The pandemic is continuing to throw typical business operations for many industries into flux, resulting in disastrous financial consequences.

Small- to medium-sized businesses (SMBs) in particular are struggling against the loss of revenue, something that has already led more than 100,000 SMBs within the United States to permanently close down.

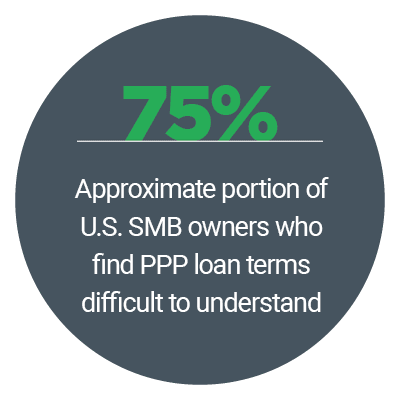

Government entities in the U.S. have moved to address this ongoing issue, with the development of the Paycheck Protection Program (PPP) designed to grant funds to SMB owners. There have been issues with approval processes and disbursing of these funds, however, due to struggles with high application volumes and outdated payments infrastructure that is unequipped to handle such volumes.

issues with approval processes and disbursing of these funds, however, due to struggles with high application volumes and outdated payments infrastructure that is unequipped to handle such volumes.

Interest in SMB lending overall has therefore sharpened in recent months as legacy banks, digital-only FinTechs and lenders have moved to close the PPP’s gaps, but quick disbursements still remain a priority for waiting SMBs. Entities that are unable to provide such an experience will quickly find themselves left behind by the expanding competition within the SMB lending space.

In the latest Disbursement Tracker®, PYMNTS examines how the pandemic has impacted the SMB lending industry, especially when it comes to the adaption of new technologies for loan approvals and disbursements. The Tracker also examines how these changes will continue to impact the industry in the near future.

Around the Disbursements World

The U.S. government passed its PPP Flexibility Act on June 5, intended to adjust some of the rules attached to its initial PPP program. This includes reducing the original percentage of funds that need to be spent firmly on payroll, which was originally set at 75 percent and adjusted to 60 percent. The Flexibility Act also extends the timeframe of the loans, granting SMBs 24 weeks to fully spend their funds as opposed to the initial eight weeks. The hope is that these changes will offer SMBs the adaptability they need to keep their operations moving throughout the ongoing pandemic.

Other player s are making moves in the SMB lending space to create a more digital lending process, including eCommerce firm Amazon. The company has announced a partnership with financial institution (FI) Goldman Sachs, with the two teaming up to develop an SMB lending product that will provide a credit line of up to $1 million for eligible SMBs. The credit line will work by pairing the sellers listed on Amazon’s digital marketplace with Goldman Sachs’ financial services, with the funds to be underwritten by the bank. Businesses can then make use of the funds similar to how they would use typical business credit cards, according to the companies.

s are making moves in the SMB lending space to create a more digital lending process, including eCommerce firm Amazon. The company has announced a partnership with financial institution (FI) Goldman Sachs, with the two teaming up to develop an SMB lending product that will provide a credit line of up to $1 million for eligible SMBs. The credit line will work by pairing the sellers listed on Amazon’s digital marketplace with Goldman Sachs’ financial services, with the funds to be underwritten by the bank. Businesses can then make use of the funds similar to how they would use typical business credit cards, according to the companies.

SMBs based in other countries, such as the United Kingdom and India, are also seeking new solutions, and one avenue that appears to be cropping up for businesses in India especially is finding payment or loan products through social media platforms. Facebook-owned messaging app WhatsApp now has several digital lending startups offering its products through the service, including digital SMB lender Instamojo, which is working through WhatsApp to offer SMBs sachet loans. These are loan funds and other financial services that are “bundled” together within one product for efficiency. Facebook also employs emerging technologies, such as automated tools, to handle messaging and connection between such lenders and interested SMBs, expediting the loan process.

For more on these and other stories, visit the Tracker’s News & Trends.

Why Kabbage Is Relying on ACH for Speedy, Digital PPP Disbursements

SMBs across the U.S. are facing bankruptcy or other severe financial consequences as a result of the negative effects of the pandemic upon their businesses, making the ability to quickly receive any incoming capital essential. That means FIs and digital-only lenders must not only have the capabilities to swiftly approve applications from these SMBs, but to disburse the funds at speed, according to Kathryn Petralia, co-founder and president of SMB lender Kabbage. Using automated technologies in tandem with digital disbursement methods is one way that lenders can pair quick loan approvals with the speedy access to funds businesses need to stay afloat.

SMBs across the U.S. are facing bankruptcy or other severe financial consequences as a result of the negative effects of the pandemic upon their businesses, making the ability to quickly receive any incoming capital essential. That means FIs and digital-only lenders must not only have the capabilities to swiftly approve applications from these SMBs, but to disburse the funds at speed, according to Kathryn Petralia, co-founder and president of SMB lender Kabbage. Using automated technologies in tandem with digital disbursement methods is one way that lenders can pair quick loan approvals with the speedy access to funds businesses need to stay afloat.

To learn more about how SMB lenders are approaching innovation in this space during the pandemic, visit the Tracker’s Feature Story.

How the Pandemic Is Driving SMB Lending Innovation

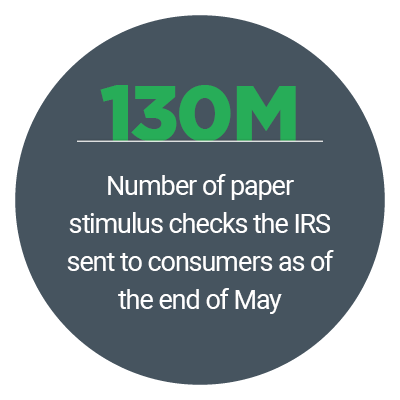

The pandemic also appears to be having a significant impact on the SMB lending industry as a whole, as banks and other lenders seek to provide critical funding to these waiting businesses. Digital-only FinTechs are competing with legacy FIs to provide this capital, and some of the latter FIs are finding their paper-based lending processes may not be adequate. Paper checks are also still one of the main ways in which SMBs pay out their vendors or other business partners, further adding time and unnecessary complexity to using the full benefits of these loans even when they do finally arrive.

To learn more about how the SMB lending industry is shifting during the pandemic, visit the Tracker’s Deep Dive.

About the Tracker

The PYMNTS Disbursements Tracker ®, powered by Ingo Money, is the go-to monthly resource for staying up to date on the trends and changes in the digital disbursements space.