cards, and the Main Street focus may be winnowed down to a much more targeted approach. Apparently, the checking accounts that would have been on offer to everybody will now be obtainable only by a few consumers, and the robo-advisers will be available to high-end clients.

Not exactly a democratization of retail banking that some might have hoped. But beyond the tailored approach that seeks to bring those more basic banking services to tried and true customers lies a cautionary tale.

Pause and Reflect?

Advertisement: Scroll to Continue

Goldman had been pouring time and money into the unit and while Marcus had something more than $100 billion in deposits towards the end of last year, further details have been a bit nebulous. There’s no sign yet as to what might become of the card-focused efforts with Apple.

But there are some signs that maintaining a competitive advantage — much less extending that advantage — may be an onerous task in the hyper-inflationary environment of 2022. Back in August, we noted that there was something akin to a race to the top, at least in traditional banking. Rising rates demand that banks — no matter if they are digital or brick and mortar or hybrid — must offer competitive rates on deposits, too, to keep consumers in place while attracting new accounts. Back then, Goldman’s Marcus boosted the rate paid on its high-yield savings account to 1.7%, which marks a rebound to pre-pandemic levels and up from last month’s 1.5%. Other banks such as Ally Bank have also raised rates.

A glance at the rate offered on Marcus accounts today reveal a 2.1% APY, indicating that the cost of doing business is getting more expensive. At the same time, there’s no telling yet what market volatility may have done to the all-important Goldman investment banking, institutional activity and wealth management pillars that help fund Marcus. We noted back in the summer that Goldman generated $487 million in net interest income in its consumer and wealth management segment in the latest quarter.

We’ll know more in the newest earnings report from Goldman, due in the slew of commentary from companies large and small in the next few weeks. But the reported pullback signals that either the money being thrown off by its firmly entrenched businesses was not enough to keep funding Marcus at a comfortable level or that Marcus has found the jousting for retail clients a bit costly. Or it could be a combination thereof. Cross-selling to existing clients and employees signals that the company may want to whittle down customer-acquisition costs.

No matter the reasoning, even if Goldman is not going back to the drawing board on its retail and digital banking aims, it’s clear the blueprint is getting some renewed scrutiny.