Ingrained faith in the physicality of banknotes has long driven German consumer behavior, as cash still accounts for an average 51% of all retail transactions as recently as 2020. For comparison, the rate in the neighboring Netherlands is 22% and Luxembourg’s is 24%. Partially driven by the preponderance of local businesses limiting their payments to cash, shoppers are simply used to carrying a physical wallet containing euros to purchase from local merchants.

These numbers corroborated previous PYMNTS research finding that even pandemic-associated lockdowns did little to sway the seemingly countrywide preference for cash. And, as noted in the PYMNTS’ May “How the World Does Digital,” the distribution of payment preferences in Germany remains both remarkably steady and evenly divided.

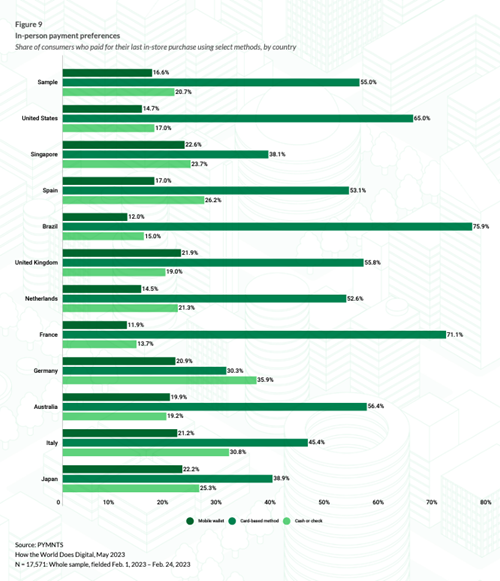

As demonstrated in the chart, Germany’s use of cash or checks for 36% of all in-store retail purchases far outpaces the other surveyed countries, with the closest runner-up the also cash-heavy Italy. Conversely, however, Germany remains one of the largest adopters of mobile wallet use for in-store purchases, which accounts for 21% of all retail transactions made using the payment platform. These shares haven’t much budged since 2022, when a PYMNTS-PayPal collaboration on super apps found that 29% of German consumers preferred card-based transactions, 38% preferred using cash and 20% said the same for mobile transactions.

The question now: If pandemic-related restrictions didn’t deter German consumers’ cash reliance, could an economic downturn do so? Hints of the country falling into a recession have lingered since late 2022, when Germany’s Federal Statistical Office reported a 2.8% decline in retail turnover compared to the month prior. PYMNTS found this drop correlated to a slowdown in online engagement in Q3, including an overall 13% dip in daily digital activities, with digital transactions decreasing 6% from the previous quarter.

As recently as April, German consumers have begun mirroring the behavior of U.S. shoppers. The country’s consumer online transactions are being pared back to the essentials as the country’s fashion sector saw a 21% drop in sales year-over-year in Q1 2023.

And, as noted last week (May 25) by the Financial Times, this pullback has partially driven Europe’s largest economy into firm recession territory.

Payment preferences clearly have little effect on an economy’s overall health. However, economic unease could certainly influence consumer behavior, as many may be inclined to not make any sudden moves when it comes to personal finances. Although habits and patterns change both with and without outside influences, it may be a while longer before German consumers see a reason to shift significantly away from using cash.