Small businesses represent 99.9% of all businesses in the United States, and there were 32.5 million small businesses operating as of 2021, according to a report. On average, it takes four days to launch a small business and roughly one-third begin with less than $5,000. Considering the pandemic propelled more workers toward self-employment, there is an enormous opportunity for banks to offer digital supports. Existing small businesses can seek additional digital banking solutions when pressed by inflation and supply chain disruptions.

The functionality of traditional banks does not typically accommodate online account opening or lending for small businesses. The current process can take one to two weeks and requires a visit to the bank. Small businesses that are under pressure are prioritizing their digital banking relationships. PYMNTS research found that 75% of small- to medium-sized businesses (SMBs) experiencing financial stress are the most likely to use a digital-only bank as their primary financial institution (FI).

SMBs Seek Digital Banking Features That Streamline and Personalize Services

SMBs Seek Digital Banking Features That Streamline and Personalize Services

Payment innovations that offer positive cash flow are vital to the stability and growth of SMBs. Payment rails and digital cash management tools are among the leading solutions they seek to quickly and safely send and receive money. SMBs, however, require more to keep up with rapid shifts in customer preferences.

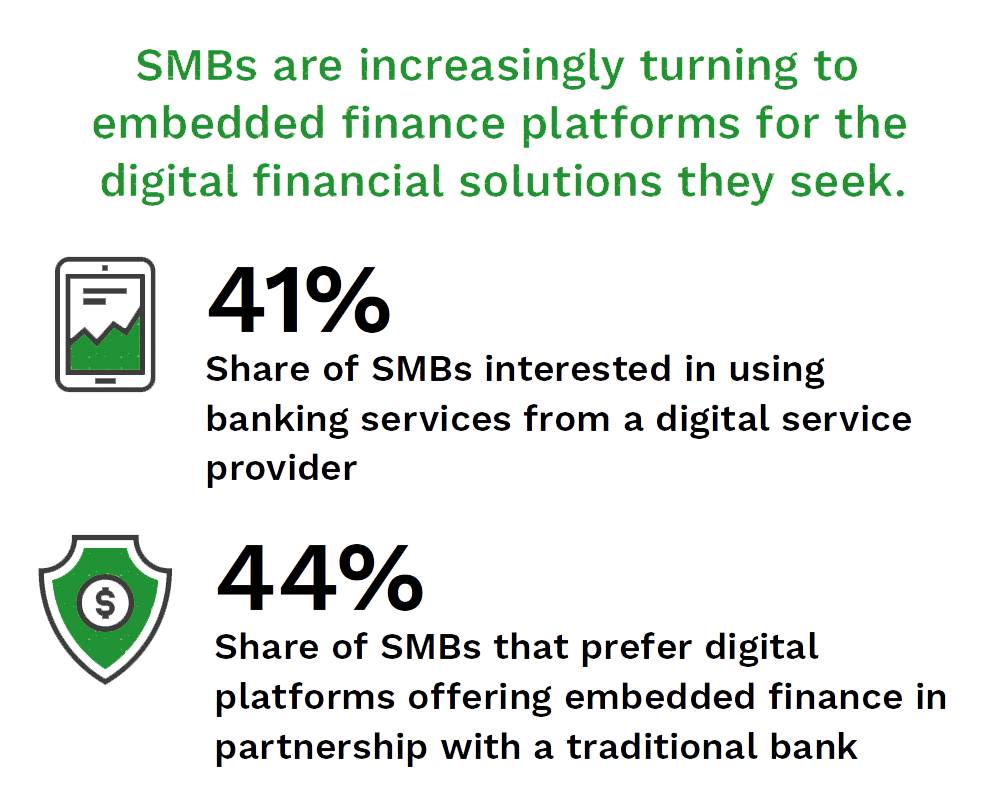

Embedded finance represents a major opportunity for SMBs to use a convenient digital platform to access financial services, and it could represent 26% of global SMB banking revenue by 2025. Personalization is also one of the most sought-after features that SMBs want from financial partners. A report showed 83% sought convenience from their financial partners, followed by 69% who wanted customer analytics and intelligence, while 65% who are likely to work with a financial advisor to receive the personalized attention they need.

Closing the Banking Support Gap

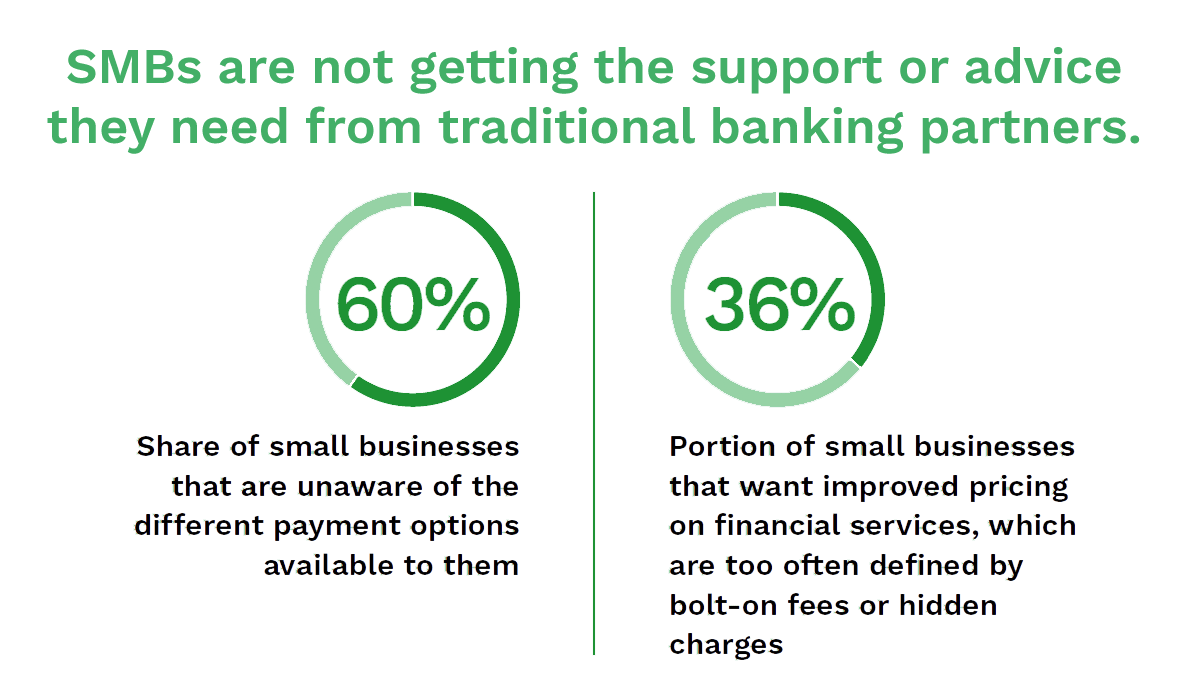

Advice is crucial to SMBs facing rising operating costs and shifting consumer demands. Traditional banks, however, are mostly coming up short. A study found that 76% of SMBs want financial advice from their bank on topics such as reducing banking fees, improving their financial situation and understanding how they can benefit from their bank’s technology offerings. Only 15%, however, receive comprehensive advice.

Advice is crucial to SMBs facing rising operating costs and shifting consumer demands. Traditional banks, however, are mostly coming up short. A study found that 76% of SMBs want financial advice from their bank on topics such as reducing banking fees, improving their financial situation and understanding how they can benefit from their bank’s technology offerings. Only 15%, however, receive comprehensive advice.

SMBs are seeking guidance on several fronts hoping to improve their financial health. Inflation motivates 60%, ongoing supply chain issues move 44%, and talent shortages and acquisition prompt 36% of SMBs to go to their bank for support. Bank executives realize there is a support gap, however, with a mere 9% of bankers saying their digital customer experience was “excellent.”

FIs Must Provide Appropriate Digital Support for SMBs’ Needs

SMBs across the Middle East and North Africa (MENA) are retooling their businesses for growth, but banks are not necessarily supporting them with the appropriate solutions for their next steps. Sixty percent of SMBs are altering business and operating models to drive profitability and growth, but 75% said they did not get the advisory support they anticipated from their bank. As a result, nearly 39% of those seeking financing are turning away from traditional banks and toward FinTech or Big Tech for future funding.