Do US Consumers Underestimate the Potential Of Digital Wallets?

In the United States, digital wallets can be anywhere a smartphone is. In other words, everywhere. Many U.S. consumers are embracing digital wallets, particularly for online shopping. In fact, data shows consumers are 23% more likely to use them for online shopping than in-store purchases. Beyond shopping, PYMNTS Intelligence finds that digital wallets are popular for peer-to-peer payments.

In the United States, digital wallets can be anywhere a smartphone is. In other words, everywhere. Many U.S. consumers are embracing digital wallets, particularly for online shopping. In fact, data shows consumers are 23% more likely to use them for online shopping than in-store purchases. Beyond shopping, PYMNTS Intelligence finds that digital wallets are popular for peer-to-peer payments.

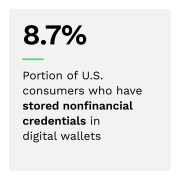

Yet, despite a reputation for tech-savviness, most U.S. consumers are unfamiliar with all these tools could offer. For example, just 8.7% of consumers have used one to store nontransactional credentials. Even fewer have used one of the credentials they have stored.

These are just some of the findings detailed in “Digital Wallets Beyond Financial Transactions: U.S. Edition,” a PYMNTS Intelligence and Google Wallet collaboration. This report examines consumer perceptions and use of digital wallets in the last year and into the future in the U.S. market. It draws on insights from a survey of 2,169 consumers conducted from Jan. 11 to Feb. 5.

Other key findings in the report include:

Most U.S. consumers are unfamiliar with using digital wallets for anything beyond transactions.

Most U.S. consumers are unfamiliar with using digital wallets for anything beyond transactions.

Nontransactional applications include accessing events, but data reveals just 3.4% of U.S. consumers have used a digital wallet in this way. Other uses are similarly underutilized, with just 2.9% using one to access a rewards program. The most common nontransactional use is for travel and transportation, but even there, only 4.1% have used those features. The report details how this usage varies by wallet provider.

A solution that could simplify the identification process.

Proving your identity is a part of everyday life, from the bank to the airline gate. Most U.S. consumers had reason to verify their identity in the last year, and most consumers carry their phones everywhere. It is only natural, then, that many consumers anticipate they’ll be able to use a digital wallet to verify their identity in the next three years.

Proving your identity is a part of everyday life, from the bank to the airline gate. Most U.S. consumers had reason to verify their identity in the last year, and most consumers carry their phones everywhere. It is only natural, then, that many consumers anticipate they’ll be able to use a digital wallet to verify their identity in the next three years.

Consumers in the U.S. are missing out on the vast potential of this technology, as they mostly use it to make purchases or peer-to-peer payments. Download the report to learn more about digital wallets’ nontransactional features.