The majority of bridge millennials would pay for retail purchases via bank transfer if they could earn rewards for doing so, PYMNTS research reveals, but other generations are more hesitant.

For PYMNTS’ study “New Payment Options: Building Stronger Customer Ties With Pay By Bank Transfer,” we surveyed over 2,000 U.S. consumers to understand their willingness to use online bank transfers for recurring bill payments and online purchases.

The results of the study, created in collaboration with payment technology company Nuvei, revealed that a sizable share of consumers would make payments in this way for retail purchases is offered a reward for doing so.

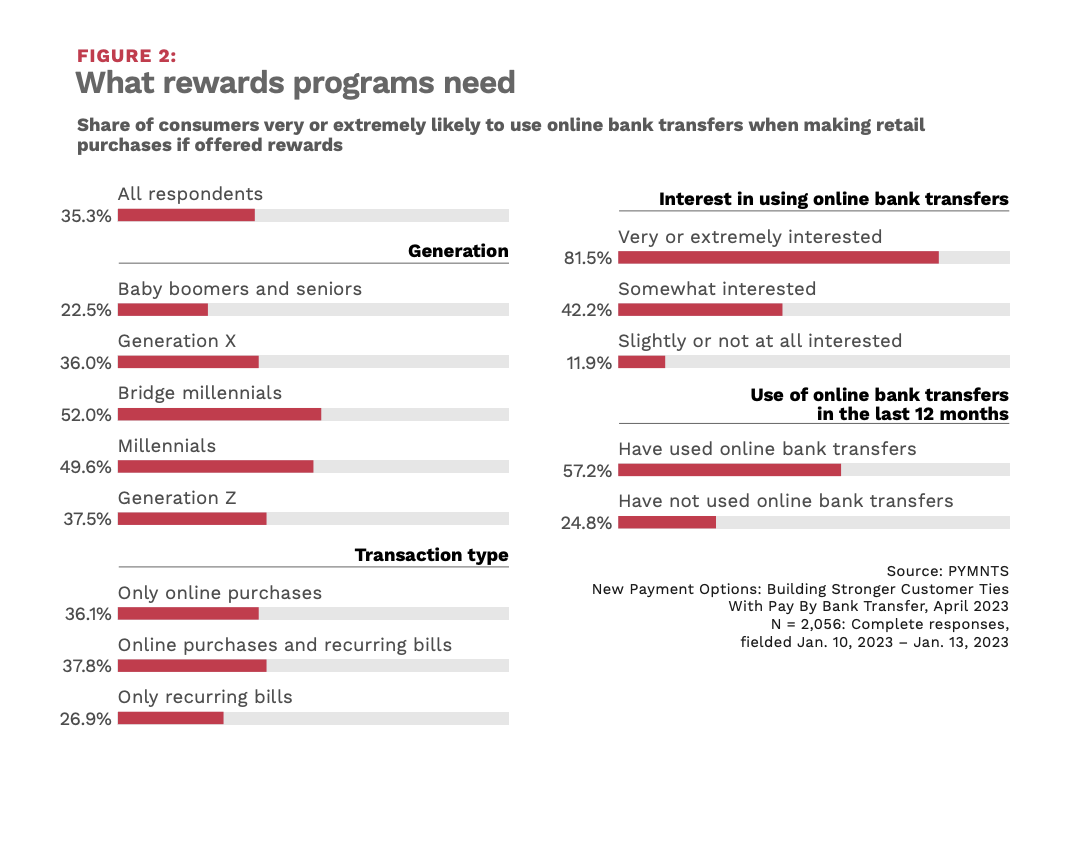

Specifically, across the entire sample, 35% of consumers reported that they would be very or extremely likely to use pay by bank transfers for retail purchases if a rewards program was available.

That share jumps up to 52% when looking at bridge millennials (the cusp generation representing older millennials and the youngest members of Generation X, generally considered to have been born between 1980 and 1989). Millennials are similarly interested, with just under 50% reporting the same.

In contrast, only 38% of Gen Z consumers would be very or extremely likely to use online bank transfers to earn points on retail purchases via a rewards program, and that share falls further for older generations: 36% of Gen X said the same, and in a dramatic drop, only 23% of baby boomers and seniors.

Yet the consumers who are the most likely to use online bank transfers for retail purchases if offered rewards, regardless of generation, are those who have used online bank transfers in the last 12 months. Those who have done so are more than twice as likely as those who have not to use online bank transfers when making retail purchases if offered rewards.