More consumers want faster disbursements through digital channels for more complex financial transactions, and they want that functionality available now. Merchants and disbursements providers need to innovate quickly to stand up against their competitors, many of which are smaller FinTechs or startups that can capitalize on the host of customers that near-exclusively transact and receive money through digital and mobile devices.

More consumers want faster disbursements through digital channels for more complex financial transactions, and they want that functionality available now. Merchants and disbursements providers need to innovate quickly to stand up against their competitors, many of which are smaller FinTechs or startups that can capitalize on the host of customers that near-exclusively transact and receive money through digital and mobile devices.

In the latest Disbursements Tracker, PYMNTS analyzes the impact of instant payments and disbursements on a variety of use cases and industries, as w ell as how payment innovation continues to grow and change in accordance with consumers’ disbursements needs.

ell as how payment innovation continues to grow and change in accordance with consumers’ disbursements needs.

Around The Disbursements World

Instant payments are gaining in international markets. Six Nordic banks have teamed up to develop an instant payments solution that will be known as P27, to officially launch in 2021. The service will seek to enable both businesses and consumers to have access to faster payments and disbursements in real time. It will allow payments from mobile devices and will also seek to simplify transactions for end users.

Card networks like Mastercard are seeking ways to bring faster disbursements to workers that may be living paycheck to paycheck or are reliant on gig or freelance work. The network has partnered with financial wellness FinTech Branch to develop a solution for workers that lack access to traditional bank accounts, allowing them to simply receive funds through debit cards. The solution also offers savings and checking accounts to these workers.

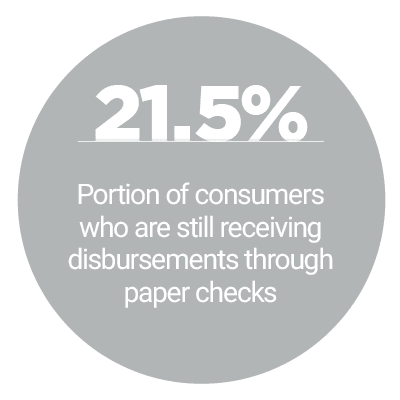

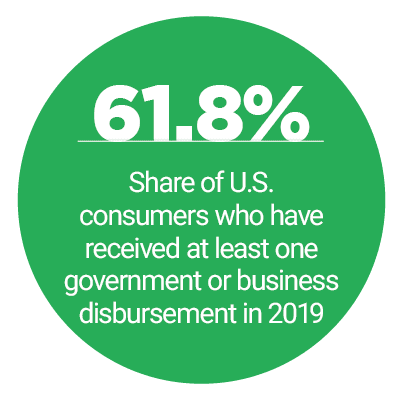

Frustration over slow disbursements is all th e more heightened when consumers are waiting for such payments from government entities or other firms that may send routine or repetitive payments each year. The PYMNTS Disbursements Satisfaction Report noted that U.S. consumers receive 18 disbursements from governments a year, and that 51.6 percent of those customers would like those payments to be instant. Access to digital and instant disbursements would also significantly relieve consumers’ financial stress, the study found.

e more heightened when consumers are waiting for such payments from government entities or other firms that may send routine or repetitive payments each year. The PYMNTS Disbursements Satisfaction Report noted that U.S. consumers receive 18 disbursements from governments a year, and that 51.6 percent of those customers would like those payments to be instant. Access to digital and instant disbursements would also significantly relieve consumers’ financial stress, the study found.

To read more about this and other news items, visit the Tracker’s News & Trends section.

Instant Loans And The Speed And Security Balancing Act

Consumers are fairly used to applying for everything from a personal to a business loan online. But consumers no longer consider instant lending processes instant, if they don’t come with an equally fast disbursement experience, says Paul Gu, co-founder and head of product for online lender Upstart. That means instant disbursements are about to become critically important for lenders, he explained in a recent interview with PYMNTS. To learn more about how Upstart is approaching instant disbursements as competition in online lending increases, visit the Tracker’s Feature Story.

Deep Dive: How Instant Payments Are Changing The Lending Industry

Consumers have grown used to speed when making daily payments thanks to the advent of person-to-person (P2P) apps like Venmo or Zelle, and that predilection is making itself known for more complex online transactions. Customers expect speedy disbursements in areas like lending, and as more lenders begin to use mobile apps and services to connect with borrowers, providing instant payments can create a key advantage. To learn more about how lenders are making use of instant payments and how it’s changing the industry, visit the Tracker’s Deep Dive.

About the Tracker

The PYMNTS Disbursements Tracker, powered by Ingo Money, is the go-to monthly resource for staying up to date on the trends and changes in the digital disbursements space.