Linking Networks Key to Delivering Instant Payments Ubiquity

As the pandemic has sped up the transition for both consumers and businesses to conduct more and more transactions in digital spaces, the use of checks has become less desirable. The number of digital payment rails available has exploded in recent years, and payees have become accustomed to the idea that they should be able to receive disbursements quickly and securely through whichever account or platform they prefer. Regardless, many payors still rely on sending checks through the mail and manual invoicing procedures, especially for business-to-business (B2B) transactions.

Payments ubiquity requires payors to juggle various platforms and payment rails. It also requires taking a new look at how invoicing and accounts payable are managed to eliminate inefficiencies and redundancies in manual processes. This month’s Disbursements Tracker® examines how meeting those challenges will require many payors to consider strategic partnerships that provide them with a boost toward payments ubiquity.

Around the Disbursements Space

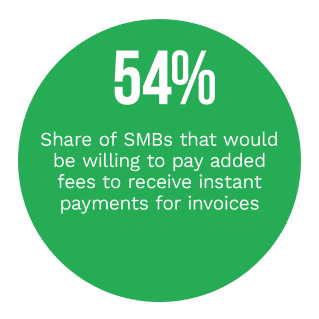

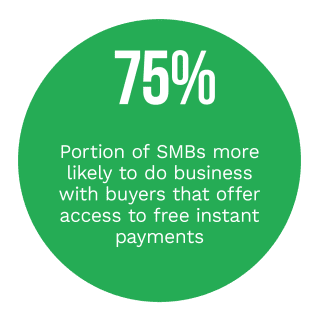

Businesses are facing pressure on their cash flows from multiple directions and looking to ease some of that pressure by removing delays from the disbursements they receive. Thirty percent of ad hoc payments to small- to mid-sized businesses (SMBs) are made late, and 60% of those run at least a month overdue. To ensure payee satisfaction and maintain positive B2B relationships, payors must incorporate digital payments strategies to ensure disbursements arrive on time.

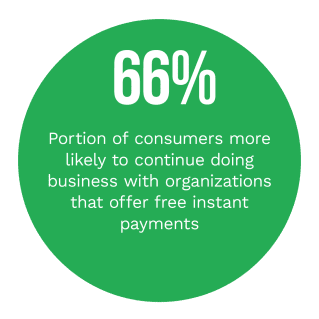

Business-to-consumer (B2C) disbursements are leading B2B disbursements when it comes to payment choice, and that choice results in more and more consumers choosing instant payments when offered. Seventy-one percent of consumers who received an instant payment in 2021 could select how money was disbursed to them. At the same time, choice in income and earnings disbursements grew between 2020 and 2021, from 59% to 75%, and in insurance and borrowing disbursements, the increase was from 51% to 74%.

For more on these stories and other disbursements developments, check out the Tracker’s News and Trends section.

KeyBank on Challenges and Opportunities Payors Face in Reaching Payments Ubiquity

Certainty, security and speed are all significant factors driving payee demand for better disbursement solutions, whether those payees are consumers or businesses. In this month’s Feature Story, Megan Kakani, head of emerging products, product and innovation with the enterprise commercial payments group at KeyBank, talks about the different challenges payors face in reaching payments ubiquity are making payments to vendors and other businesses or consumers.

PYMNTS Intelligence: Making Sense of Digital Transformation Disbursements

For businesses, disbursing funds quickly and easily over the payment rail that works best for an individual payor poses a significantly greater challenge than taking in money from different payment sources and platforms. Especially regarding B2B disbursements such as to vendors and contractors, many payors choose to fall back on the legacy solution of just dropping a check in the mail. While that solution was acceptable in the past, it introduces security, speed and reliability concerns.

This month’s PYMNTS Intelligence looks at how businesses can benefit from payments ubiquity in B2B and B2C transactions and the barriers standing in the way of getting there.

About the Tracker

The Disbursements Tracker®, a PYMNTS and Ingo Money collaboration, examines the latest trends and developments shaping the disbursements space and the challenges payors face in reaching payments ubiquity.