Consumers from different demographic groups are perceiving the economy in different ways, but their mood is generally negative, according to Reality Check: The Paycheck-To-Paycheck Report, a PYMNTS and LendingClub collaboration based on a survey of 2,366 U.S. consumers.

Read more: Reality Check: The Paycheck-To-Paycheck Report

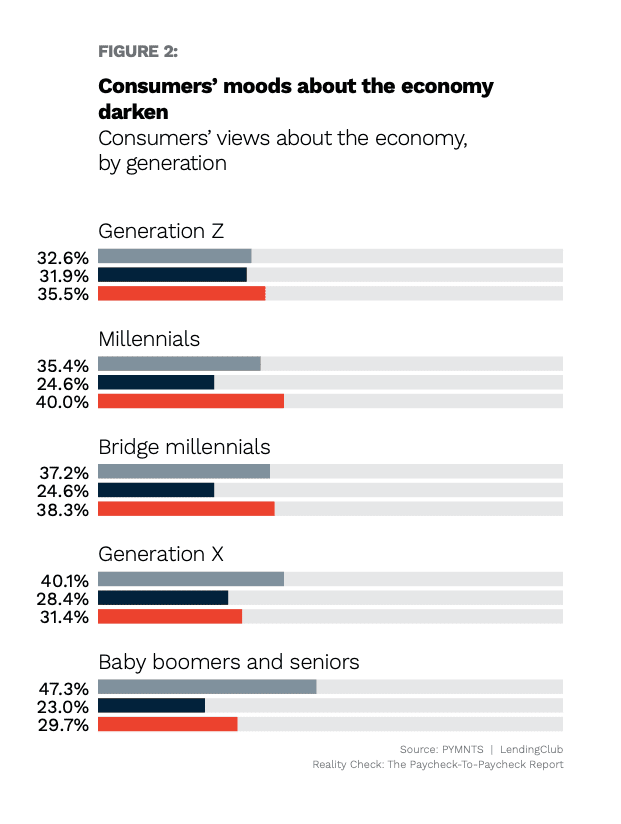

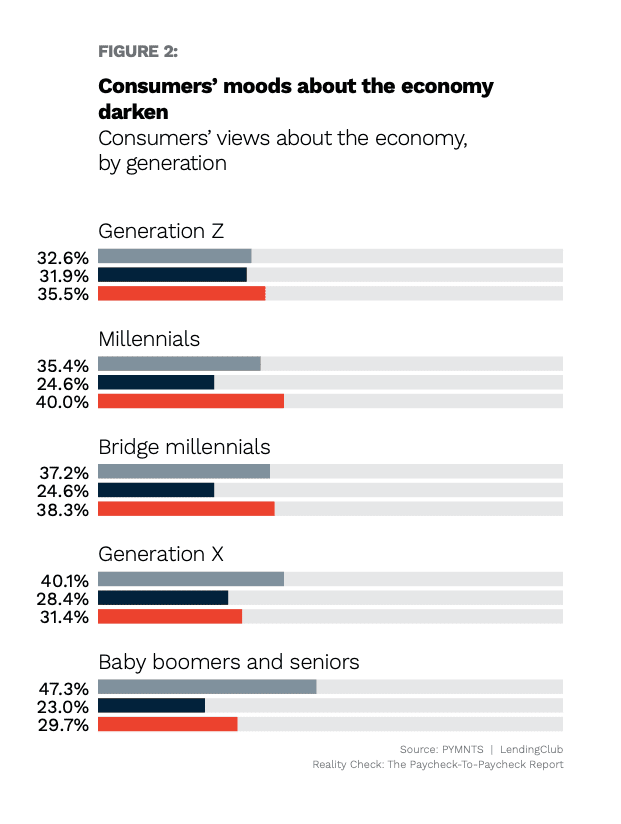

The older the demographic group, the more likely they are to be pessimistic about the economy. Forty-seven percent of baby boomers and seniors have a gloomy view of the economy, as do 40% of Generation X members. Only 30% of baby boomers and seniors and 31% of Gen Xers say they are optimistic.

Three younger demographic groups have views of the economy that are more mixed. Thirty-seven percent of bridge millennials, 35% of millennials and 33% of Generation Z members are pessimistic about the economy. The shares of these groups who are optimistic are not much different: 38% of bridge millennials, 40% of millennials and 36% of the members of Gen Z.

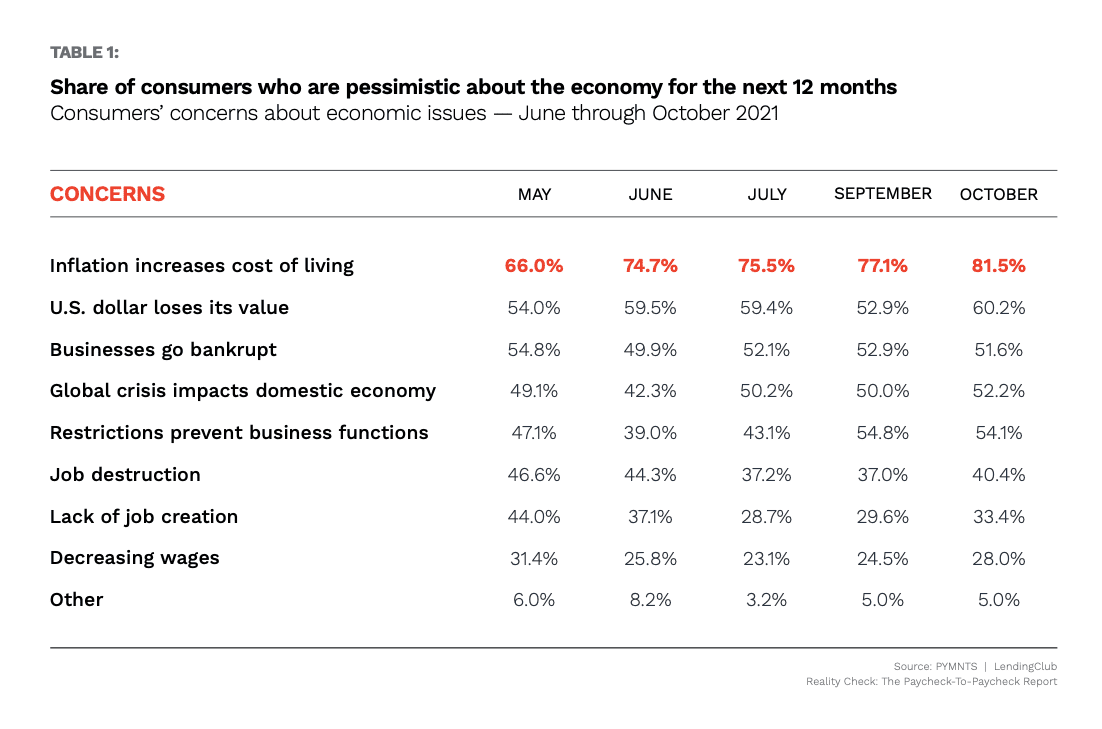

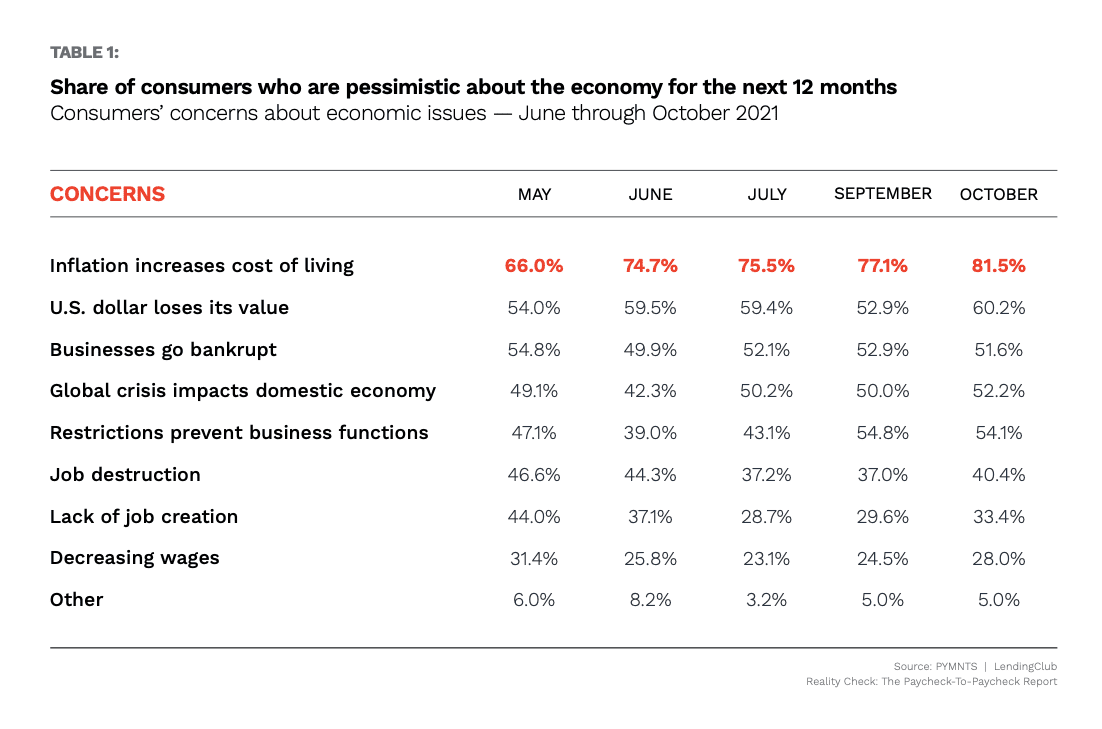

The top concern driving consumers’ pessimism is the rising cost of living. Among consumers who have a gloomy outlook for the economy, 82% say they are concerned about inflation increasing the cost of living.

There are four more concerns that are cited by more than half of the consumers who are pessimistic about the economy: the U.S. dollar losing its value, restrictions preventing business functions, a global crisis impacting the domestic economy and businesses going bankrupt.

Advertisement: Scroll to Continue

Worries about financial security are common even in the best economic times but they gained ubiquity during the pandemic’s darkest days. Even now, the steady rise in prices that has persisted since the spring is weighing on consumers’ moods.