Zillennials, born between 1991 and 1999, are reshaping payment trends as their spending power increases. They are embracing digital wallets, moving away from cash, and being cautious with credit cards. As this generation’s influence grows, businesses must adapt to their payment preferences to meet their demands for convenience and security.

A PYMNTS Intelligence report, “In-Store and Online, Digital Wallets and Debit Are Zillennials’ Signature Payments,” which surveyed more than 2,500 U.S. consumers across grocery, retail, restaurant and travel sectors, highlights zillennials’ preferences for fast, seamless and secure payments.

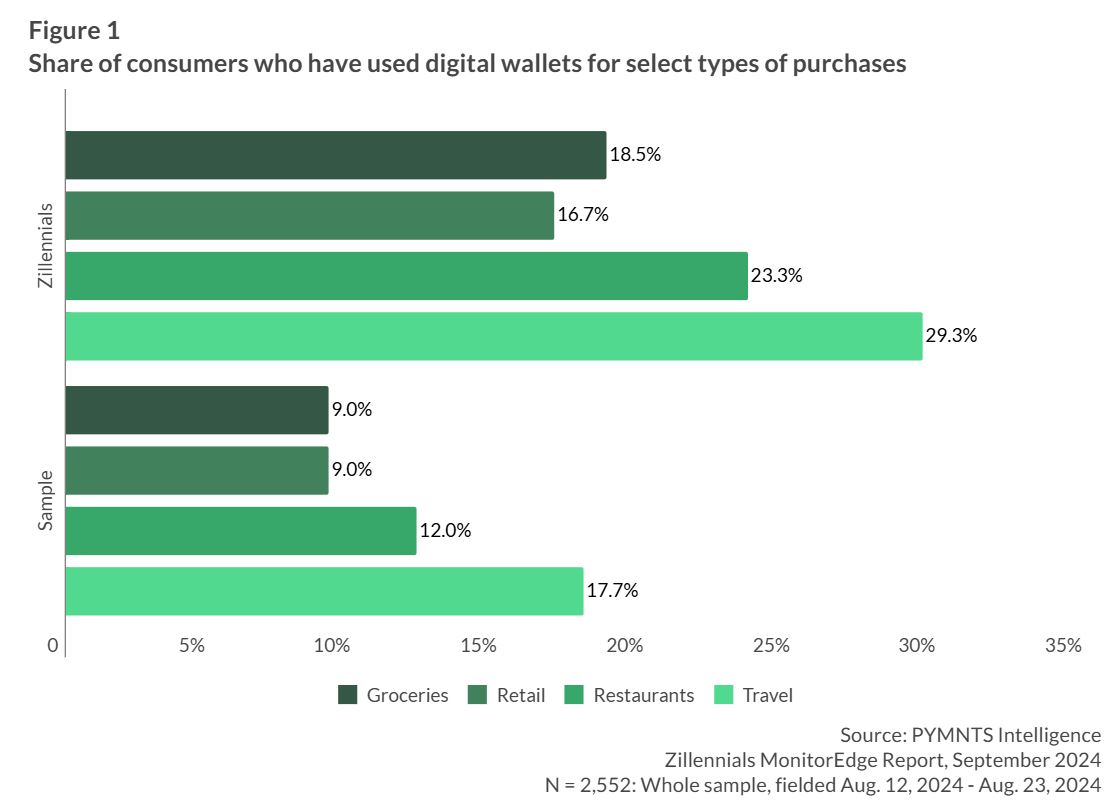

Zillennials are leading the charge in adopting digital wallets, outpacing the general population in nearly every sector.

In grocery shopping, 19% of zillennials used a digital wallet for their last purchase, compared to just 9% of consumers across all generations. The trend continues in retail, where 17% of zillennials used a digital wallet, nearly double the 9% rate for the general population. The gap is even more pronounced in dining and travel. In restaurants, 23% of zillennials opted for digital wallets, compared to 12% of all consumers. Similarly, 29% of zillennials used digital wallets for their last travel purchase, a significant rise from the 18% seen across other age groups.

Convenience and ease of use are primary motivators for these digital payments. According to the report, 61% of mobile wallet users cite convenience as the main reason for using these payment methods in-store, with 60% similarly prioritizing convenience for online transactions.

Cash usage among zillennials is significantly lower than in older generations. In restaurants, only 11% of zillennials used cash, compared to 17% of consumers overall. Retail transactions also show a notable difference, with just 9.2% of zillennials paying with cash, versus 12% of the general population. According to the report, the main driver behind this decline is convenience, with 51% of consumers who use cash less often citing it as the key factor. Additionally, 26% of non-cash users turn to PayPal, while 15% prefer Apple Pay, with platforms like Cash App and Venmo also gaining traction.

Despite this trend away from physical money, the shift is less pronounced in grocery shopping, where 12% of zillennials used cash, just two percentage points below the 14% of the overall population. This suggests that for everyday essentials, cash still holds some relevance, but it is on the decline for larger transactions.

Zillennials are more cautious than older generations when it comes to using credit cards, likely due to concerns about debt. Only 24% of zillennials used credit cards for their last grocery purchase, compared to 32% of the broader population. The trend extends across other sectors: 25% of zillennials used credit cards in retail, 22% in restaurants and 26% for travel, all significantly lower than their older counterparts. This aversion shows a preference for financial security, with many prioritizing the avoidance of debt.

Instead, zillennials are more inclined to use debit cards, with 41% using them for grocery and retail purchases, and 38% for dining. Debit cards offer better control over finances and less risk of overspending, aligning with the generation’s cautious approach to spending. As zillennials gain more financial power, their preference for secure, convenient and digital payment methods will continue to influence the evolution of payment technologies.