Neobank Innovations Raise Consumer Expectations for Traditional Banking Services

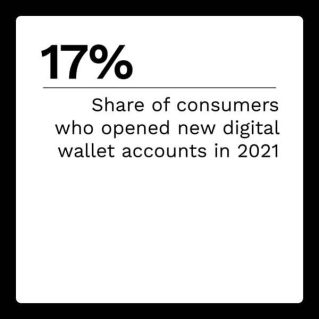

Even for the significant number of consumers who still prefer opening accounts with traditional financial institutions (FIs), most new accounts opened by consumers are via digital channels. At the same time, those consumers frequently link new accounts — whether they be digital wallets, peer-to-peer (P2P) or banking — with an already existing account to fund it at the opening. On the other hand, moving money between two accounts a consumer owns may be fraught with obstacles.

Even for the significant number of consumers who still prefer opening accounts with traditional financial institutions (FIs), most new accounts opened by consumers are via digital channels. At the same time, those consumers frequently link new accounts — whether they be digital wallets, peer-to-peer (P2P) or banking — with an already existing account to fund it at the opening. On the other hand, moving money between two accounts a consumer owns may be fraught with obstacles.

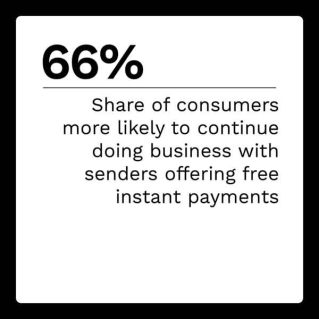

Additionally, with the ease of conducting such business online comes the ease with which consumers can abandon a new account application and, seconds later, start the process over on a competitor’s site. When providers make it too difficult to move money from one account to another or apply for a new account, they risk losing customers. Account providers need to balance security against convenience to maintain customer satisfaction.

Security and authentication are still of growing importance, as the same systems developed to simplify it for consumers may also make things easier for scammers. As a result, account providers need to ensure that their security protocols and systems can reliably verify identities and detect suspicious activity that indicates fraud.

The first edition of the Money Mobility Tracker® examines the challenges impeding money mobility and looks at what FIs and FinTechs will need to address to ensure seamless, secure money mobility with all accounts.

Developments From the Money Mobility Space

Consumers are unlikely to keep significant balances in their checking accounts, preferring instead to use the accounts as stopovers for money that will cover regular monthly expenses. Based on survey data, 95% of U.S. consumers have a checking account, and just 29% of those have a running balance of $1,000 or more. Thirty-four percent of checking account holders maintain a running balance of less than $100. Even the 13% who maintain a balance of $2,000 or more may not have the 25% to 30% of monthly expenses some experts recommend as padding in a checking account.

Consumers are unlikely to keep significant balances in their checking accounts, preferring instead to use the accounts as stopovers for money that will cover regular monthly expenses. Based on survey data, 95% of U.S. consumers have a checking account, and just 29% of those have a running balance of $1,000 or more. Thirty-four percent of checking account holders maintain a running balance of less than $100. Even the 13% who maintain a balance of $2,000 or more may not have the 25% to 30% of monthly expenses some experts recommend as padding in a checking account.

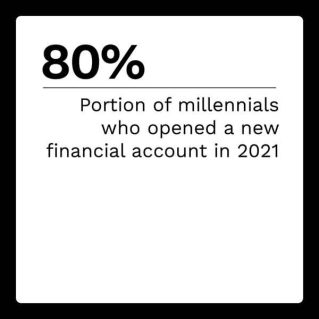

Digital-first banks are growing in popularity as the FIs of choice for consumers when selecting a primary checking account. Approximately one-quarter of those aged 21 to 26 and one-third of those aged 27 to 41 say their primary checking account is with a digital-first FI. Even older consumers in the 42 to 56 age bracket are increasingly turning to digital-first FIs for checking accounts. The share of these consumers reporting their primary checking account is with such an institution grew from 8% in October 2020 to 22% in January 2022.

For more on these stories and other money mobility developments, check out the Tracker’s News and Trends section.

Current on How Neobanks and FinTechs Must Keep Money Mobility Top Priority

Neobanks and FinTechs are leaders in innovative financial services and solutions, pioneering many of the features now offered by larger, traditional FIs, but keeping that edge requires them to continue innovating. In this month’s Feature Story, Josh Stephens, vice president of product at neobank Current, talks about how neobanks can approach money mobility and how to overcome the obstacles standing between customers and their money.

PYMNTS Intelligence: Overcoming the Challenges of Money Mobility

Consumers are opening new accounts at a growing rate to take advantage of specific features offered by account providers and to address new use cases that are becoming part of their everyday lives, such as P2P payments. They also prefer opening those accounts through digital channels and are likely to exit a new account application if forced to use multiple channels to complete the application. While providers want to meet that desire to open and connect accounts by making the process as frictionless as possible, they must still ensure they address fraud related to the process.

This month’s PYMNTS Intelligence look at the challenges facing FIs and FinTechs as they seek to enable money mobility and attract new customers.

About the Tracker

The Money Mobility Tracker®, a PYMNTS and Ingo Money collaboration, examines the latest trends and developments shaping the money mobility space and the challenges facing FIs and FinTechs in ensuring seamless and secure money mobility.