DraftKings Throws Fraudsters Curveballs: Here’s How

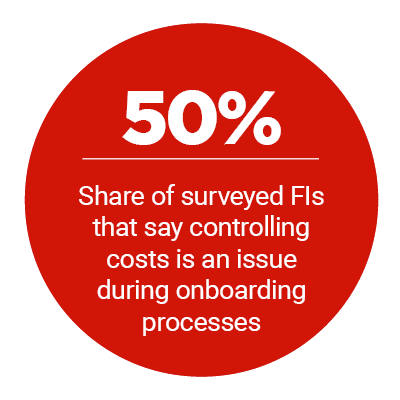

An increasing number of customers want to onboard with retailers and banks through their mobile phones, putting greater pressure on businesses to provide robust, digital know your customer (KYC) checks and other security measures. However, these companies must keep their onboarding processes swift and intuitive, or they’ll turn customers off.

In the April “Digital Consumer Onboarding Tracker,” PYMNTS explores how players from around the world are taking new approaches to onboarding security.

Around the Digital Consumer Onboarding World

Mastercard, for one, is aiming to help consumers go through the identity verification process more quickly, without having to resupply personal information to each new company with which they onboard. Recently released plans show details on Mastercard’s forthcoming decentralized universal ID project, which calls for storing tokenized identity information on consumers’ personal devices.

Allfunds, a fund distribution platform, is also looking into ways to streamline onboarding processes. The company recently announced a new online solution for onboarding fund houses. The solution is intended to support same-day onboarding, as well as handle KYC and anti-money laundering checks.

Meanwhile, Spanish banking group BBVA is tapping photo- and video-based document and biometric verification measures to secure its digital onboarding.  Keeping online identity verification secure is particularly important for BBVA, which announced that a full 38% of its U.S. customers now onboard digitally.

Keeping online identity verification secure is particularly important for BBVA, which announced that a full 38% of its U.S. customers now onboard digitally.

Find all the latest headlines in the Tracker.

How DraftKings Keeps Fraud Out of Fantasy Sports

The online fantasy sports-betting space is growing strong. Yet, if platforms want to participate, they must keep up with regulations and security requirements. That means thwarting money laundering efforts, would-be underaged users and anyone attempting to use someone else’s account information. These security efforts must also be handled without passing frictions on to customers, or they’ll move on to a competitor.

In this month’s feature story, Jennifer Aguiar, vice president of compliance and risk for DraftKings, explained a data-centric approach to providing behind-the-scenes security during onboarding, and throughout the entire customer relationship.

Read the full story in the Tracker.

De ep Dive: How Online Gaming Platforms Can Fight Fraudsters, Customer Defection

ep Dive: How Online Gaming Platforms Can Fight Fraudsters, Customer Defection

The issue of balancing onboarding security with ease is top of mind for all companies operating in the gaming and gambling space. A quarter of digital gambling customers have said they’d give up on joining a platform if the onboarding process was too long or complicated, so it’s a pressing issue.

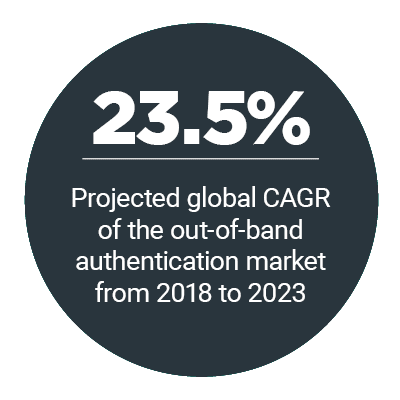

This month’s Deep Dive explores how platforms are leveraging artificial intelligence and other technologies to provide quick — and painless — customer identity verification.

Find the full account in the Tracker.

About the Tracker

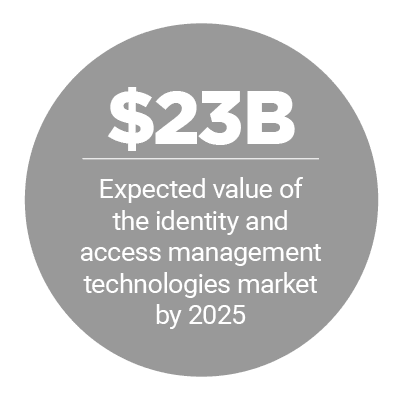

The “Digital Consumer Onboarding Tracker,” powered by Acuant, examines the latest KYC, digital onboarding and online verification news and trends. The Tracker also gauges the roles that technologies — such as biometrics and blockchain — play as identity verification procedures continue to change and expand around the world.