When much of the U.S. shut down because of the pandemic in March 2020, the hands-on nature of the hair and beauty industries saw them hit particularly hard, according to Kate Kirk, a vice president in U.S. Merchant Marketing at American Express. While other sectors, such as restaurants, were able to provide outdoor service and consumer packaged goods (CPGs) retailers were able to shift to eCommerce, she said “many salons simply had to close.”

But now, nearly a year and a half later, “the industry is poised to rebound, as customers are eager to spend on beauty services as life continues to resume,” Kirk said, adding that over half of adults surveyed by American Express said they felt an obligation to help their local salons that have been impacted by the pandemic.

According to PYMNTS’ Digitizing Beauty Businesses Report, which was done in collaboration with American Express, reservations at beauty and personal care businesses were up 156% year over year in May, an 81% increase from the February 2020’s pre-pandemic levels. Gross year-over-year payment volumes also jumped 121%, up 25% from before the pandemic began. Additionally, 74% of consumers said they expect to increase expenditures on makeup as more businesses reopen, and 94% planned to invest in new health and wellness routines.

Read more: By Offering Contactless Payments, Salons Go a Cut Above

Evolving Payment Methods

Kirk said, though, that to keep up with consumers, salons and other beauty services providers need to digitize their business operations and enable digital payments. Online salon management systems and scheduling apps are becoming an expectation, “and the things customers care about most are changing,” she said. For example, 84% of adults surveyed in an Amex Trendex study said that it’s important that their preferred payment option is available when deciding whether to shop at a business.

(This Morning Consult poll was conducted between June 2 and 14 among a national sample of 2,000 general population consumers with a household income of more than $50,000, and a national sample of 500 small business decision makers. Results from the overall survey have a margin of error of plus or minus 2 percentage points.)

“Payment methods are always evolving,” Kirk said, noting that salons have increasingly adopted card-on-file solutions and QR code technology so that barbers and stylists can be paid in tips without reaching for a wallet. “Digital payments are becoming the norm in the rapidly evolving marketplace.”

In the Digitizing Beauty Businesses Report, PYMNTS found that contactless transactions have grown more than 40% since the onset of the pandemic, and 73% of consumers who changed their shopping habits for safety reasons said they wanted merchants to provide contactless payment options.

“Not only is this a faster way to pay, but they keep the checkout process cleaner by being touchless,” Kirk noted.

Additionally, nearly three out of four consumers surveyed in April who shifted to online shopping during the pandemic said they will continue to do so, which Kirk said suggests that many of the customer-friendly strategies and technologies adopted during the pandemic are becoming industry staples.

Thinking Like a D2C Brand

Kirk noted that one strategy that American Express is emphasizing with merchants as they define their new normal is to “think like a direct-to-consumer (D2C) brand,” which means putting the customer first and coming up with creative solutions to problems. This could mean personalizing communications using available customer data or creating a subscription service for consumers. The exact implementation, Kirk said, “really depends on a number of things, such as the industry, target audience, the type of products a company is offering to consumers.”

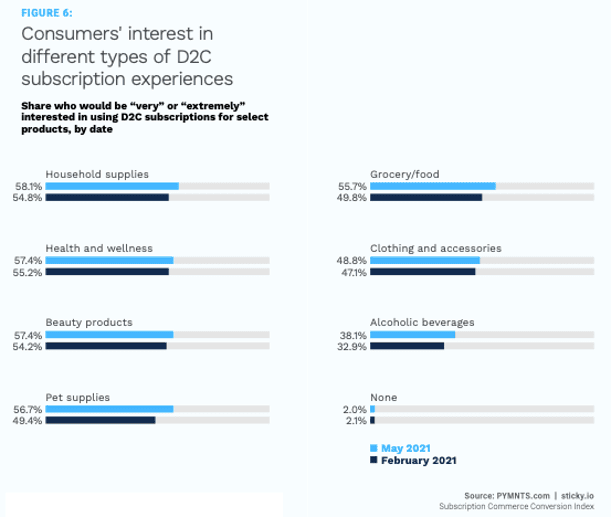

According to PYMNTS research, 46% of subscribers use D2C subscription services because such services are more convenient than shopping in stores, or they do it to save money, to avoid having to shop for certain products regularly, or to save time. Over 57% of consumers surveyed said they would be “very” or “extremely” interested in using D2C subscriptions for beauty products.

See: 45 Pct of Gen Z Subscribers Used Only D2C Subscriptions in Q2 2021

Three types of subscription services that seem to work, Kirk noted, are replenishment services, which provide regularly recurring deliveries of products; curation subscription services, which provide collections of products to individuals based on their needs and tastes; and the access model, where customers must purchase a membership in order to have access to the company’s products.

“As we navigate the next phase of recovery, let’s focus on creating an easier customer journey to help merchants once again grow and thrive,” Kirk said.