Deep Dive: How Digitizing the Lending Process Can Help Accelerate Secure Fund Disbursements

Technological improvements across the financial sector have revolutionized the industry, and recent events surrounding the pandemic have only accelerated advancements.

In response to the changing expectations of an increasingly digital-savvy customer base and the need to improve efficiencies and experiences, the financial sector increasingly is looking to digital solutions. Web and mobile technologies already have transformed how financial institutions (FIs) engage with customers, and the creation of digital experiences makes the borrowing process faster and more convenient.

Unlike the digital-first experience offered in managing other financial products, most loan approvals still require manual paperwork. Filling out, copying and sending physical forms adds to labor costs and time delays in the process. A digital approval process would eliminate the added work, the built-in delay of physical forms and the risk of an added delay if delivery of physical paperwork is interrupted or lost. Digital applications also provide a higher level of accuracy and reduce the risk of human error.

Compared to a manual approach, digital lending makes it easier for both traditional and FinTech lenders to analyze processes and evaluate best practices. The digital process can automate data gathering, which lends itself to faster analysis of trends, areas for improvement and potential solutions. Having that integrated data also can eliminate delays in processing applications and decision-making. This month’s Deep Dive examines how speed and security are crucial when funding loans and how FIs can help accelerate loan processing and disbursements.

The Move to Digital Lending

The pandemic disrupted the entire economy, not least of all the lending industry, in  which digital lending from acquisition to loan management gained traction throughout 2020. The move to digital has enabled FinTech lenders to use automation to improve speed and accuracy in their underwriting decisions. These lenders apply advanced algorithms and analytical tools to traditional and alternative data sources, enabling them to make fast, accurate and secure lending decisions.

which digital lending from acquisition to loan management gained traction throughout 2020. The move to digital has enabled FinTech lenders to use automation to improve speed and accuracy in their underwriting decisions. These lenders apply advanced algorithms and analytical tools to traditional and alternative data sources, enabling them to make fast, accurate and secure lending decisions.

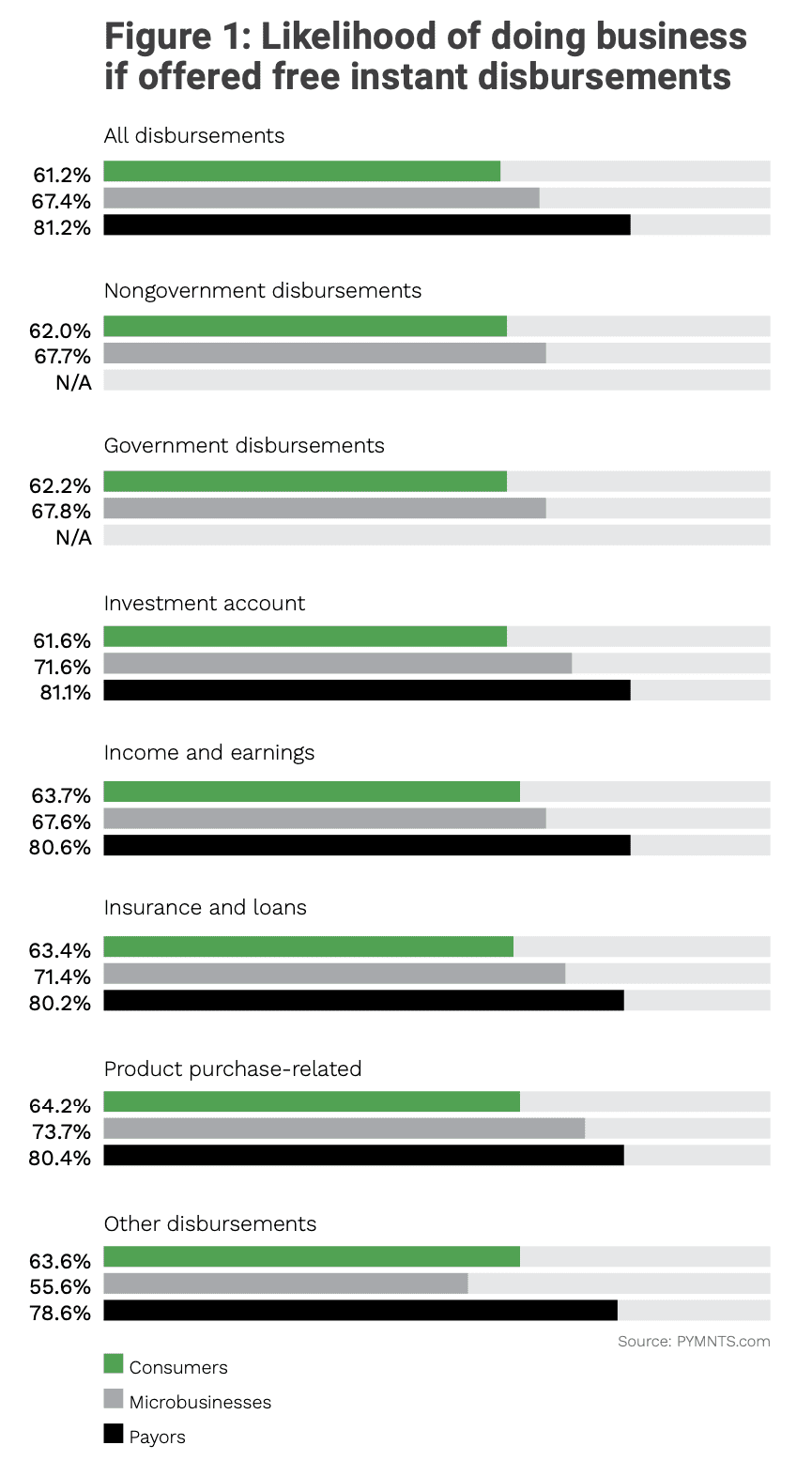

The digital trend also impacts the loan management process, with disbursements and repayments handled electronically through various channels, including bank accounts, eCommerce accounts and mobile wallets. This move not only increases the speed with which funds are disbursed and collected but also provides more opportunities for applicants to receive and repay loans in a manner that best suits their needs. A PYMNTS survey found that more than 63% of microbusinesses and more than 71% of consumers would be more loyal to a lender that offers free instant payments.

Digital lending also provides more accessible data to lenders regarding individual borrowers and the overall processes, enabling more efficient collection and recovery strategies. That same data also can improve the customer experience, helping lenders customize the user experience at every step of the lending process, from communication to account management.

Optimizing Digital Channels Without Losing Customers

Respondents in a report said they experienced a faster approval process of 12.7 days on average when digital self-services complemented live, personal service. Too many channels can slow the process, though, and adding traditional communication methods such as mail and email brought the average timeline to 21.5 days. Lenders also need to optimize channels through customizable approaches. The one-size-fits-all approach common at the start of the pandemic, while streamlined and efficient from the perspective of loan originators, led to problems in customer satisfaction.

At the start of the Paycheck Protection Program (PPP), small- to medium-sized businesses (SMBs) expected FinTechs to help navigate the process more quickly, but a survey of PPP loan recipients found that just 18% of those who borrowed through FinTechs were satisfied with their experience, 40% were neutral and 42% were dissatisfied.

Gauging Borrower Interest

There is still plenty of borrower interest, however. After weathering 2020, 56% of SMBs expressed interest in working with online lenders in the coming year. Another survey showed that competitive rates and favorable terms would motivate 23% of respondents to consider a FinTech lender. Another 19% of respondents believed securing an online loan would be easier than working with a traditional lender, and 8% said online lending would be more convenient.

The growing preference for handling financial matters online motivated 9% of respondents to favor FinTech lenders, although personal reasons ranged from pandemic concerns to paperless preferences. Of the 12% who already had secured loans from digital lenders, most had secured personal loans to cover expenses, such as food and household goods. PYMNTS research showed that personal loans are now the second most popular type of unsecured loan after credit cards, with 24% of respondents using personal loans.

Both SMBs and individuals continue to show growing interest in securing loans, and digital solutions will play an essential role in acquiring and servicing those loans efficiently. Still, lenders of all types and sizes will need to evaluate their processes, ensuring they are improving and not staying stagnant. These improvements include making use of automated data gathering and data analysis to evaluate best practices and optimization, as well as applying solutions to refine workflows and balance live, personal service with self-service options.