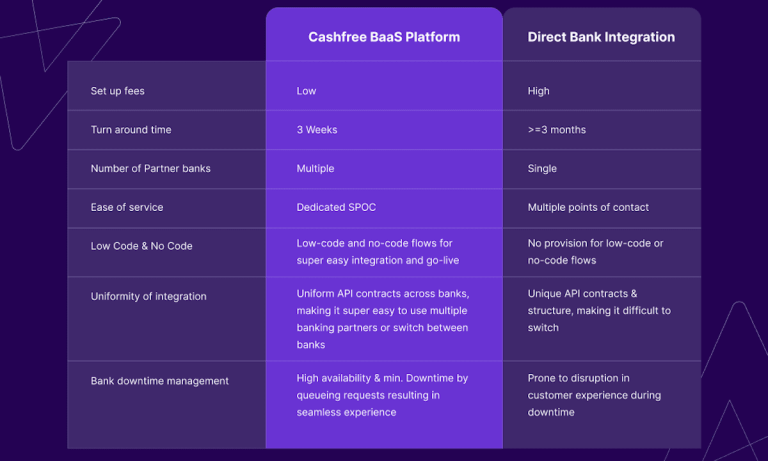

Issuance can be used for payroll, customer loyalty programs, expense management and more and will offer low-code and no-code flows so businesses can launch prepaid cards within weeks and without multiple integrations, according to a Wednesday (Oct. 19) press release.

The customized prepaid cards give businesses the ability to assign spending limits as well as create closed-loop, open-loop or hybrid payment options. Cards can be mono-branded or co-branded, bundled and seamlessly packaged with Cashfree Payments’ Payment Gateway and Payouts, APN News reported.

The low-code flow of issuance points to the company’s “technological prowess,” said Cashfree Payments Co-Founder and CEO Akash Sinha, per the report.

“As a front-runner in the API banking and payments space, ‘Issuance’ strengthens our focus on accelerating digital payments for India,” he said in the report.

With over 50% market share among payment processors, Cashfree Payments leads bulk disbursals in India with its product Payouts, according to the release.

Advertisement: Scroll to Continue

Cashfree Payments works in association with financial institutions (FIs) to develop payments and banking infrastructure and is integrated with major platforms, including Shopify, Wix, Paypal, Amazon Pay, Paytm and Google Pay, the APN News report stated.

Incubated by PayPal and backed by SBI, Y Combinator and Apis, the scalable payments platform handles the payment needs of more than 150,000 businesses to collect and make more than $40 billion and serves over 200 million bank accounts, according to its website.

See also:

Cashfree Payments Upgrades Its Token Vault

India’s DASH Platforms Offer Cashfree Payments POS to Merchants

Increasing RuPay, UPI Acceptance In EU, Middle East Helps Indian Travelers Spend With Ease