Banks risk losing customers to neobanks — and a key battleground may lie with savings accounts.

And in that case, the advantage may go to the traditional financial institutions (FIs), who have the installed base of clients, the financial firepower and a host of complementary and adjacent revenue streams that the digital-only upstarts just don’t have.

To that end, as found in the latest Digital-First Banking Tracker® Series, “Personalization Beyond Traditional Banking To Build Financial Wealth,” PYMNTS’ research shows that 25% of consumers would switch from their banks for savings accounts.

Savings are Top of Mind

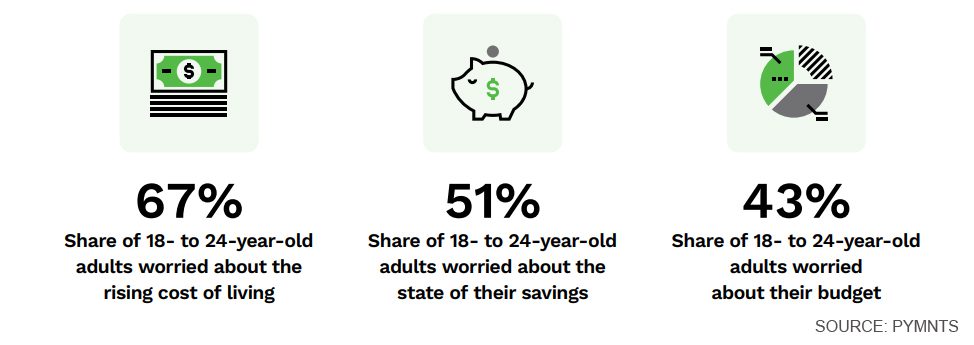

Drill down a bit, and it’s especially apparent among younger individuals — critical to financial service firms’ future business prospects — that there’s a need to improve their finances.

There’s fertile ground in helping them beef up their savings accounts. As shown in the PYMNTS stats below, the majority of younger consumers are worried about the rising costs of daily living and a majority are also worried about their savings.

The race to boost savings rates on accounts — and to lure deposits — is and has been global in scope.

In just one example, Starling, based in the U.K. last month launched its “Fixed Saver” product offering 3.25% on deposits between 2,000 GBP to 1 million GBP. The traditional banking giants have not been idle here, though. J.P. Morgan Chase has, in a move effective this week through Chase U.K., boosted its rate to 2.7% from 2.1%.

Chase U.K., of course, is the digital arm of the banking giant. A cursory glance around the Web reveals that even smaller banks — the ones with physical branches and yes, of course, they have digital conduits — have increased their rates to 4% APY or more, per data from Bankrate.com.

The pressure is on for the challengers to lure customers and gain critical mass in an environment where there are a number of existential concerns. The funding environment has, to put it mildly, been transformed, and not for the better. Data from CB Insights has noted that as recently as the third quarter of this year, global FinTech funding fell 38% quarter over quarter to $12.9 billion, and now is at levels not seen since the middle of 2020.

The fact remains that investors are seeking yield elsewhere. The institutional capital, of course, has been important in giving digital-only players the funding they need to get new products and services off the ground. Many neobanks have launched as debit cards that eventually lead to new offerings.

But interchange revenues garnered with each swipe are no sure bet, not anymore.

The challenges of gaining digital-only adherents in retail banking have been felt even by stalwarts like Goldman Sachs, which has been fine-tuning and scaling back its Main Street ambitions with Marcus. Simply investing billions in digital initiatives and offering high yield rates on accounts will not be guarantees of success.

But for the traditional banks, the ones with the branches and lending operations in place, the cross-selling opportunities are firmly in place. A diversified revenue stream across retail and business clients keeps a revenue model firing on several cylinders.

The battle for consumers’ mind-and-wallet share, waged between banks and neobanks, will be one of both innovation and endurance, and the advantage may accrue to those firms that have been around for decades, even centuries.