Report: Address Verification APIs Fix eTailers’ Last-Mile Problem

Consumers are flocking to digital channels during the current COVID-19 pandemic, an ever expanding volume that is challenging merchants to keep up. These customers want to be able to complete their transactions as quickly as possible, meaning the onboarding process must be swift and seamless to ensure they do not abandon it for faster competitors.

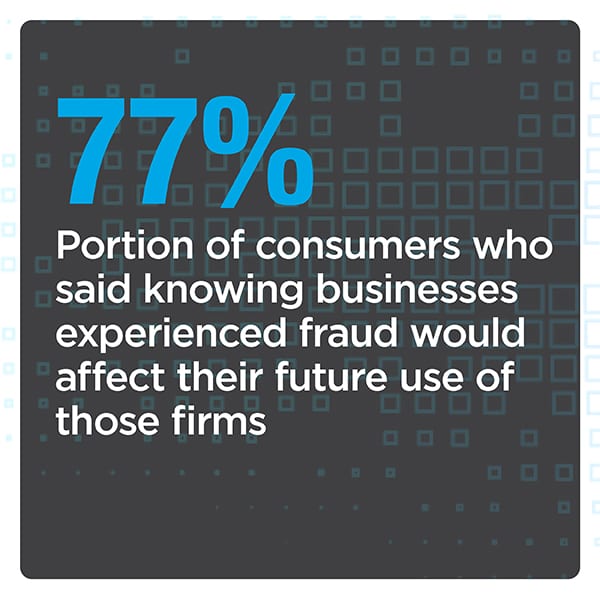

Merchants and other online services must be sure these processes are also secure, however, especially as fraud attempts have continued to climb. Distinguishing between legitimate and illegitimate customers is critical, and these companies, therefore, need to verify new users’ names, addresses and payment methods in shorter timeframes than ever to both attract new customers and keep fraudsters out.

Merchants and other online services must be sure these processes are also secure, however, especially as fraud attempts have continued to climb. Distinguishing between legitimate and illegitimate customers is critical, and these companies, therefore, need to verify new users’ names, addresses and payment methods in shorter timeframes than ever to both attract new customers and keep fraudsters out.

In the latest “Digital Consumer Onboarding Tracker®,” PYMNTS analyzes how the ongoing COVIID-19 pandemic is continuing to affect digital onboarding, the technologies companies are employing as part of these processes and why robust address verification has become essential during this time.

Around the Digital Onboarding World

Creating onboarding experiences that can keep consumers’ attention to completion has only become more difficult in recent years as customers have become spoiled for choice of online merchants. Many of these digital shoppers are now also weighing the security of this experience as top priority when they go to shop at new online retailers, according to one recent study. The research found that approximately 50% of survey respondents have left behind uncompleted onboarding signups because they felt it was either too hard or “untrustworthy.” Making sure that the signup process appears secure to consumers at first glance is thus becoming more crucial for merchants as they compete for a growing base of digital customers.

Relying upon digital onboarding can also help entities expand the number of markets — and thus the number of consumers — that entities can target. U.S.-based Bank of Hawaii has announced it will be expanding its onboarding solutions to allow new customers in Guam, Palau and Saipan to sign up for its services. The financial institution (FI) will be working with a third-party technology provider to support the expansion and digital onboarding solutions it will use. The bank is also allowing consumers to complete the signup process at their leisure, enabling customers to save their onboarding progress up to 60 days after they start. This will give them more time and flexibility, according to the FI.

The financial institution (FI) will be working with a third-party technology provider to support the expansion and digital onboarding solutions it will use. The bank is also allowing consumers to complete the signup process at their leisure, enabling customers to save their onboarding progress up to 60 days after they start. This will give them more time and flexibility, according to the FI.

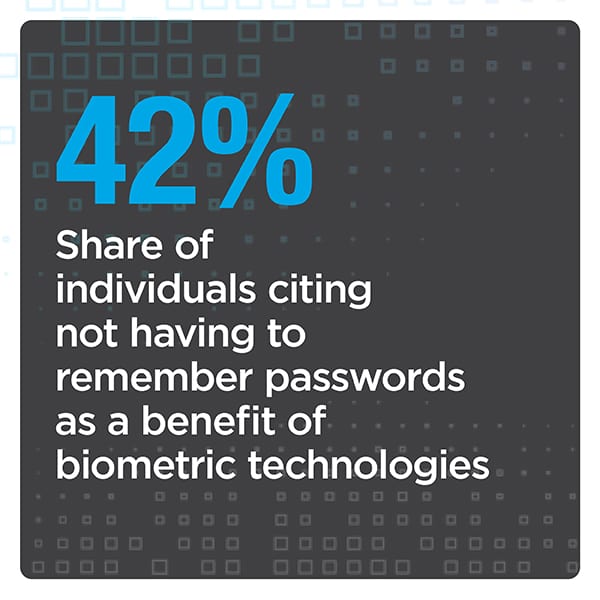

Other FIs are tapping emerging technologies to give their onboarding processes the speedy yet secure edge they need to entice consumers to complete them. This includes Dutch digital-only challenger bank Knab as it attempts to shore up its solutions to comply with the European Union’s Strong Customer Authentication (SCA) regulation. SCA requires that customers are authenticated under more robust verification terms, requiring banks and merchants to employ two-factor authentication (2FA) for this process. The challenger bank will be integrating biometric capabilities into its onboarding solutions and will be working with a third-party provider to do so. The bank is currently in the process of testing out these new biometric features.

For more on these and other stories, visit the Tracker’s News & Trends.

Why eCommerce Marketplaces Need to Get Address Verification Right the First Time

Making sure that the addresses associated with new customers are correct has always been critical to the success of eCommerce firms and marketplaces. The ongoing COVID-19 pandemic has only made address accuracy more critical, however, as more consumers rely on online shopping and grow more impatient to finalize their transactions and receive their goods. Having to slow down this part of the onboarding process to verify addresses could, therefore, create significant strain in the customer experience, explains Rodrigo Rodríguez, assortment and merchandising regional manager for Latin American eCommerce marketplace Linio.

To find out more why swift address and payment verification is essential to the success of eCommerce marketplaces during the pandemic, visit the Tracker’s Feature Story.

Deep Dive: How Inaccurate Address Verification Can Topple Digital Onbo arding

arding

Verifying consumers’ addresses seems like it would be simple, but getting this seemingly minor part of the onboarding process correct is critical to ensuring that consumers can onboard successfully. It is also a process rife with pitfalls for which merchants must watch, from customers inadvertently entering incorrect information to fraudsters attempting to impersonate legitimate users to 17% of addresses growing obsolete each year, for example. Companies must be sure that they can collect and authenticate this information at speed — as well as other immediate details such as the customers’ names and payment methods — to ensure new users do not grow frustrated and look for alternative merchants or services. Having slow or inaccurate address verification solutions can therefore directly impact merchants’ customer conversion or revenue.

To learn more about how slow or piecemeal address verification can cause frictions in the consumer experience, visit the Tracker’s Deep Dive.

About the Tracker

The “Digital Consumer Onboarding Tracker®,” a partnership with Melissa, examines the latest KYC, digital onboarding and online verification news and trends. The Tracker also examines the role alternative data sources and related technologies such as advanced analytical tools can play in this space as onboarding needs grow more sophisticated.