What Banks Can Learn From Amazon About Digital Onboarding

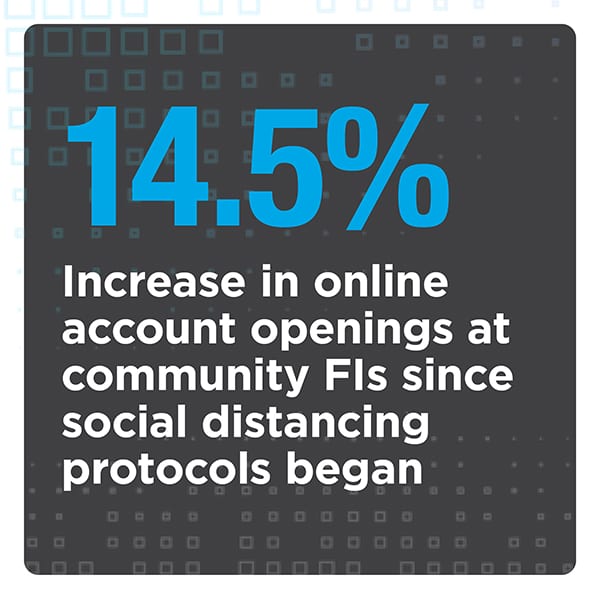

The new coronavirus led many financial institutions (FIs) to close or limit the hours of operation of their brick-and-mortar branches amid stay-at-home orders, in effect making digital platforms the only option for many consumers to interact with their banks. FIs thus received an influx of customers looking to mobile onboard as they pivoted to facilitating typically in-person activities online.

The new coronavirus led many financial institutions (FIs) to close or limit the hours of operation of their brick-and-mortar branches amid stay-at-home orders, in effect making digital platforms the only option for many consumers to interact with their banks. FIs thus received an influx of customers looking to mobile onboard as they pivoted to facilitating typically in-person activities online.

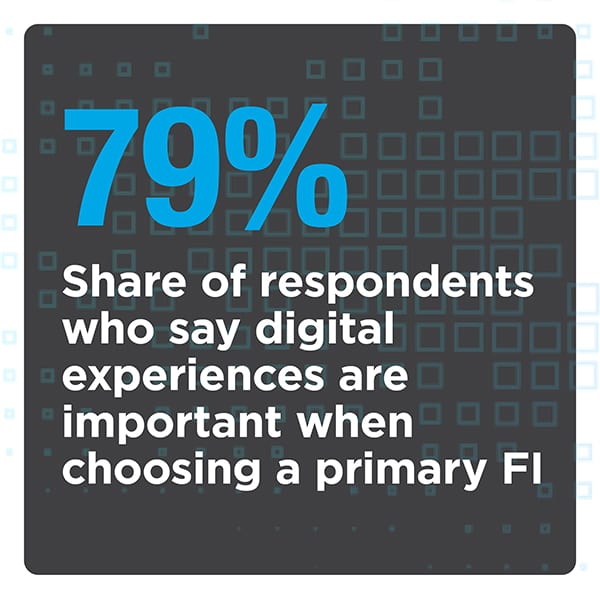

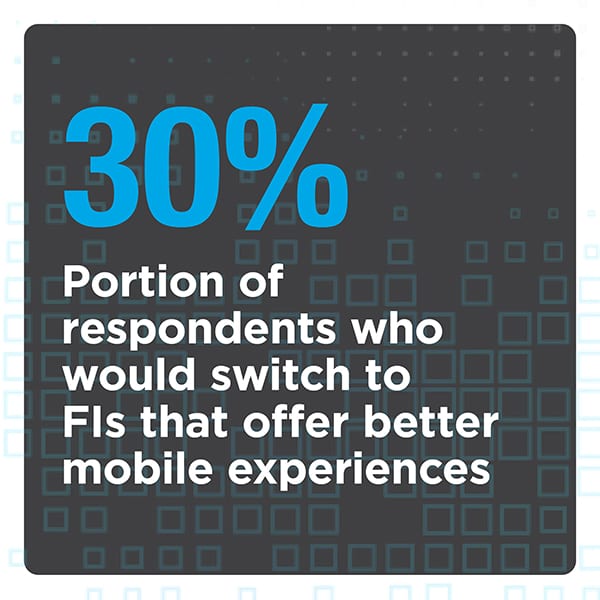

Banks are familiar enough with mobile banking, but mobile onboarding is a different story. Only 8% of financial service onboarding applications, which includes personal account opening creation, can be completed on smartphones. Yet 30 percent of consumers state they would leave their existing FIs for increased mobile capabilities.

Finding ways to address this gap only rose in importance for FIs looking to gain new customers during the pandemic, as these users searched for banks that could provide them with the quickest access to their accounts on their preferred devices.

In the latest “Digital Consumer Onboarding Tracker®,” PYMNTS analyzes how FIs are keeping up with the way the COVID-19 pandemic’s continued economic impact has changed consumers’ onboarding needs, and how this may affect the adaption of mobile banking and mobile onboarding for customers and FIs in the future.

Around the Digital Onboarding World

Consumers dramatically shifted the way they interacted with FIs and businesses in a matter of weeks to comply with the stay-at-home orders designed to keep exposure to COVID-19 to a minimum. Banks, therefore, have also had to shift the way they offer products to new customers as well as interact with those potential users. U.S. FI Citibank, for example, has expanded its CitiDirect BE digital onboarding solution to a total of 37 countries in the hopes that more consumers on a global scale will be able to access these products and build accounts remotely. The solution uses digital know your customer (KYC) technologies to allow for quick identification and account approval, including eSignatures and biometric authentication tools.

Other FIs are turning their attention to underbanked or unbanked customers at this time, two groups that are especially financially vulnerable during the COVID-19 pandemic. Ecobank Nigeria has therefore created a personal account opening process that can be conducted through smartphones for Nigerian consumers in those groups. The tool enables these individuals to create Ecobank Xpress accounts on the banks’ digital platform by calling in a specific code on their phones. These accounts will then allow customers to access and apply for microloan products, make money transfers or conduct other typical financial activities with more ease. The hope is that the product will remove some of the friction points keeping these individuals from being able to open bank accounts, as well as eliminate the need for them to finalize these accounts at bank branches among continuing health concerns regarding the pandemic.

Other FIs are turning their attention to underbanked or unbanked customers at this time, two groups that are especially financially vulnerable during the COVID-19 pandemic. Ecobank Nigeria has therefore created a personal account opening process that can be conducted through smartphones for Nigerian consumers in those groups. The tool enables these individuals to create Ecobank Xpress accounts on the banks’ digital platform by calling in a specific code on their phones. These accounts will then allow customers to access and apply for microloan products, make money transfers or conduct other typical financial activities with more ease. The hope is that the product will remove some of the friction points keeping these individuals from being able to open bank accounts, as well as eliminate the need for them to finalize these accounts at bank branches among continuing health concerns regarding the pandemic.

BBVA Switzerland, meanwhile, is leaning on video technologies to help enable safer and more seamless onboarding via digital means for new customers. The bank is utilizing what is known as a “zero contact” method for KYC checks of potential new users where it verifies individuals’ identities via video calls. These video calls can be conducted on mobile phones as well as typical laptops and require that customers share their personal information — such as their passport numbers or other official identification numbers — on these calls to complete the verification process. This allows the bank to complete onboarding safely, without the need for consumers to leave their homes.

For more on these and other stories, visit the Tracker’s News & Trends.

How Cadence Bank Is Adding a Personal Touch to Mobile Onboarding

Consumers who typically prefer to speak with bankers face-to-face were on the hunt for alternative options as the pandemic forced them to lay low at home. Many of these customers went to digital platforms to fulfill their banking needs, including mobile devices — and staying on top of this move to mobile means FIs need to get mobile onboarding right, and fast.

Consumers who typically prefer to speak with bankers face-to-face were on the hunt for alternative options as the pandemic forced them to lay low at home. Many of these customers went to digital platforms to fulfill their banking needs, including mobile devices — and staying on top of this move to mobile means FIs need to get mobile onboarding right, and fast.

Banks need to provide the same convenient Amazon-like experience that consumers are used to, while also making this process easy to understand for the customers coming from branch banking, explained Stephen Welling, director of retail banking for Cadence Bank, and Thomas Sanderson, senior vice president and digital channel manager, in a recent interview with PYMNTS.

To learn more about why and how FIs must adapt their onboarding processes to include seamless mobile onboarding, visit the Tracker’s Feature Story.

Why Mobile Banking Depends on Balancing Onboarding Convenience With Security

FIs have had decades to grow used to the needs of digital onboarding, just in time for consumers to embrace banking on their smartphones. Security concerns over the safety of these personal devices, as well as how banks can properly authenticate potential new customers through them, have been the two main factors holding FIs back from implementing fully-mobile onboarding processes. These concerns still exist, and there are still challenges attached to meeting them, but the number of consumers asking for or expecting mobile solutions from their FIs — beginning from the onboarding experience — is also growing. Banks are therefore searching for ways they can provide mobile onboarding tools with the security standards they need to completely vet these individuals.

To learn more about what tools and technologies FIs are gravitating toward for security, visit the Tracker’s Deep Dive.

About the Tracker

The PYMNTS “Digital Consumer Onboarding Tracker®,” a partnership with Melissa, examines the latest KYC, digital onboarding and online verification news and trends. The Tracker also examines the role alternative data sources and related technologies such as advanced analytical tools can play in this space as onboarding needs grow more sophisticated.