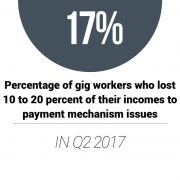

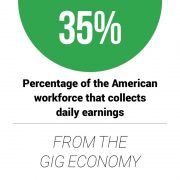

Whether it’s a full-time employee waiting for a regular paycheck, a gig worker expecting to be paid in short order or a borrower seeking a loan, payment frictions can be a roadblock to financial stability. And, if they aren’t cleared seamlessly, these hurdles can cause bills to be missed, expansion plans to be delayed and business relationships to crumble.

In the May edition of the Disbursements Tracker™, PYMNTS highlights some of the notable disbursement developments changing the way employees get paid, such as with digital escrow tools, and how borrowers, including small- to medium-sized businesses (SMBs), can access capital through their debit cards and instant deposit services.

Around the Disbursements World

In the digital lending process, just like in running, the “last mile” is often the most arduous phase. But a recent disbursement solution could soon ease that pain.

Digital lending platform Kabbage is aiming to speed up and smooth out that “last mile” and help SMBs gain faster access to much-needed capital. The company recently collaborated with push payment solution provider Ingo Money to offer real-time disbursements of commercial loans to SMBs. With the solution in place, loans can be quickly delivered to an SMB owners’ debit card or mobile wallet account to provide greater liquidity of funds.

Meanwhile, other disbursement tools are looking to make it easier for borrowers with less than ideal credit to secure loans.

A new collaboration between LendingPoint and TabaPay is working to enable borrowers who do not qualify for loans according to traditional FICO results to have loans deposited directly onto their debit cards.

And in the U.K., merchants recently gained a new tool enabling them to quickly access their earnings.

Square recently released its new Instant Deposit solution, aimed at allowing British merchants to have funds deposited into their bank accounts within a half hour instead of the following business day. Based on recent PYMNTS research, the solution is likely to be popular with merchants – the latest Disbursement Satisfaction Index™ found that direct deposit gets the highest possible satisfaction score of any payment type.

Deep Dive: Construction Payments

In the construction industry, satisfaction with payments is often elusive.

That’s because construction projects often require a hefty amount of paperwork that must be processed before contractors, or subcontractors, can be paid. This month’s Tracker includes a deep dive exploring the newest payment solutions that are helping 1.5 million construction industry workers in the U.S. get paid more efficiently.

How Digital Escrow Tools Can Build a ‘Trusted Economy’

Construction workers are far from unique in this regard – contract workers of all stripes want to get paid in full and on time for their work.

Just look at freelancers who work in the creative content industry, notably the streaming video on demand/over the top (SVOD/OTT) market. The market is projected to grow to roughly $108.6 billion by 2026, which means demand for creative content freelance workers is poised to grow as well.

But for these workers, getting paid can sometimes be a headache. If an employer is late making a payment or, worse yet, does not pay at all, gig workers can find themselves on uncertain financial footing and discouraged from taking on more freelance work.

But digital escrow solutions may offer gig workers relief from these common payment frictions in the creative content market. These solutions are designed to work by assuring freelancers that employers are both willing and able to pay for their services. And for employers, escrow tools enable companies to see if the assigned work has been completed to satisfaction before releasing the payment.

Demand for digital escrow solutions is likely to grow as the demand for creative content services increases, according to Denise Muyco, CEO of software solution provider StratusCore. For the May feature story, PYMNTS caught up with Muyco to discuss the company’s blockchain-based digital escrow service, and how it could help create a “trusted economy” in the creative content space for both gig workers and their employers.

About the Tracker

The Disbursements Tracker™, powered by Ingo Money, is your go-to resource for staying up to date on a month-by-month basis on the trends and changes in the digital disbursement space.