Freelancer.com On Why It Pays To Think Local

Firms quickly adopted solutions to operate remotely in the wake of the pandemic, and the global health crisis also appears to have changed the ways many of these companies find new talent.

More companies are turning to freelancers or independent contractors to complete projects, for example, and professionals are taking on ad hoc work more often. The United States freelance market has grown by 2 million since 2019, according to one study.

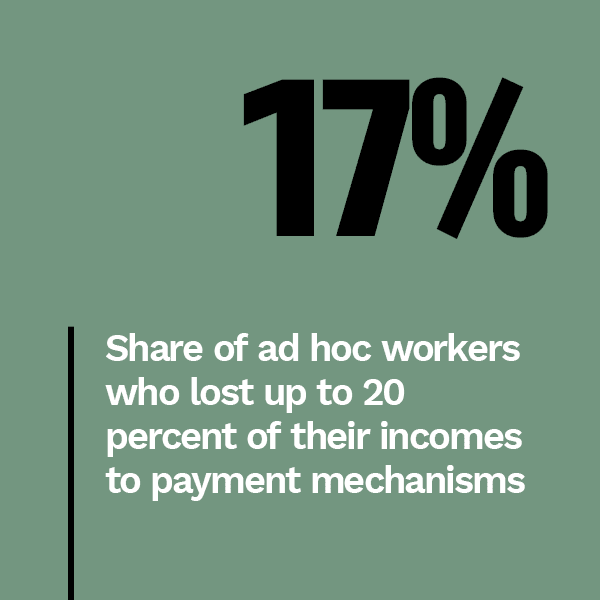

These freelancers still expect to be paid in the same way that they would receive earnings for traditional work, however — that is to say, freelancers anticipate being able to collect their money swiftly, seamlessly and in their local currencies. Sixty-seven percent of ad hoc workers based outside of the U.S. agree that having access to their funds in their local currencies is essential, in fact. This means businesses — many of which are adjusting not only to new hiring practices but to conducting these practices on a global scale — must be sure that they are offering the payment options these freelancers want in order to stay competitive.

These freelancers still expect to be paid in the same way that they would receive earnings for traditional work, however — that is to say, freelancers anticipate being able to collect their money swiftly, seamlessly and in their local currencies. Sixty-seven percent of ad hoc workers based outside of the U.S. agree that having access to their funds in their local currencies is essential, in fact. This means businesses — many of which are adjusting not only to new hiring practices but to conducting these practices on a global scale — must be sure that they are offering the payment options these freelancers want in order to stay competitive.

In the latest Digital Payments In A Digital World Playbook, PYMNTS examines how the ongoing pandemic is changing and expanding the global freelancer economy, especially in regard to how these workers want and expect to be paid. It also analyzes what these shifts mean for businesses on a global stage, and how companies can best use other virtual tools to create lasting relationships with ad hoc workers.

Freelancer.com On How Enterprises Can Tap Swift Payments To Build Trust With Global Freelancers

The pandemic  changed the way that many consumers worked worldwide near-instantly, with individuals setting up home office spaces and adopting digital technologies to operate remotely. This rapid emergence of remote working culture also appears to have impacted the growth of the global freelancing economy, with one study finding that 68 percent of remote workers reported interest in conducting some kind of freelance work. Companies have also been inspired by this remote push, with more businesses coming to online marketplaces to find freelancers they can use to complete projects or to collaborate on new ideas, said Christopher Wong, senior product manager of payments, trust and safety at global online ad hoc platform Freelancer.com, in a PYMNTS interview.

changed the way that many consumers worked worldwide near-instantly, with individuals setting up home office spaces and adopting digital technologies to operate remotely. This rapid emergence of remote working culture also appears to have impacted the growth of the global freelancing economy, with one study finding that 68 percent of remote workers reported interest in conducting some kind of freelance work. Companies have also been inspired by this remote push, with more businesses coming to online marketplaces to find freelancers they can use to complete projects or to collaborate on new ideas, said Christopher Wong, senior product manager of payments, trust and safety at global online ad hoc platform Freelancer.com, in a PYMNTS interview.

These businesses must be strategic when beginning working relationships with these freelancers, however, or risk losing out on top talent to competing companies. One way that they could potentially entice these workers to their platform is by providing swift — and crucially, personalized — payment options, Wong noted. To learn more about why fast, localized payments are essential to keep freelancers satisfied, visit the Playbook’s Feature Story.

Deep Dive: Why Freelancers Want Payment Flexibility And How Businesses Can Deliver

More and more professionals are trying their hand at freela ncing each year, with one report predicting that there will be 57 million ad hoc workers in the U.S. alone by 2021. The rising popularity of this type of work also comes as more businesses are tapping freelancers to finish outstanding projects at higher rates, with 80 percent of U.S. companies claiming that they are now reliant on a mix of full-time and ad hoc workers, for example.

ncing each year, with one report predicting that there will be 57 million ad hoc workers in the U.S. alone by 2021. The rising popularity of this type of work also comes as more businesses are tapping freelancers to finish outstanding projects at higher rates, with 80 percent of U.S. companies claiming that they are now reliant on a mix of full-time and ad hoc workers, for example.

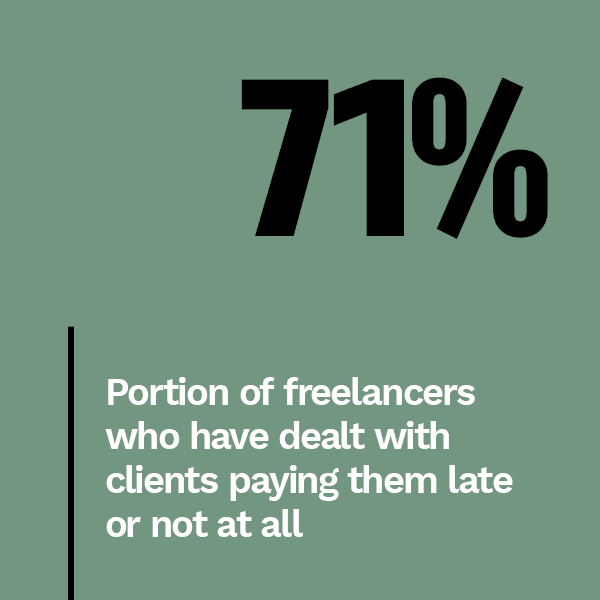

This expansion of the freelance economy also comes with several challenges, however, both for these individuals and for the companies that want to make use of their talents. Freelancers increasingly want to be paid as swiftly as possible — preferably in their local currencies — and businesses are competing against a growing list of other companies to entice skilled freelancers to work for them. Finding ways to meet freelancers’ changing payment expectations could thus prove critical for these companies. To learn more about how ad hoc workers’ payment expectations are shifting and how this provides businesses with key opportunities to entice top talent, visit the Playbook’s Deep Dive.

About The Playbook

The Digital Payments In A Digital World Playbook series, a PYMNTS and North Lane Technologies collaboration, covers the latest digital payments developments, including how consumers’ changing payment preferences are driving businesses and banks worldwide to adopt digital payments.