BigCommerce: SMBs Tap Trusted Payment Providers To Curb Cart Abandonment

Digital innovation has long been a part of the business-to-consumer (B2C) space, but it has become the name of the game in recent months.

eCommerce in particular witnessed a massive digital shift during this time, representing 19 percent of global retail sales by the end of 2020 — a 3 percentage-point rise over 2019. This digital shift in shopping habits carried with it a digital shift in payments, with a growing number of consumers becoming more comfortable using online and mobile tools to pay for everything from food to utility bills.

This widespread digital pivot has affected more than just the B2C spac e. Even business-to-business (B2B) firms observed significant changes in their operations, with firms taking to digital channels to establish critical buyer and vendor relationships and to handle payment processes. Much of this shift has been the result of B2B professionals’ experiences with seamless B2C payment processes in their personal lives, in fact.

e. Even business-to-business (B2B) firms observed significant changes in their operations, with firms taking to digital channels to establish critical buyer and vendor relationships and to handle payment processes. Much of this shift has been the result of B2B professionals’ experiences with seamless B2C payment processes in their personal lives, in fact.

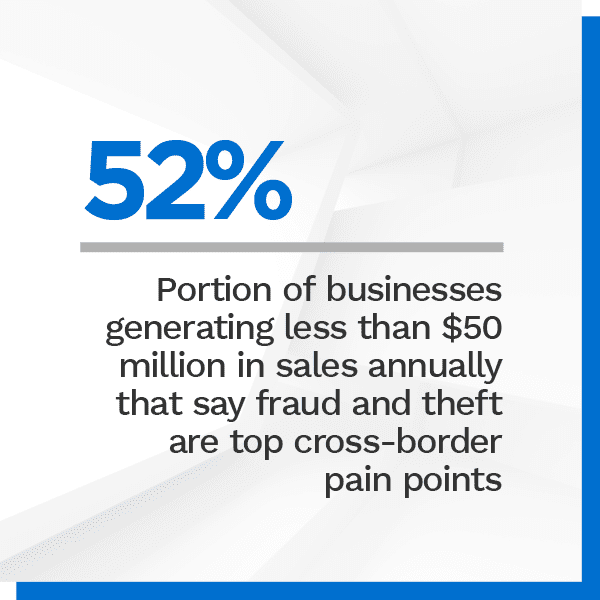

B2B firms are still hitting roadblocks as they strive to take more of their operations and payment processes digital, however. Legacy infrastructure and manual accounts receivable (AR) processes can make it difficult for them to advance their digital transformations, and this is especially true for the small- to medium-sized businesses (SMBs) that have less funding and fewer employees to devote to the cause.

The Optimizing SMB Payments Report explores the latest developments in the SMB space as more small firms work to digitize their operations. It explores how these businesses can optimize their processes and invest in the technologies to take their operations into the future — one that appears to be decidedly digital.

Around the SMB Payments Space

The U.S. Small Business Administration’s Office of Advocacy estimates that almost two-thirds of the nation’s food and drinking establishments are classified as small businesses, making them an integral part of the SMB space. Even these small eateries are beginning to realize that they can benefit from working with vendors that offer a broad assortment of payment options, however. One survey found that 90 percent of restaurateurs would value being able to access various digital payment options, and that they would not be averse to shopping around for different vendors who can help them meet their needs.

SMBs across all industries are also turning their attention toward emerging technologies like artificial intelligence (AI), with research noting its applicability for both front-end and back-end operations. Some B2B SMBs are tapping AI-driven chatbots to manage their clients’ payment-related queries, allowing these businesses to free up resources and staff for other tasks. On the back end, businesses’ AR and accounts payable (AP) operations can also benefit, with AI supporting their anti-fraud strategies and helping them make faster lending decisions.

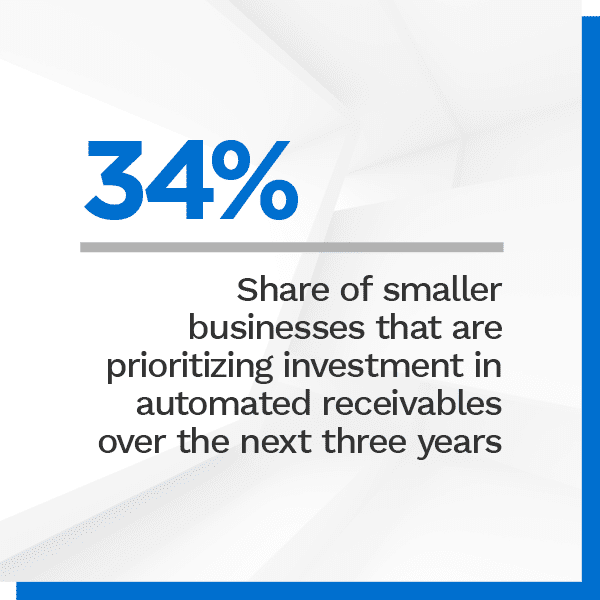

One of the main reasons AI and other auto mated technologies are so appealing to SMBs is that they promise to help these firms address their cash flow concerns. Cash flow crunches are no small issue for SMBs, with a report finding that 57 percent of small firms in the U.S. collected late payments in 2020. Part of the blame lies with SMBs’ manual payment processes, leading many to seek out automation tools to address their AR frictions and gain visibility into their cash flows.

mated technologies are so appealing to SMBs is that they promise to help these firms address their cash flow concerns. Cash flow crunches are no small issue for SMBs, with a report finding that 57 percent of small firms in the U.S. collected late payments in 2020. Part of the blame lies with SMBs’ manual payment processes, leading many to seek out automation tools to address their AR frictions and gain visibility into their cash flows.

For more on the stories and other SMB payments headlines, read the Report.

BigCommerce on Keeping Payments Secure to Help SMBs Build Trust

Competing with larger rivals means SMBs must offer numerous secure payment methods. This requires consumers to trust that their information will be safe even as they buy with SMBs for the first time, and seeing their preferred payment options at checkout can go a long way toward giving potential customers the confidence not to abandon their carts.

In the Feature Story, Chad Jaben, director of strategic business development for Software-as-a-Service (SaaS) eCommerce platform BigCommerce, explains how choosing the right payments providers can help SMBs stand out and convert first-time customers into repeat ones.

Read more in the Report.

Deep Dive: Why Automation Holds the Key to Helping B2B Firms Offer Streamlined Payme nts

nts

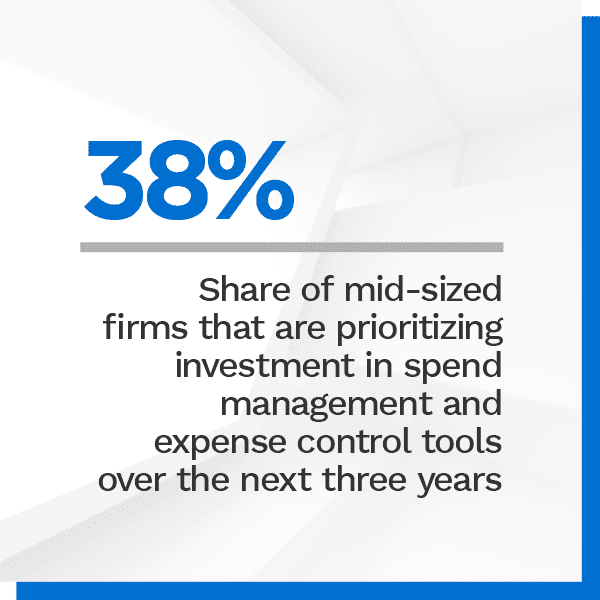

Online shopping has surged over the past two years as consumers begin to accomplish more of their daily tasks digitally. Many of these consumers are taking their digital expectations into their professional lives as well, and they are more than willing to switch to new business partners if their expectations are not met.

The Deep Dive examines how B2C payment trends are influencing the B2B space as well as which technologies and tools firms — especially those in industries like manufacturing — can use to offer small buyers the B2C-like experiences they crave.

Read the Deep Dive in the Report.

About the Report

The Optimizing SMB Payments Report, a PYMNTS and American Express collaboration, examines how SMBs in the B2B and B2C spaces can invest in emerging payment technologies and automated solutions to offer smooth, secure and streamlined payments to their customers.