Faster payments — instant payments, to be specific — are becoming top of mind for many consumers.

In the Disbursements Satisfaction report, done in conjunction between PYMNTS and Ingo Money, we found that instant payouts have a greenfield opportunity to help transform (and speed up) disbursements.

The data shows that 170 million U.S. consumers received at least one disbursement in the past year. Those disbursements span Social Security payments, insurance claim payments and other transactions.

Getting those funds more speedily into the hands of consumers can be a valuable way to help combat the ravages of inflation (and pad savings). The awareness of instant payments is high, too. Roughly half of U.S. consumers who receive disbursements would choose to receive them via instant payment rails if they could.

As for the greenfield opportunity: Only 17% of the consumers who received disbursements last year received them across instant rails, which means there is quite a bit of room for a wider embrace of those options.

Get the Report: Disbursements Satisfaction Report 2022

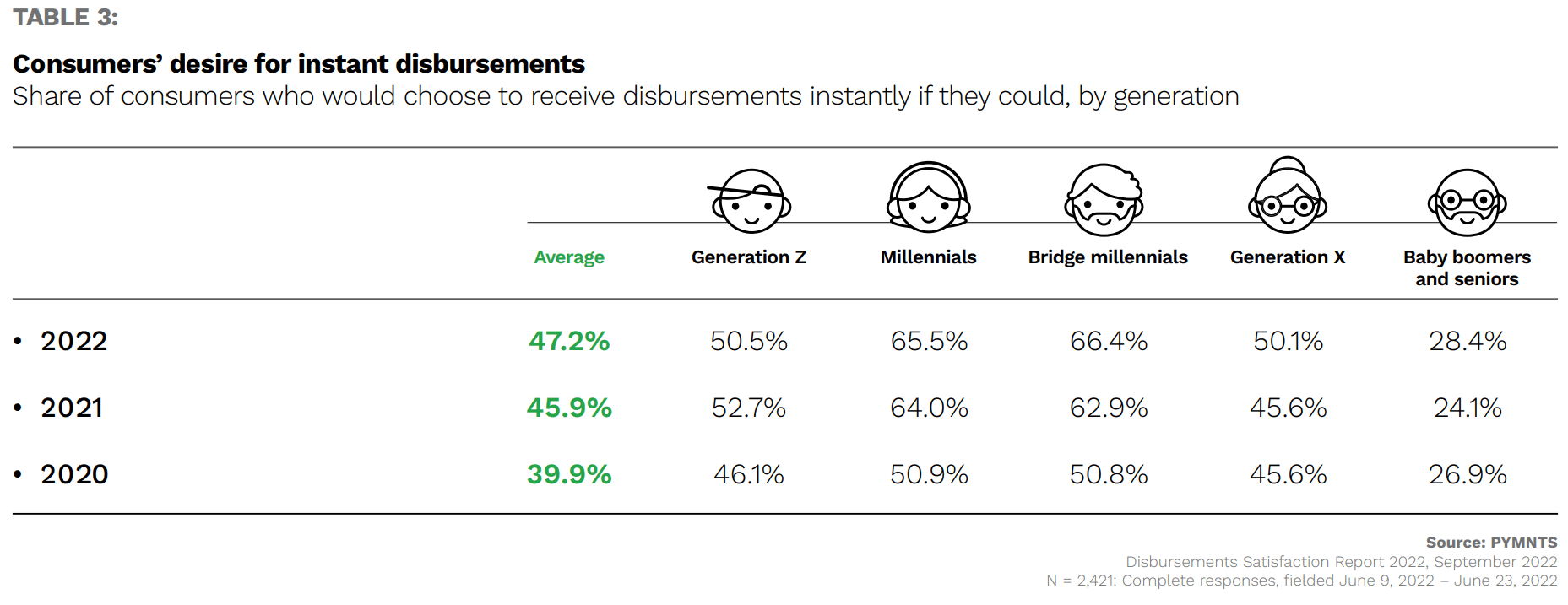

The desire for instant disbursements cuts across all demographics, and overall, the share of consumers who would like to receive those disbursements has been on the upswing, from less than 40% two years ago to a recent reading of more than 47%. The interest is most keenly felt by millennials and bridge millennials, at more than 65% across those cohorts.

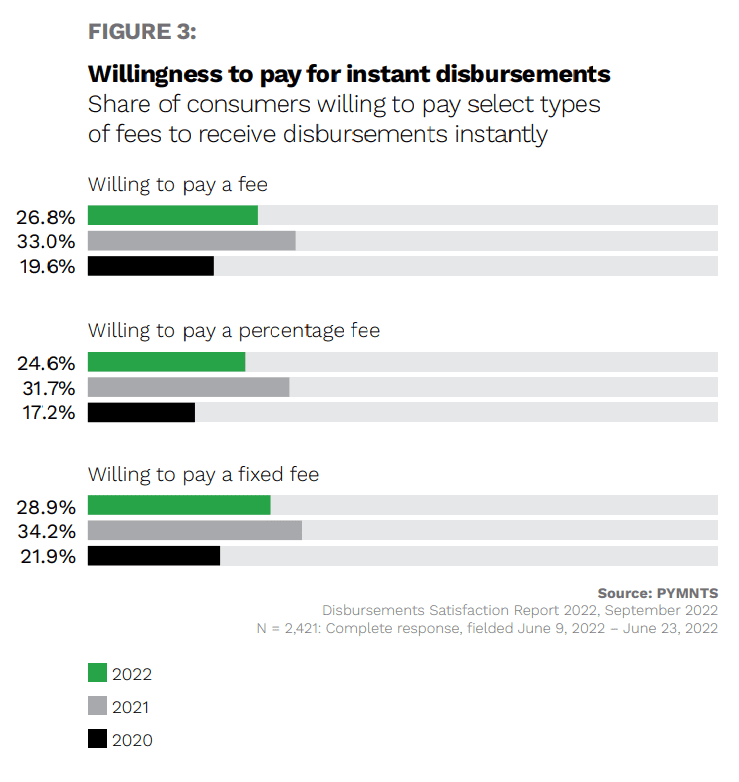

And it turns out, too, that we’re willing — at least a significant percentage of us are — to pay a fee to get out money faster. It should be noted, though, that the percentage of consumers willing to pony up for instant disbursements is less in 2022 than had been seen in 2021, though decidedly higher than levels seen in 2020.