LendingClub financial health officer Anuj Nayar told PYMNTS: “I hate to say this, but the 61% number that we reported as the percentage of consumers living paycheck to paycheck — well, I think that is going to increase, and the savings cushion is going to go down.”

Prescient words, as illustrated by findings in the just-released February “Paycheck-to-Paycheck Report: Wealth Divide Edition,” a PYMNTS and LendingClub collaboration.

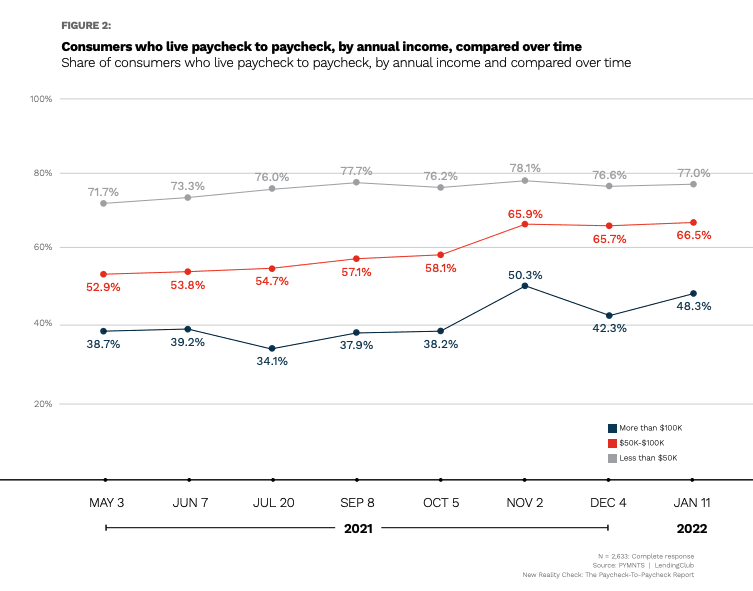

Per the latest in this ongoing study series, “The number of consumers living paycheck to paycheck has increased steadily since April 2021 and now is 12 percentage points higher than it was then, with a three-percentage-point jump between December 2021 and January 2022. Consumers of all income brackets are increasingly living paycheck to paycheck, including those earning higher incomes.”

Complexities of earnings, savings and spending are being compounded now by the highest inflation in decades, coming amid a global health crisis causing a major economic frost.

While higher earners are generally faring better — which is to say struggling less to meet monthly living expenses — the study stated, “The portion of consumers who live paycheck to paycheck now is four percentage points higher than it was in January 2021, and the wealthiest consumers comprise a growing share.”

We found that 6% more Americans earning over $100,000 annually were living paycheck to paycheck in January compared to December, meaning the situation worsened by three percentage points at the start of what’s shaping up as a challenging year for millions.

Get the study: The Paycheck-to-Paycheck Report

Get the study: The Paycheck-to-Paycheck Report

Savings and the Wealth Divide

The Wealth Divide Edition reveals contrasts between having the savings cushion Nayar spoke of, and the pressures of not having such funds to fall back on. In this environment, more people are turning to solutions like personal loans to bridge expense gaps and balance out finances.

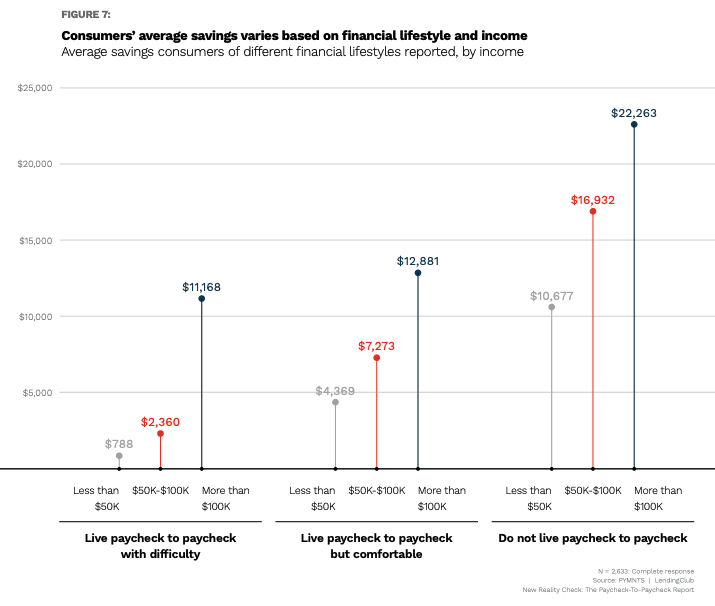

Effects of having a savings safety net are clear, with the latest study stating that consumers earning $50,000 to $100,000 per year and living paycheck to paycheck with difficulties paying bills reported an average savings of $2,360, compared to $7,273 for those without issues.

We also observed the biggest gap in savings levels “between those earning less than $50,000 per year living paycheck to paycheck with difficulties paying their bills, who reported average savings of $788, compared to $4,369 for those without issues.”

The data shows that 12% of consumers earning over $100,000 were living paycheck to paycheck and struggling with bills in January. That figure rose to 19% among those in the $50,000 to $100,000 per year bracket and soared to 34% for people earning under $50,000.

Covering the $400 Emergency

Covering the $400 Emergency

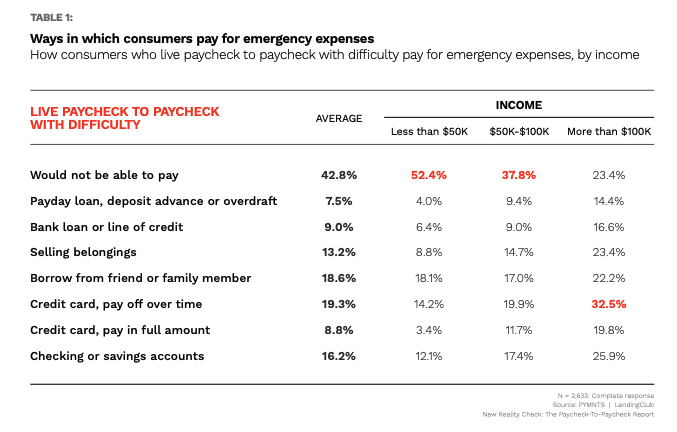

With 43% of paycheck-to-paycheck consumers overall reporting that they could not cover a $400 emergency expense — along with 23% of those earning six figures — many are making ends meet using credit cards, indicating an installments approach to living costs.

“Among consumers earning more than $100,000 who live paycheck to paycheck with issues paying their bills, 33% would use a credit card and pay it off over time, while 20% would use a credit card and pay it off in full,” according to the February report. “High-income consumers who live paycheck to paycheck without issues paying their bills are more likely to use a credit card and pay it in full (23%), and less likely to use a credit card and pay it over time (21%).”

Revolving credit use isn’t an option for everyone, either because they aren’t eligible or because high interest rates and the potential for late payment fees would add to monthly bill burdens.

However, with 52% of people earning under $50,000 and 38% of those earning $50,000 to $100,000 a year reporting they would also not be able to meet a $400 emergency expense, consumers are looking for more affordable ways to stay afloat until the situation stabilizes.

Get the study: The Paycheck-to-Paycheck Report

Get the study: The Paycheck-to-Paycheck Report