The increased use of digital services within the past year has come with an increased risk of security issues. Cybercrime is worsening as hackers plan attacks on a massive scale to steal usernames and passwords, with 36 billion records on social sites breached in 2020 alone. This unfortunate reality means that firms like auto dealers, banks, credit unions and peer-to-peer (P2P) lenders that use digital services must focus on bolstering user identity verification and authentication measures.

The increased use of digital services within the past year has come with an increased risk of security issues. Cybercrime is worsening as hackers plan attacks on a massive scale to steal usernames and passwords, with 36 billion records on social sites breached in 2020 alone. This unfortunate reality means that firms like auto dealers, banks, credit unions and peer-to-peer (P2P) lenders that use digital services must focus on bolstering user identity verification and authentication measures.

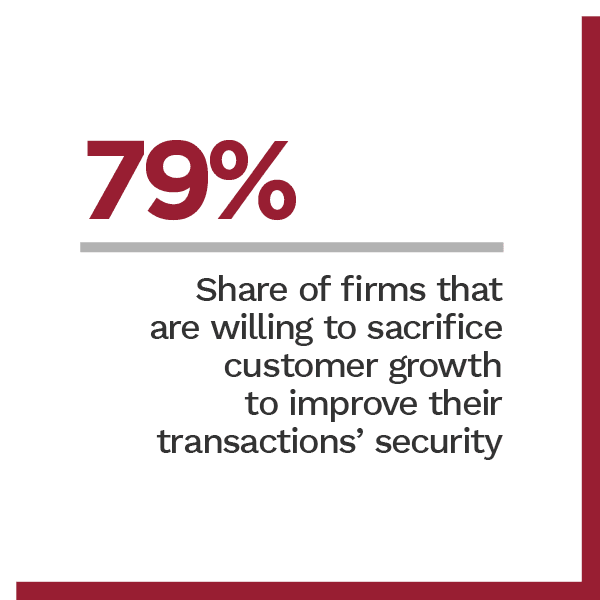

PYMNTS’ research finds that 43 percent of firms have plans to invest in digital authentication solutions to protect their businesses and their customers from increased security threats. Interest is so strong, in fact, that 79 percent of them are willing to sacrifice customer growth to improve the security of their transactions. Even with so many firms wanting to improve in this area, many admit they still have issues reconciling the need for enhanced digital identification processes with the implementation of new customer-facing technologies.

The Next Wave: Business Adoption Of Digital Identity Protection, a PYMNTS and Equifax collaboration, explores the key drivers, perceived benefits and obstacles to implementing digital identification and verification technologies. The report is based on a survey of 307 auto dealers, banks, credit unions and alternative or P2P lenders and explores what motivates them to seek solutions that can help them verify their consumers’ identities throughout their digital journeys.

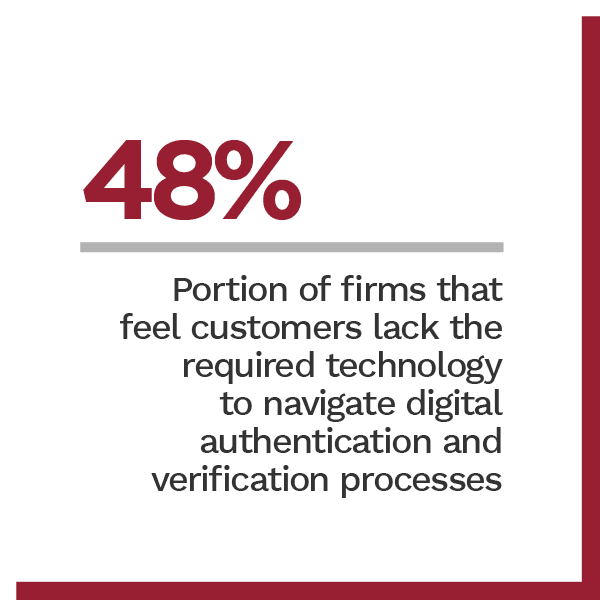

Businesses view consumers’ lack of digital skills and technology as a major problem when implementing digital verification and authentication solutions. Fifty-one percent of all firms planning to invest in such solutions believe that consumers lack the necessary digital skills to navigate them, and 48 percent of businesses feel customers also lack the required technology to do so.

Firms also report internal difficulties with implementing identity verification and authentication, especially when it comes to operational challenges related to these processes. Fifty-four percent of P2P lenders that plan to invest in these solutions report this to be a problem, for example, while 42 percent of banks and credit unions report the same. Internal problems that can cause these difficulties include digital processes that take too long, lack of financial resources to implement digital authentication and digital authentication processes that have resulted in false identities.

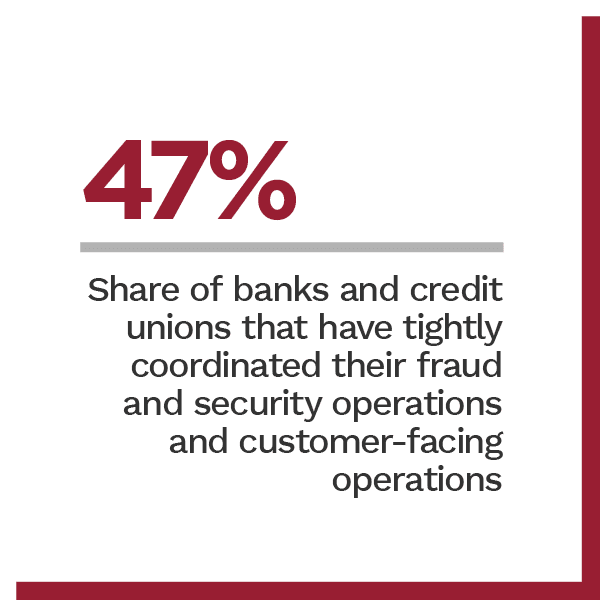

Other organizational issues can also prevent the implementation of identity verification and authentication improvements. Fifty-five percent of all firms admit that poor coordination between their fraud and security strategies and their customer-facing operations prevents identity verification and authentication processes from becoming more efficient. More established businesses tend to have coordinated fraud and security measures with their customer-facing operations, however. Forty-five percent of firms that have been in business for more than 30 years say their fraud and security are tightly coordinated with customer-facing operations, compared to just 21 percent of businesses that are less than 10 years old that say the same. Banks and credit unions are the most likely to say their fraud and security operations are tightly coordinated with customer-facing operations (47 percent), followed by P2P lenders (40 percent) and auto dealers (31 percent).

Other organizational issues can also prevent the implementation of identity verification and authentication improvements. Fifty-five percent of all firms admit that poor coordination between their fraud and security strategies and their customer-facing operations prevents identity verification and authentication processes from becoming more efficient. More established businesses tend to have coordinated fraud and security measures with their customer-facing operations, however. Forty-five percent of firms that have been in business for more than 30 years say their fraud and security are tightly coordinated with customer-facing operations, compared to just 21 percent of businesses that are less than 10 years old that say the same. Banks and credit unions are the most likely to say their fraud and security operations are tightly coordinated with customer-facing operations (47 percent), followed by P2P lenders (40 percent) and auto dealers (31 percent).

These findings touch on just a few of the insights outlined in our research. To learn more about businesses’ perceptions of and plans for digital identity protection, download the report.