PYMNTS Intelligence: Why Digital-Everywhere Is Moving Banking Forward

Digital banking was already gaining momentum before the pandemic supercharged demand for remote services. As more consumers turned to their banks’ mobile apps than to physical branches, the industry began investing heavily in mobile experiences, including essential features and solutions that drive convenience. With 99% of consumers rating their financial institutions’ online and mobile app experiences as good to excellent, it is clear that anywhere, anytime access to banking services is the new industry standard.

FIs have been so quick to respond that the line between essential and convenient features has begun to blur. A survey found that once-top sought-after digital banking features such as transferring funds between accounts, mobile check deposit and viewing statements and account balances are now less valuable overall. Bill pay was a top-three mobile app feature, but its use was down year over year. Budgeting and tracking tools, however, were up 2%, demonstrating consumer demand for support during difficult economic times.

Competition and changing preferences force FIs to pursue end-to-end digital transformation.

The pressures of the pandemic have given way to more long-term revenue concerns and increased competition across the global banking industry. FIs are also feeling the weight of consumers’ and investors’ increasing interest in environmental, social and governance issues.

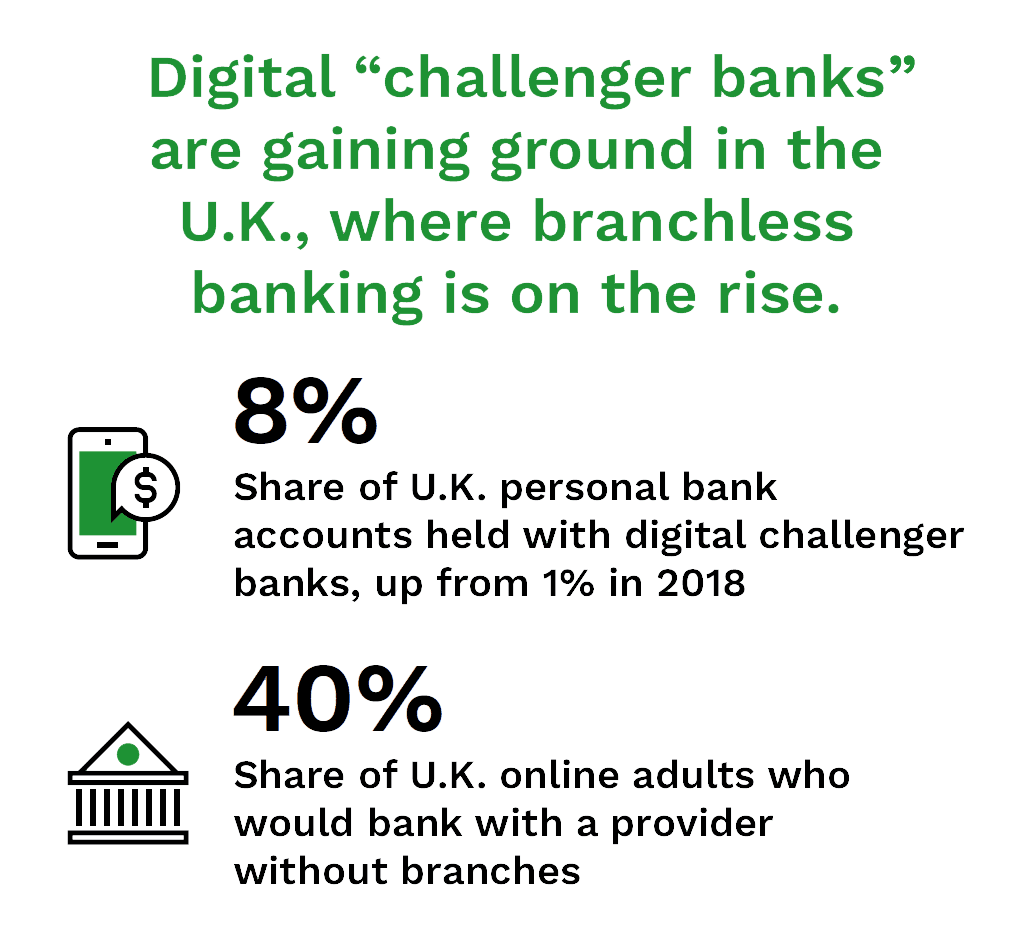

Many banks in the United Kingdom are closing branches and investing in digital innovation to create new business models and customer value. This shift is significant, with more banks moving toward end-to-end transformation to improve their IT, agility and innovation. One in four services decision-makers at U.K. banks cite their companies’ technology strategies and employee availability for digital transformation as their biggest challenges.  Those banks that can capitalize on this rapid change will be best-suited to compete over the next decade.

Those banks that can capitalize on this rapid change will be best-suited to compete over the next decade.

Bank branch evolution aims to optimize physical locations.

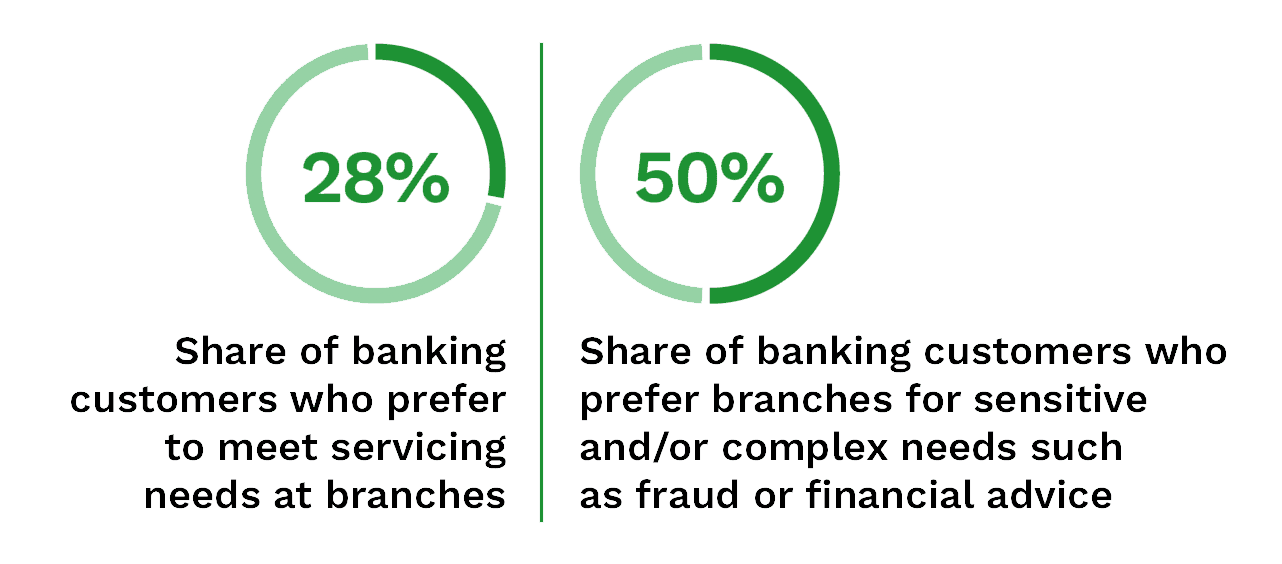

With banks’ ever-growing digital footprints, it may seem as if physical bank branches are dying, but while branch banking declined to 10% due to the pandemic, it increased to 14% in the last year while other channels such as ATMs and phone calls fell. Many customers still prefer to open new accounts in person, as physical bank branches allow them to receive support and better understand banks’ policies and fee structures. Adjusting to this changing landscape has not been easy, with sales per staff dropping 25% since 2017, and optimizing each location will continue to be an important differentiator for incumbent banks. A hybrid model will provide the most value for consumers, enabling them to choose their preferred method for specific needs.

The right combination of digital and physical will win more customers.

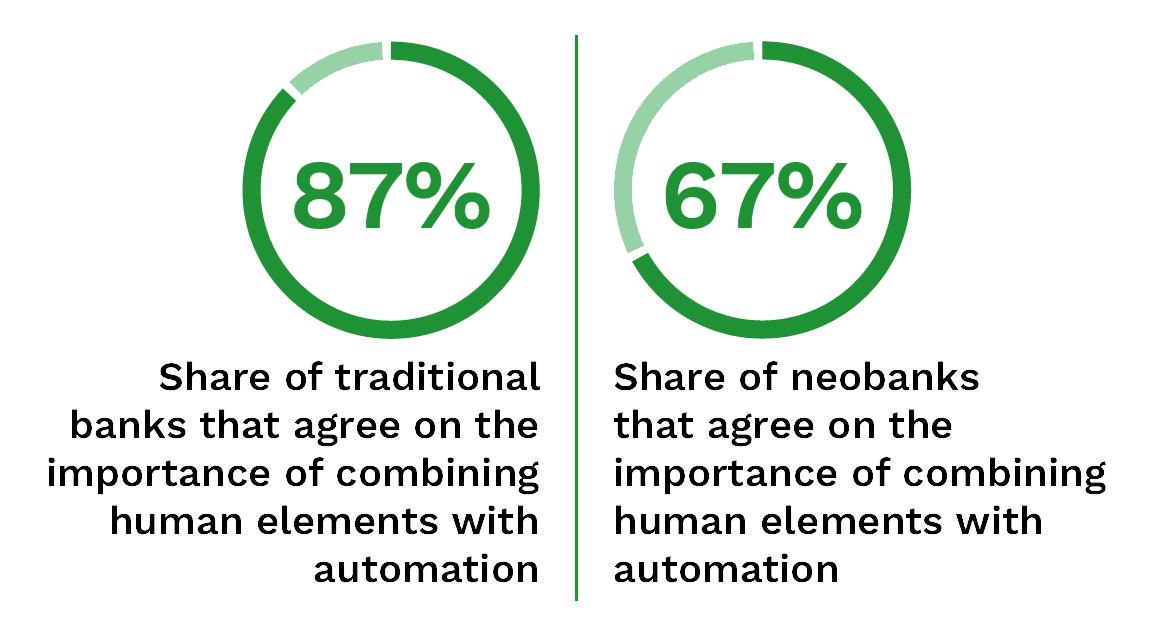

Human interaction is still an important factor in banking, with 55% of customers citing its importance to their loyalty to financial services providers. This need must help drive the balance between digital efficiency and customer expectations in banks’ strategies.

Omnichannel experience is the order of the day for the banking sector as FIs look to deploy digital for more personalized services and features for their customers. Overcoming legacy systems is a challenge for traditional banks, while neobanks have ground to make up around trust and communications. Those banks that can surmount these obstacles will be best-positioned to play a significant role in the modern customer journey.