Earnings season, moving into its final few weeks, may seemingly be dominated by headlines about consumer spending.

But dig a bit deeper, and details emerge as to state of business financing — specifically, loans and working capital products that help give smaller companies the cash on hand they need to manage inventory and operations.

This past week, results from Block and PayPal underscored the ways in which platforms and ecosystems have extended beyond transactions and offer up financial services — but, in triangulating management commentary and details from corporate filings, merchant financing and lending standards have been tightening.

Drilling Down Into the Filings

To that end, PayPal’s latest 10-Q filing with Securities and Exchange Commission (SEC) shows that, through its PayPal Working Capital and PayPal Business Loan products (also known as merchant finance offerings, as businesses borrow a percentage of their annual payments volume processed by PayPal), the company purchased $1.3 billion of those receivables through the first nine months of the year, compared to the $2.3 billion in receivables in the previous year.

During the conference call with analysts, PayPal CFO Gabrielle Rabinovich said that “we are maintaining a tightened origination strategy for the PayPal business loans portfolio. Principal and interest receivables declined nearly 30% in the quarter, and this portfolio now represents approximately 12% of our overall credit receivables portfolio versus 21% 12 months ago.”

The latest SEC filing also shows that 4.3% of receivables were 30-59 days past due at the end of September, compared to 3.6% at the end of December 2022.

Advertisement: Scroll to Continue

In Block’s earnings results, the company noted in its investor materials that Square Loans facilitated approximately 120,000 loans totaling $1.17 billion in originations, up 4% year over year.

Our own research into the capital pressures confronting smaller firms — and conduits to relieve those pressures — has shown that headed into the last months of the year, 48% of Main Street firms were seeking more credit. The Kansas City Fed reported recently that small business commercial and industrial lending continued to decline in the second quarter, decreasing 16.8% from the same period in 2022 and 1.2% from the previous quarter.

Small and medium-sized businesses (SMBs), as queried by PYMNTS Intelligence, have incentive to look for funding, as only 26% have access to the equivalent of at least 60 days’ worth of revenue, and 17% have no ready access to emergency funding.

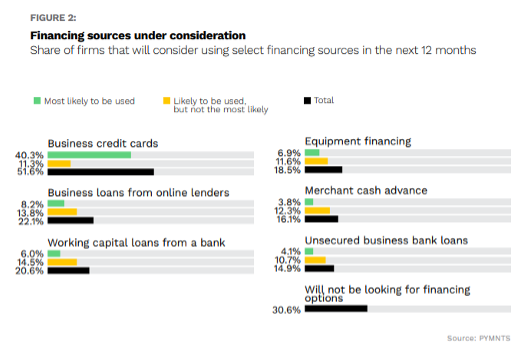

The accompanying chart details the avenues of consideration for these smaller companies. A majority of companies — at 51% — would consider using business credit cards in the next 12 months; 16% would opt for merchant cash advances. And while a third of respondents say they’d prefer to use large national banks as their lenders, there’s still a significant percentage of business owners, at more than 26%, who would tap into the options available at online lenders.