The unlucky “Ides of March” — referring to the assassination of Julius Caesar on or about March 15, 44 BCE — renewed its myth millennia later when, on March 19, 2020, the first statewide COVID-19 shutdown in the U.S. was ordered. Within a month, American stores were empty except for frantic excursions seeking the last remaining off-brand hand sanitizers.

At the one-year anniversary of that watershed event, PYMNTS surveyed more than 2,700 Main Street small and medium-sized businesses (SMBs) across nearly 30 verticals to learn how they improvised and digitized to keep the wolves from the door during a this highly volatile time.

In the latest installment to PYMNTS “Pandenomics” report series, 2021’s Main Street Business Survivor Study: Understanding The Profile Of Main Street SMBs That Have Weathered The Pandemic’s Fallout, we find that while 12 percent of all Main Street SMBs were lost — and with 45 percent of those still standing feeling at risk — the report notes, “These Main Street Survivors may not all be on solid financial ground, but their resilience and resourcefulness have already helped them weather a year of uncertainty.”

That’s understating it somewhat, as surviving as a Main Street SMB over the past year has been a herculean task that took smarts, guts and vision to make it through. We know that digital saved the day for most one way or another, and the latest research bears it out.

To give an idea, the study states that “Fifty-nine percent of all Main Street Survivors now generate at least some of their sales on their websites and 33 percent generate them on digital marketplaces or third-party aggregators. Brick-and-mortar stores are still the most common way Main Street Survivors generate sales, however, as 61 percent do so. Only 15 percent of Main Street Survivors generate all their sales online, and they may operate out of physical locations on Main Street but only accept online orders for delivery or in-person pickup.”

Marketplaces And Product Mix To The Rescue

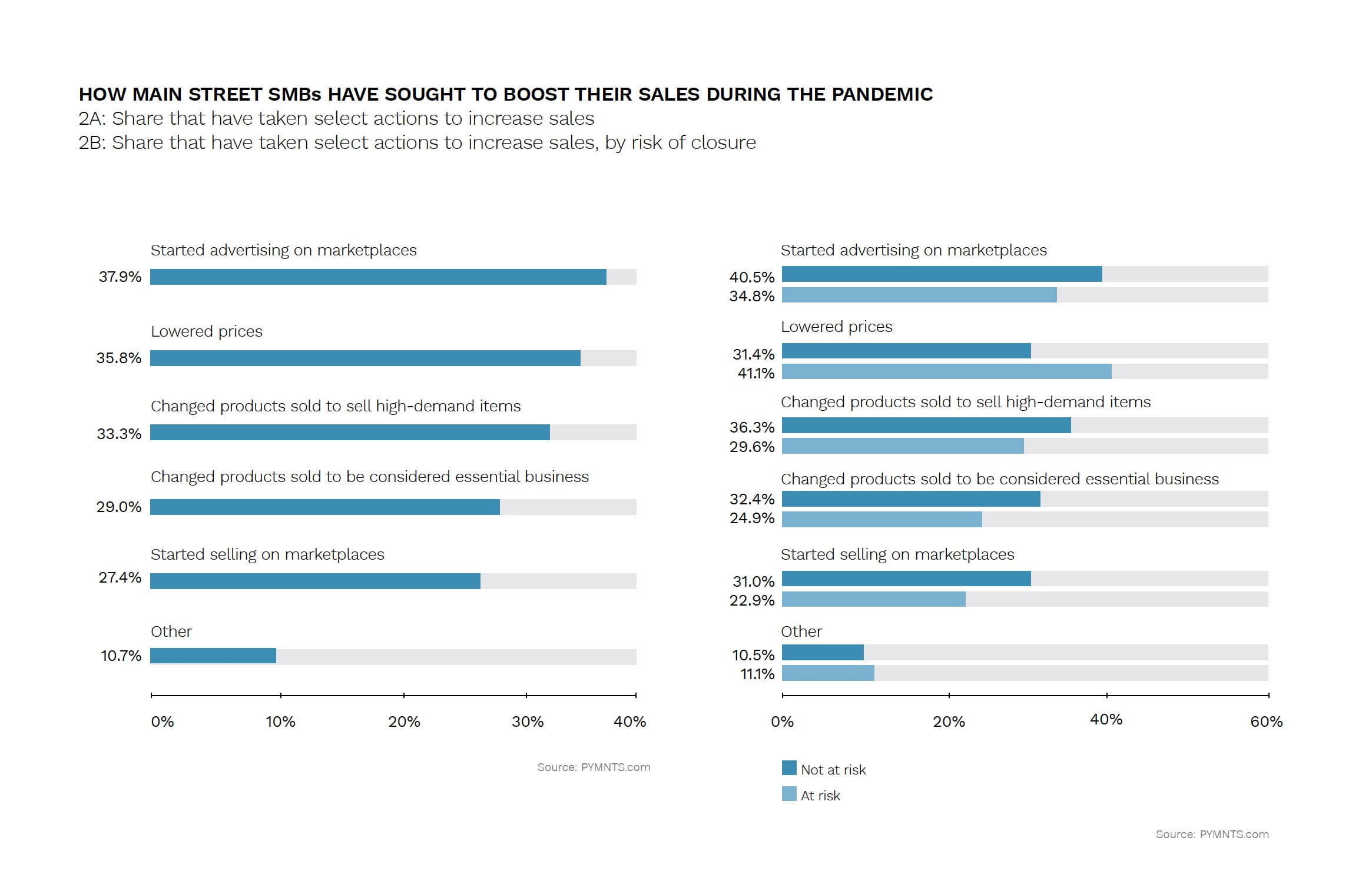

Examining how Main Street retailers drove sales and managed costs all while planning for a future filled with unknowns, Understanding The Profile Of Main Street SMBs That Have Weathered The Pandemic’s Fallout shows that rapid shifts to online selling in easy to access marketplaces and platforms did the trick, as in-store selling evaporated virtually overnight.

SMBs figured it out fast, with 52 percent moving onto digital marketplaces in the past year.

“Most Main Street Survivors rely on multiple channels to generate sales, but digital platforms stand out the most,” per the study. “Forty-seven percent of the Main Street Survivors that sell via digital platforms say those sales have increased since the pandemic began. Website sales are in second place, with 44 percent of Main Street Survivors saying the sales made on their websites have grown since the pandemic began.”

In-store sales show the least growth, “with only 16 percent of Main Street Survivors saying their brick-and-mortar sales are up compared to their pre-pandemic levels. Sixty-two percent of them have witnessed their brick-and-mortar sales decrease in that time.”

Product mix is another strategy employed by SMBs to stay afloat, with 51 percent of all Main Street Survivors selling “entirely different products than they did before the pandemic began. Thirty-three percent have switched to selling products they feel are in higher demand, hoping that doing so will convince more consumers to buy them,” while 29 percent now sell products that help them qualify as “essential” businesses allowing them to stay open despite regulations.

A Rosier Outlook For Main Street, USA

With nearly 80 percent of Main Street SMBs telling researchers they did not apply for the second round of Payroll Protection Program (PPP) loans, cash flow remains a life-and-death struggle for small businesses that have so far managed to avoid closure.

As would be expected, jobs have been lost. “Eighteen percent of Main Street Survivor business owners have cut their full-time staff and 15 percent have lowered their workers’ salaries. Both of these practices have grown less common in the last three months, but that is partly because many Main Street Survivors have less full-time and more part-time workers,” per study.

All is not bad news, however. Main Street Survivors are optimistic, which can help a lot.

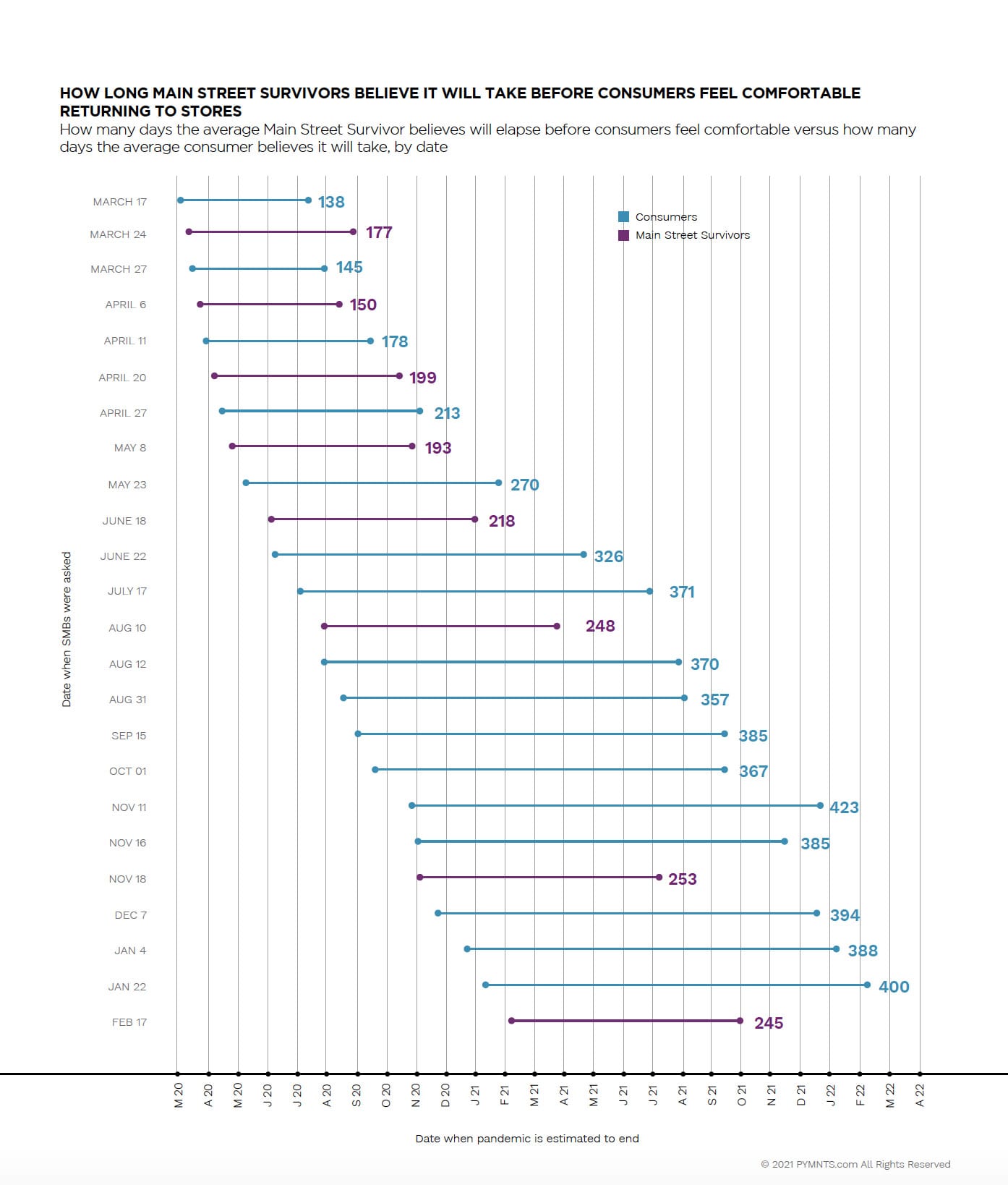

In 2021’s Main Street Business Survivor Study: Understanding The Profile Of Main Street SMBs That Have Weathered The Pandemic’s Fallout, we find that the average Main Street survivor “now believes consumers will feel comfortable reengaging in the physical world by late October 2021 — just seven months from now. This is the first time since April 2020 that Main Street Survivors’ expectations for how long it will take for the pandemic to subside have improved.”

Consumers see that happening about four months later than SMBs but given the speed with which the Biden administration is moving on vaccinations and reopening, the optimism of Main Street SMBs may be due to their sales instincts —and talk of pent-up consumer demand.