Prepaid Cards Help DoorDash Meet Unbanked Gig Workers’ Payment Needs

While demand for instant payments rises — encompassing everything from online purchases to paychecks and insurance payouts — the understanding of underlying mechanics of disbursements has not grown at the same rate. Sizable shares of both businesses and consumers have misunderstandings about the difference between relatively fast digital disbursements and truly instant payments, a situation that is further complicated by the temptation for companies to market any digital payment platform as “instant.”

The January/February Disbursements Tracker® examines some of the misconceptions that consumers and businesses have about instant payments and what they entail. It also explores how offering truly instant payments and adequately explaining their benefits to both parties can help financial institutions (FIs) and other organizations drive instant payments adoption to new heights.

Around the Disbursements Space

Money mobility will be the “big thing” in 2022, according to Drew Edwards, CEO of Ingo Money, as providers find better ways to make transactions between disparate accounts more frictionless. Consumers and businesses are now faced with various ways to hold and move money, including using peer-to-peer (P2P) payment providers, FinTechs, traditional FIs and neobanks. Edwards compared the experience of transferring funds between such accounts to removing cash from an ATM and travelling to another bank and deposit the cash there. On the digital side, those accounts can be stored within the same mobile phone, for example, yet moving funds between them can still be arduous. The future of instant payments hinges on providers finding ways to deposit funds into a user’s chosen account without requiring intermediary steps, Edwards said.

The move to cloud-based payroll solutions has come with its own set of potential problems and threats, and a recent ransomware attack against payroll and human resources vendor Kronos demonstrates how important it is for employers to conduct security due diligence and have backup plans in place. The attack left several healthcare providers that use Kronos without an immediate payroll solution while the provider recovered its systems. It is believed that sorting out problems such as missed holiday pay may take months, even after Kronos’ systems are fully restored.

The move to cloud-based payroll solutions has come with its own set of potential problems and threats, and a recent ransomware attack against payroll and human resources vendor Kronos demonstrates how important it is for employers to conduct security due diligence and have backup plans in place. The attack left several healthcare providers that use Kronos without an immediate payroll solution while the provider recovered its systems. It is believed that sorting out problems such as missed holiday pay may take months, even after Kronos’ systems are fully restored.

For more on these stories and other disbursement developments, check out the Tracker’s News and Trends section.

DoorDash on Delivering Faster Payouts to Gig Workers

As instant payments and digital disbursements have become more common among consumers, these consumers have begun looking for payment options that also provide faster and more frequent paydays in their professional lives. This is especially true for gig workers, who must often pay for operational expenses, such as fuel and other daily necessities, to get their jobs done.

In this month’s Feature Story, Emma Glazer, head of Dasher marketing at delivery aggregator DoorDash, talks about the Dasher Direct prepaid Visa card that enables the company to digitally pay unbanked employees while also providing daily payouts for the gig workers who deliver for DoorDash.

PYMNTS Intelligence: Differentiating Instant Payments From Other Digital Disbursements

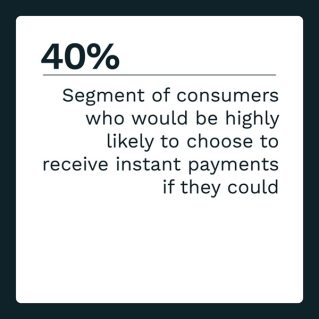

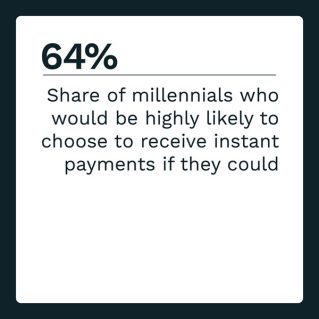

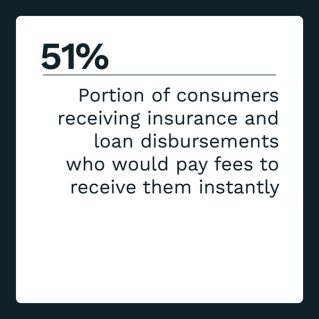

Instant payments rose to account for 17% of all digital disbursements in 2021, almost triple their 5.7% share in 2018.  Despite the popularity of instant payments, a relative scarcity of digital disbursements products has added to the confusion over what a true instant payment entails. While both consumers and businesses see the individual benefits of faster transactions, many may not understand the value or underlying mechanics that would differentiate digital disbursements — some of which can take anywhere from minutes to days to settle — from actual instant payments.

Despite the popularity of instant payments, a relative scarcity of digital disbursements products has added to the confusion over what a true instant payment entails. While both consumers and businesses see the individual benefits of faster transactions, many may not understand the value or underlying mechanics that would differentiate digital disbursements — some of which can take anywhere from minutes to days to settle — from actual instant payments.

This month’s PYMNTS Intelligence looks at the misconceptions consumers and businesses have about instant payments and other forms of digital disbursements, and examines the need for instant payment providers to educate users about the value of their products.

About the Tracker

The Disbursements Tracker®, a PYMNTS and Ingo Money collaboration, examines the latest trends and developments shaping the disbursements space and how instant payments providers can differentiate their products from other digital disbursement products.