A side effect of the pandemic has been pressure on traditional bill pay options, as consumers grow increasingly concerned with on-time payments, accruing debt, negative hits on credit reports and other ills that can arise from unfulfilled bill pay needs and expectations.

For the Flexibility Factor: Mapping Consumer Demand For Bill Payment Innovation, a PYMNTS and BillGO collaboration, we surveyed nearly 2,300 U.S. consumers about their bill pay preferences and found flexibility is a key component of a better bill pay experience.

“Consumers continue to seek easier ways to remove friction from payments,” the study states, “and innovative financial institutions (FIs) and FinTechs are beginning to respond to consumers’ need for flexibility with online tools designed to increase their control over their financial lives.”

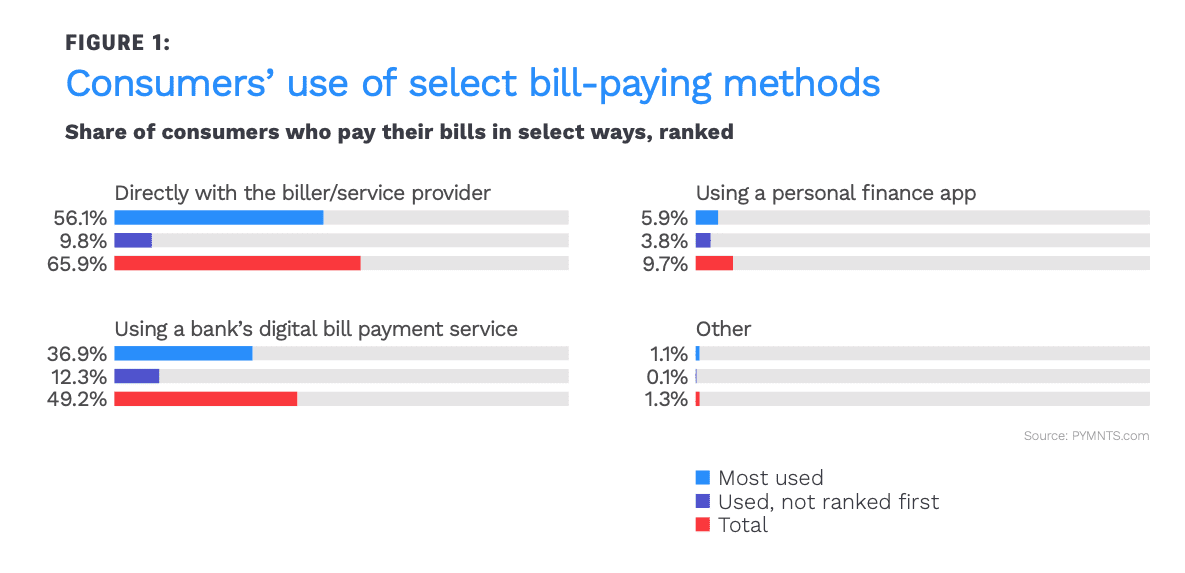

And while a majority of consumers are still paying all or most bills directly to billers from utilities to auto loans, the appetite for better digital tools is growing stronger. This is important to financial institutions (FIs) that want to be part of the bill pay flow.

Get the study: The Flexibility Factor: Mapping Consumer Demand For Bill Payment Innovation

Advertisement: Scroll to Continue

Late Payment Fears Loom Large

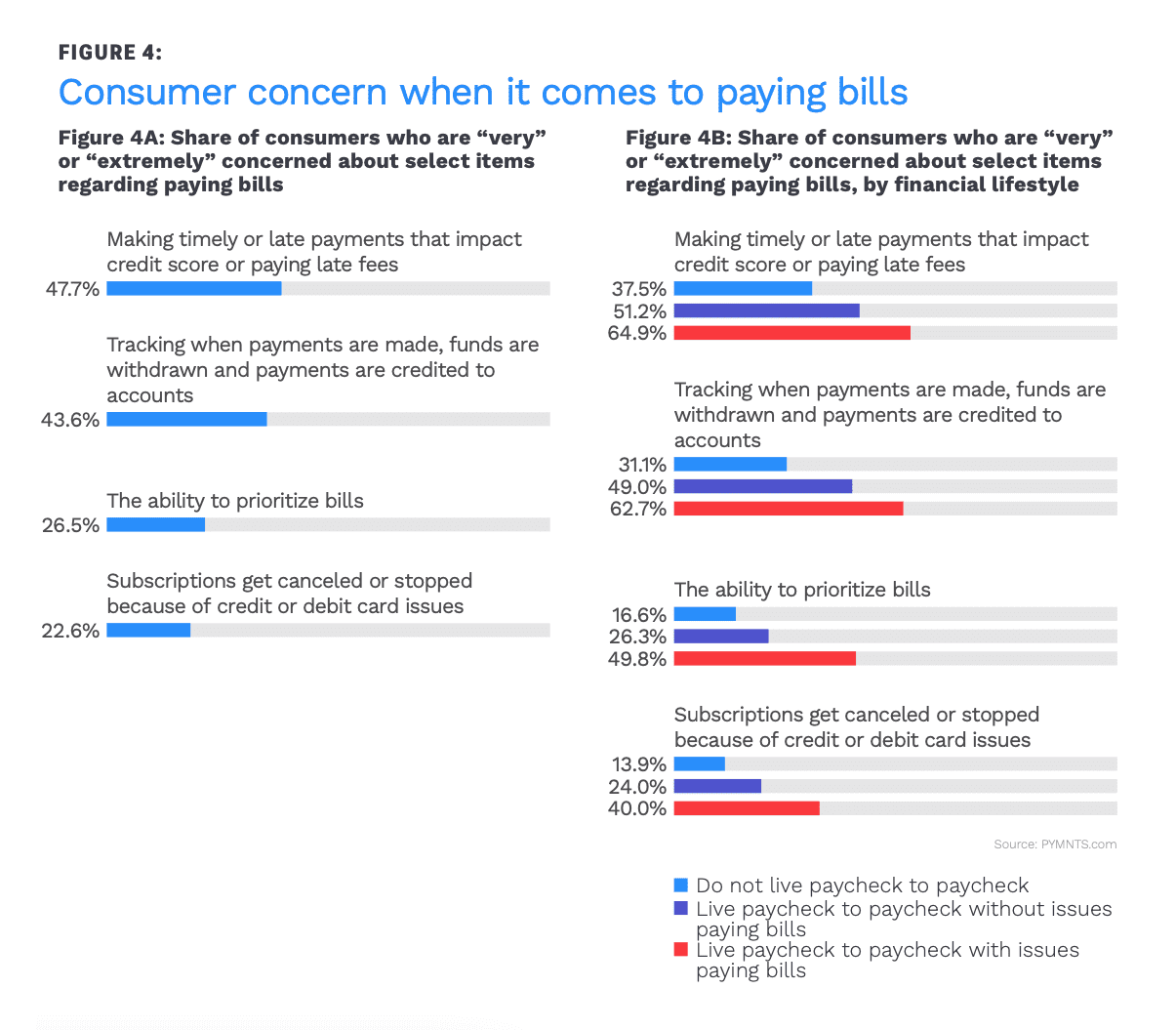

The upheaval in bill pay routines is another side effect of the pandemic. Researchers found that nearly half of those surveyed fear missing payment and the impact it can have on credit scores.

Per the study, “Economic uncertainty has had a lasting impact on millions of Americans, and many still struggle to pay their bills. PYMNTS’ research reveals that 24 percent of consumers made a late payment or missed a payment in the last 12 months — a share that is much higher for millennials (40 percent) and bridge millennials (38 percent).”

Additionally, we found that 48 percent of consumers remain “very” or “extremely” concerned about making timely or late payments in 2021. “This percentage increases substantially among consumers who are under significant financial stress and who describe themselves as living paycheck to paycheck. Forty-four percent of consumers are concerned with tracking time when payments are made, when funds are withdrawn and when payments are credited to accounts.”

Read: The Flexibility Factor: Mapping Consumer Demand For Bill Payment Innovation

The Microloan Moment

With bill pay fears pressing in on millions of Americans, many are seeking microloans to bridge the gap. The study found that 17 percent of consumers are “very” or “extremely” interested in accessing a low-interest microloan for bill payment purposes.

According to the study, “Many consumers simply let overdraft fees accrue when cash flows are inconsistent, yet microloans can be viable for those who prefer to avoid adding to a poor payment history. 75 percent of consumers who are already ‘very’ or ‘extremely’ interested in using low-interest microloans to help pay bills are more likely to use a microloan when the fees charged are lower than overdraft and late fees.”

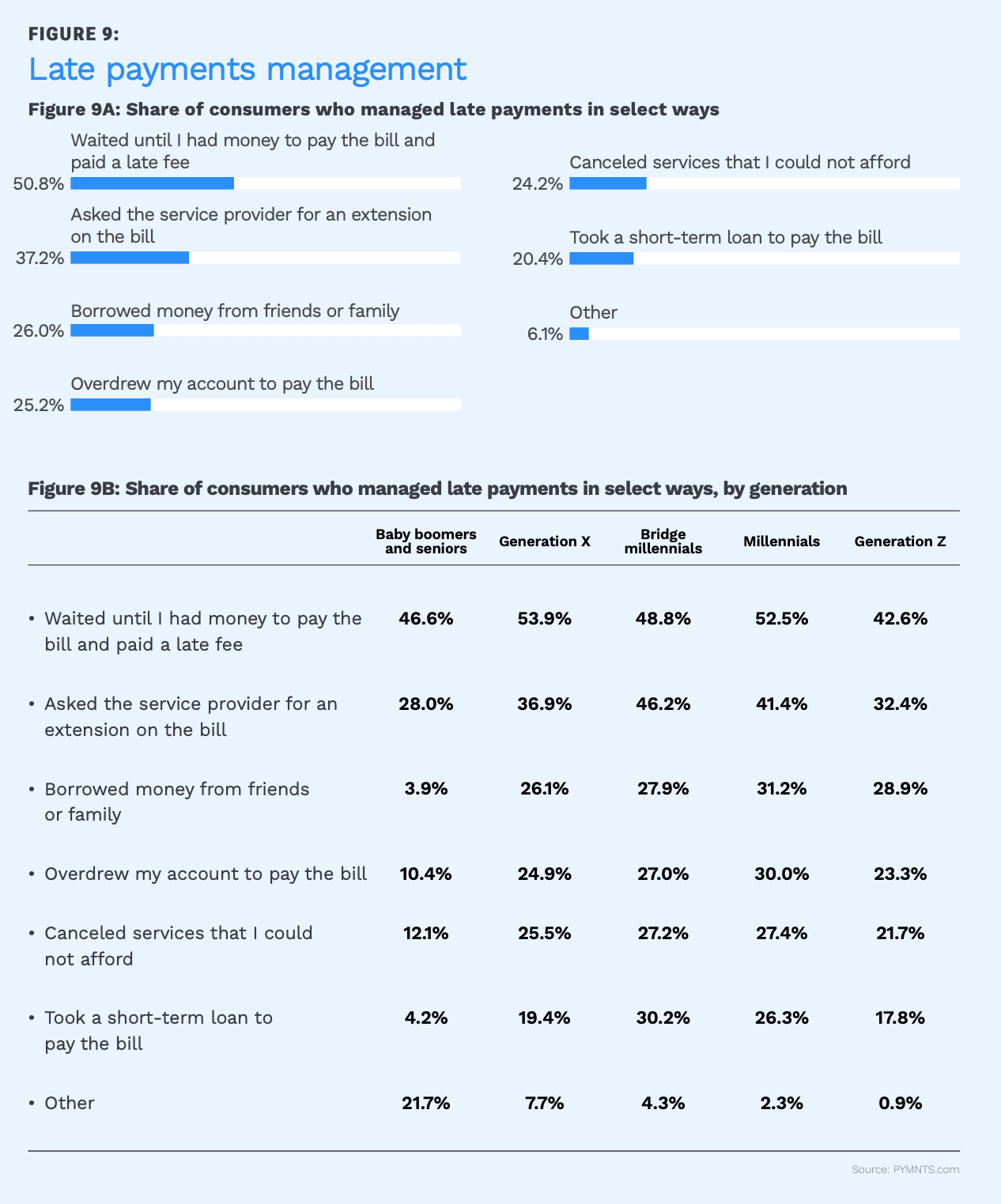

Additionally, “PYMNTS found that just over half of consumers who failed to pay a monthly bill tended to wait until they had enough money to pay and incurred a late fee at least one time in the past 12 months. Another 25 percent of consumers have overdrawn their accounts to pay a bill. Microloans can provide these financially at-risk consumers with the ability to make small, on-time payments on their bills, potentially helping them protect their credit while allowing them to cover basic needs and build cash reserves.”

Read: The Flexibility Factor: Mapping Consumer Demand For Bill Payment Innovation