As hackers are becoming more prolific with cyberattacks on digital accounts, biometric authentication technologies such as fingerprint, voice and facial recognition have grown favorable for customer identification and verification. Not just banks, but businesses of all kinds are bolstering security and privacy protection to gain consumers’ trust and retain their brand loyalty. Biometric verification methods are getting easier and more convenient for consumers to use as smartphones with supporting techn ologies become ubiquitous.

ologies become ubiquitous.

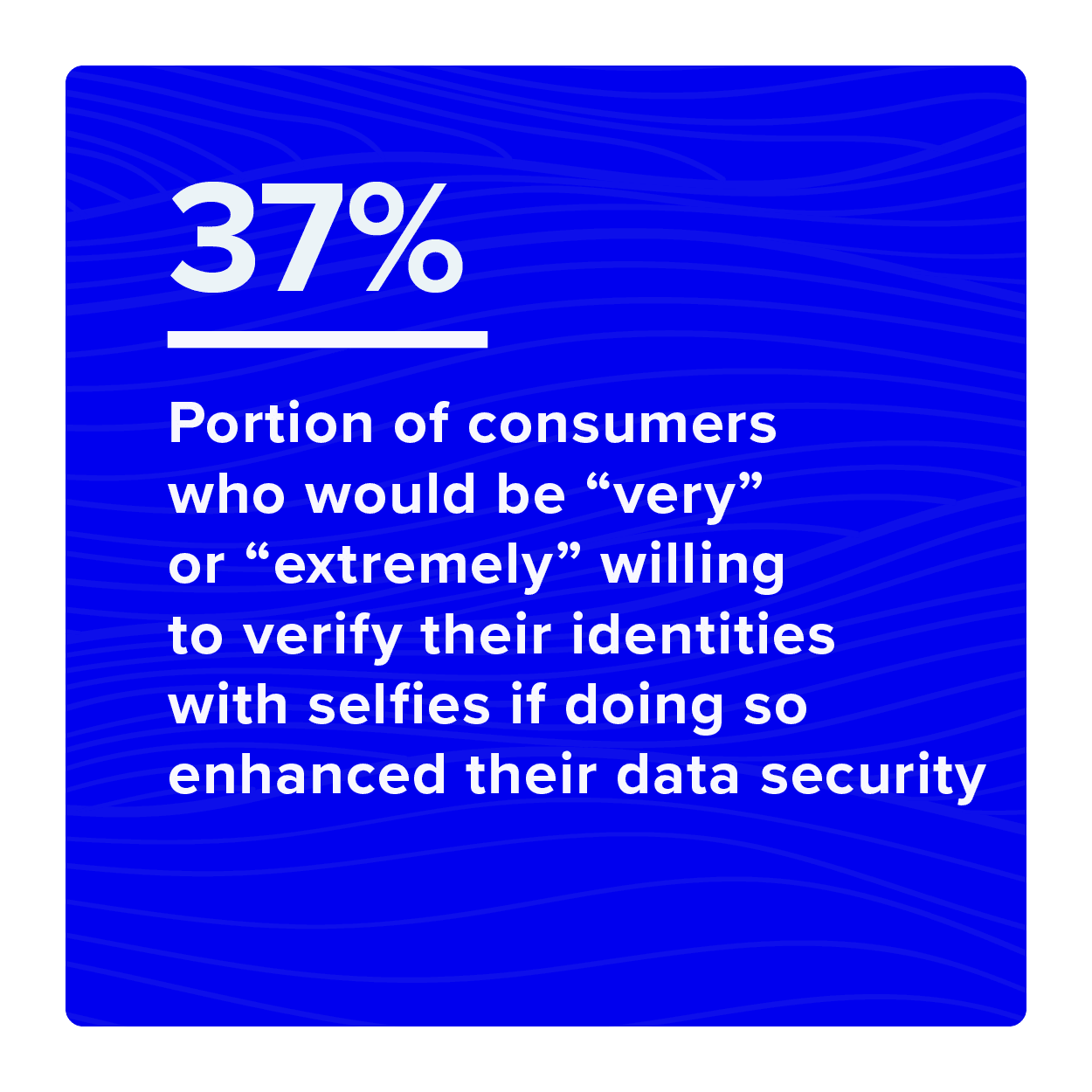

Businesses can now verify a consumer’s identity remotely using a selfie checked against a photo ID for authenticity. This gives a business the assurance that not only is ID valid, but that it is being presented by its rightful owner. Our research reveals that the “selfie method” helps ease consumers’ data security concerns. Forty percent of consumers are very concerned about the security of online accounts they use every day, especially when it comes to online gaming and gambling, social media or marketplace and sharing economies. As a result, consumers are more interested and willing than ever to present government IDs or selfies to verify their identities and secure their digital accounts, as 37 percent of consumers would be “very” or “extremely” willing to verify their identities with selfies if doing so enhanced their data security.

Selfie ID: Consumers And The Use Of Facial Biometrics To Secure Digital Commerce, a PYMNTS and Onfido collaboration, is based on a survey of 2,580 United States consumers and provides an overview of consumers’ attitudes toward data security and the possibility of using selfies to verify their identities when opening new eCommerce accounts. The report examines consumers’ willingness to use selfies to confirm their identities, particularly if they knew this method of ID verification enhanced their account security.

The report indicates that large shares of consumers are “very” or “extremely” concerned about the security of accounts for online gaming or gambling (45 percent), marketplace or sharing economies (44 percent), social media platforms (42 percent) and eCommerce (41 percent). It also shows that digitally savvy consumers are particularly anxious about their account and digital identity security, with 47 percent of millennials and bridge millennials who are very concerned about the security of their digital accounts. In terms of income, 44 percent of consumers with more than $100,000 in annual income say they are very concerned, compared to only 33 percent of consumers who earn less than $50,000 annually.

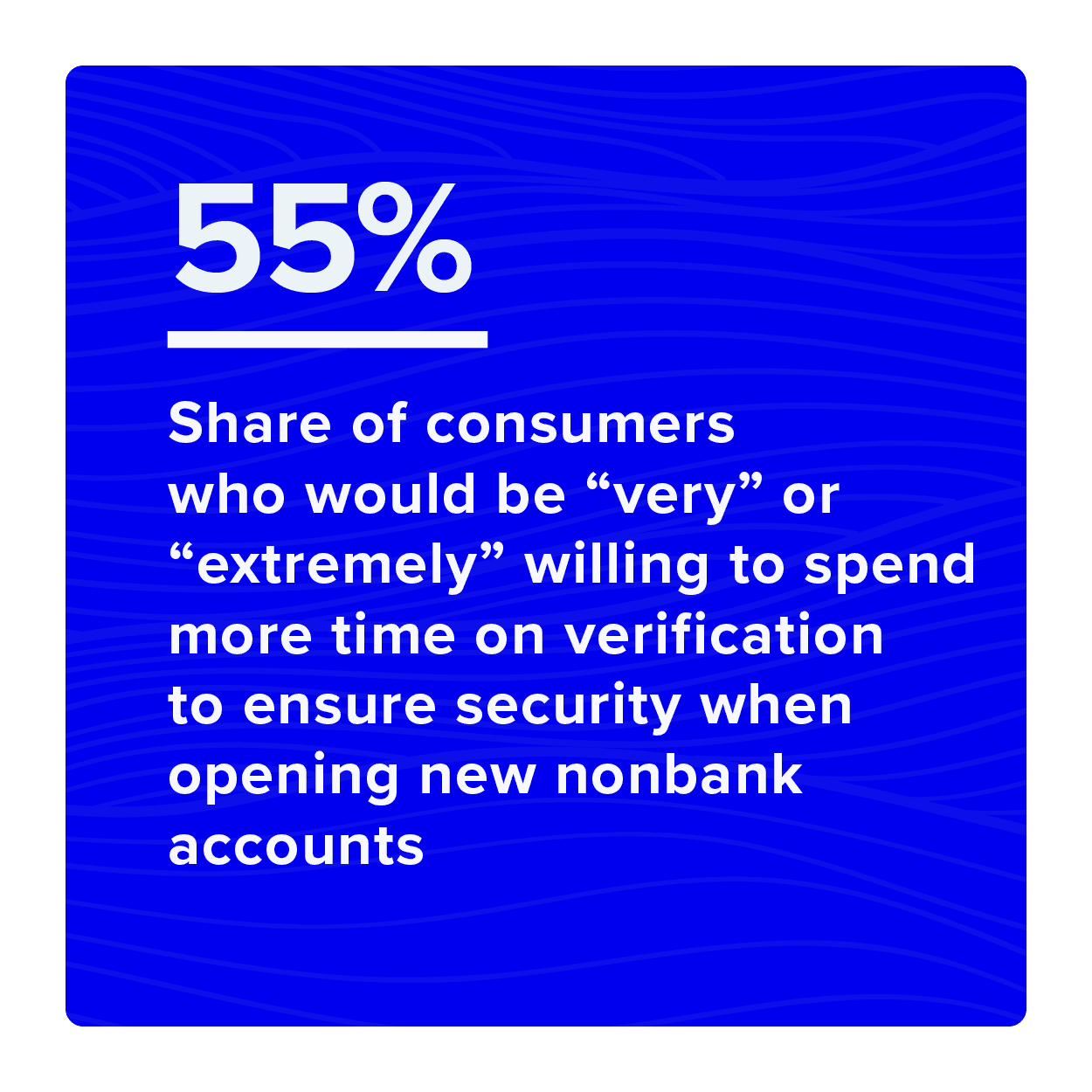

In terms of drivers for using identification verification methods, consumers do not mind taking more time to open an account if doing so creates a secure experience. This is especially true for marketplace and sharing economy, healthcare and eCommerce accounts, and 55 percent of all consumers say they are willing to spend more time verifying when opening nonbank accounts to ensure security.

Offering selfie-based identity verification can increase the loyalty and trust consumers have in their account provider. This is true for 84 percent of millennials and 83 percent of bridge millennials. Baby boomers and seniors are less eager to use selfies to verify their identities, but even among them, 47 percent would be willing to do so if their providers required it. Fifty-nine percent of consumers who are satisfied with the selfie method cite the ease of use as

Offering selfie-based identity verification can increase the loyalty and trust consumers have in their account provider. This is true for 84 percent of millennials and 83 percent of bridge millennials. Baby boomers and seniors are less eager to use selfies to verify their identities, but even among them, 47 percent would be willing to do so if their providers required it. Fifty-nine percent of consumers who are satisfied with the selfie method cite the ease of use as

the top driver of satisfaction.

These findings touch upon just a few of the insights outlined in our research. To learn more about consumers’ perceptions of and plans for selfie method digital identity protection, download the report.