Consumers See Higher, Longer Inflation Than Government – Why That Matters

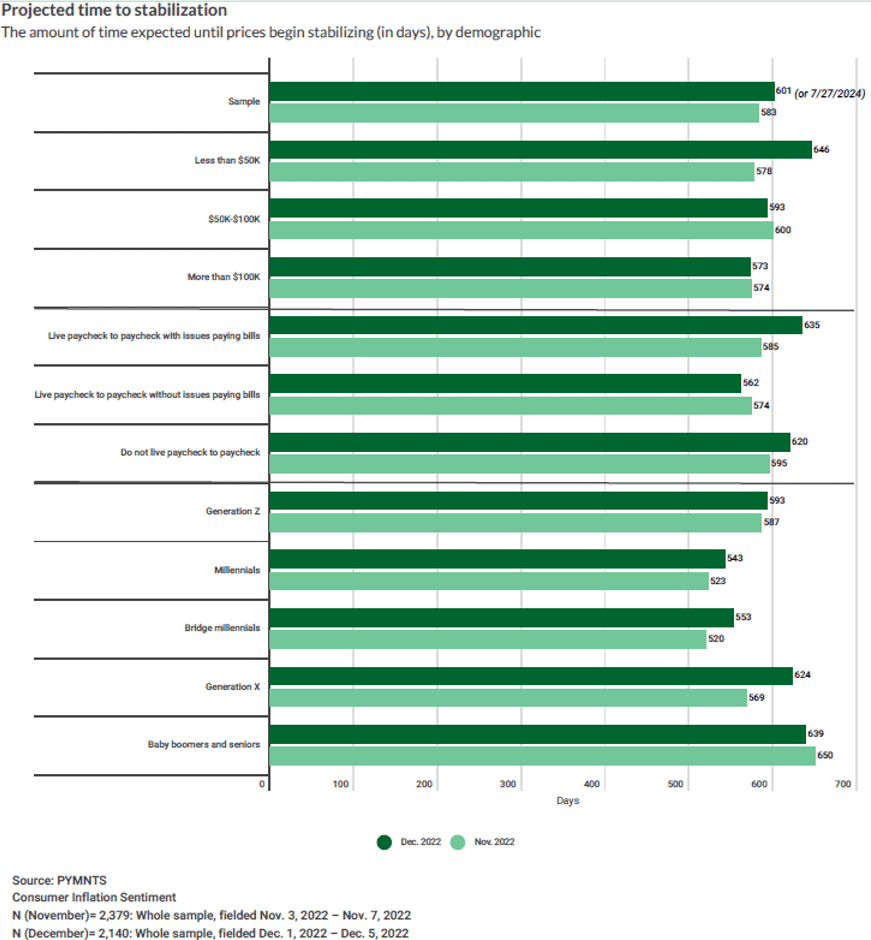

PYMNTS’ national study of 13,250 U.S. consumers over the last seven months may tell policymakers everything they need to know about inflation expectations: consumers think it will take another nineteen months — until roughly June 2024 — for inflation to return to the Fed’s 2 percent target.

Millennials are slightly more optimistic and call it sometime around April 2024.

Perhaps more telling: month after month, according to our surveys, the consumer’s inflation expectation timeline has wavered little, despite the government reporting that monthly inflation levels have moderated. If anything, the timeline has extended a month since we began fielding the monthly consumer inflation sentiment studies of roughly 2,000 consumers in July of 2022.

These inflation expectations are important for macroeconomic policy because they suggest that the Fed has a long way to go to convince consumers — many of whom are also wage earners — that their salary increases and job offers don’t need to cover rising costs of living.

More importantly, these findings suggest that consumers may have a better handle on inflation than the governmental data and the economists poring over it.

Consumers Can Be Better Experts than the Experts

Advertisement: Scroll to Continue

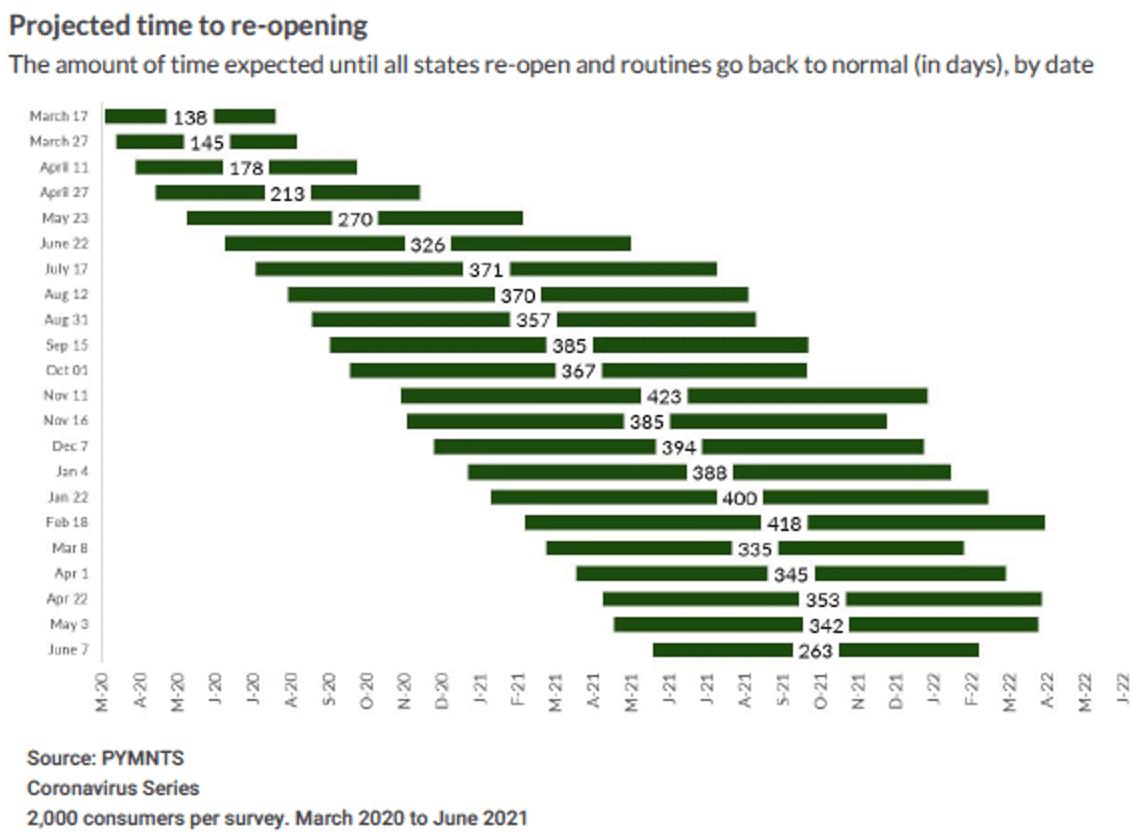

Our twenty months of data, collected monthly during the pandemic, shows how accurate consumers are when predicting the duration of once-in-a-generation events.

In March of 2020, when the government and epidemiologists were predicting a two-month COVID timeline, PYMNTS data reported a U.S. consumer who said it wouldn’t be until the Fall of 2020 until things would “return to normal.”

In May of that year, when epidemiologists said it would be Fall, consumers said February of 2021. In December of 2020, PYMNTS data reported a consumer who said it would take until the end of 2021 before COVID would be under control at a time when most everyone else predicted March of 2021.

It was the consumer who was right on the money, despite the world’s foremost experts with their spreadsheets and piles of data.

That sentiment influenced the consumer’s day-to-day — how they worked, shopped, traveled, lived, had fun, ate and communicated with others. Their shift to digital was pervasive and has largely redefined the digital-first dynamics of how consumers and businesses engage today, even as consumers return to the physical world.

When faced with another once-in-a-generation event — like 40-year historically high levels of inflation — it may be the consumer who predicts inflation’s level and duration more accurately and influences the market dynamics underpinning it.

The consumer who looks at her bill when checking out at the grocery store, scans the menu prices at her favorite restaurants and QSRs, and tallies up how much more she pays for clothes and household items now than she did in 2020 and 2021.

The consumer who calculates the gap between a paycheck that has not kept pace with the unprecedented levels of inflation and the prices staring back at her on those checkout receipts.

The consumer who reads about layoffs at companies that aren’t only the FinTechs or the Big Techs and starts to worry and pulls back.

The consumer, now suddenly an expert, crafting expectations about inflation by measuring and managing the only metric that matters: her personal financial well-being.

When Perception is Reality

Professors John Gourville and Dilip Soman wrote an article for Harvard Business Review in 2002 on pricing and the psychology of consumption. Their thesis is that few executives consider the relationship between how a product is priced and how consumers buy and use them.

One of their theories relates to the timing of payment and the use of a product.

They cite as an example the purchase of a theatre ticket of identical value.

Twice as many consumers who bought a ticket the day before the event said they would still attend if they woke up sick with the flu the day of the event as those who bought their ticket six months before and also became ill the same day of the performance.

Their insight: the closer the payment to the point of consumption, the more likely consumers are to use the product.

Or, in inflationary times, perhaps not buy one at all.

I’m From the Government and I’m Here to Tell You About Inflation

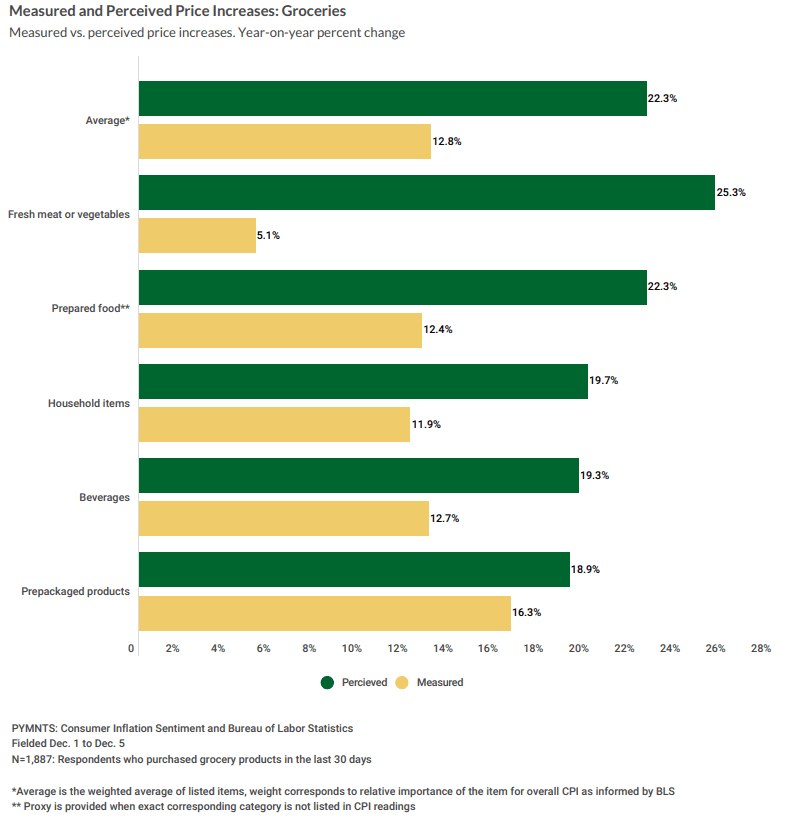

Seven months of consumer data as reported by PYMNTS show that consumers consistently say that the prices they pay for food, gas, clothing and household essentials are more than twice as high as what government data reports.

For example, consumers report that food prices at the grocery store are nearly twice what CPI data reports. They report the prices of fresh meat and vegetables — the reason most consumers go to the physical grocery store — have risen at a rate five times higher than CPI reporting.

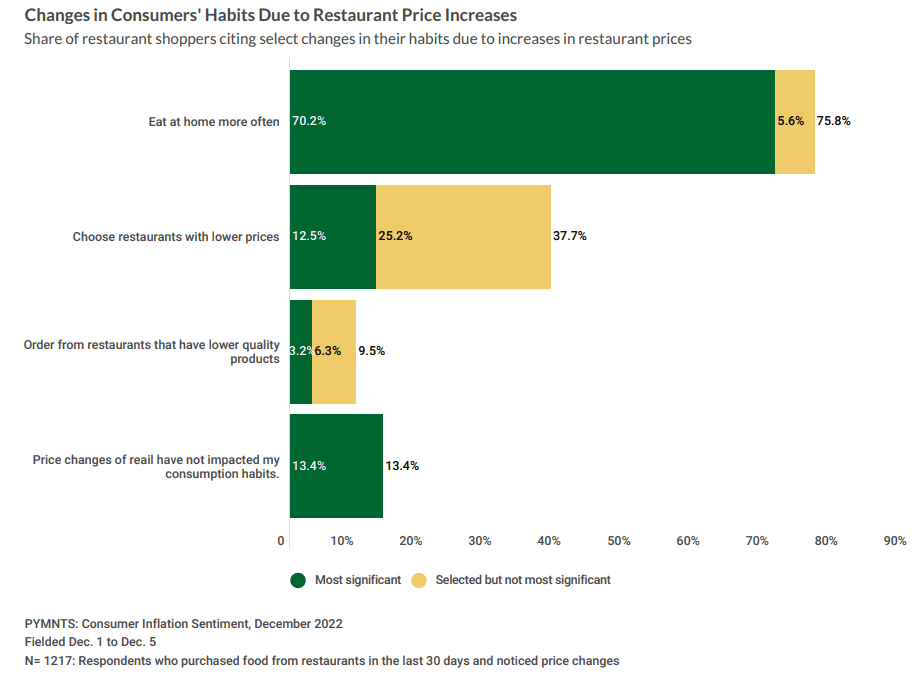

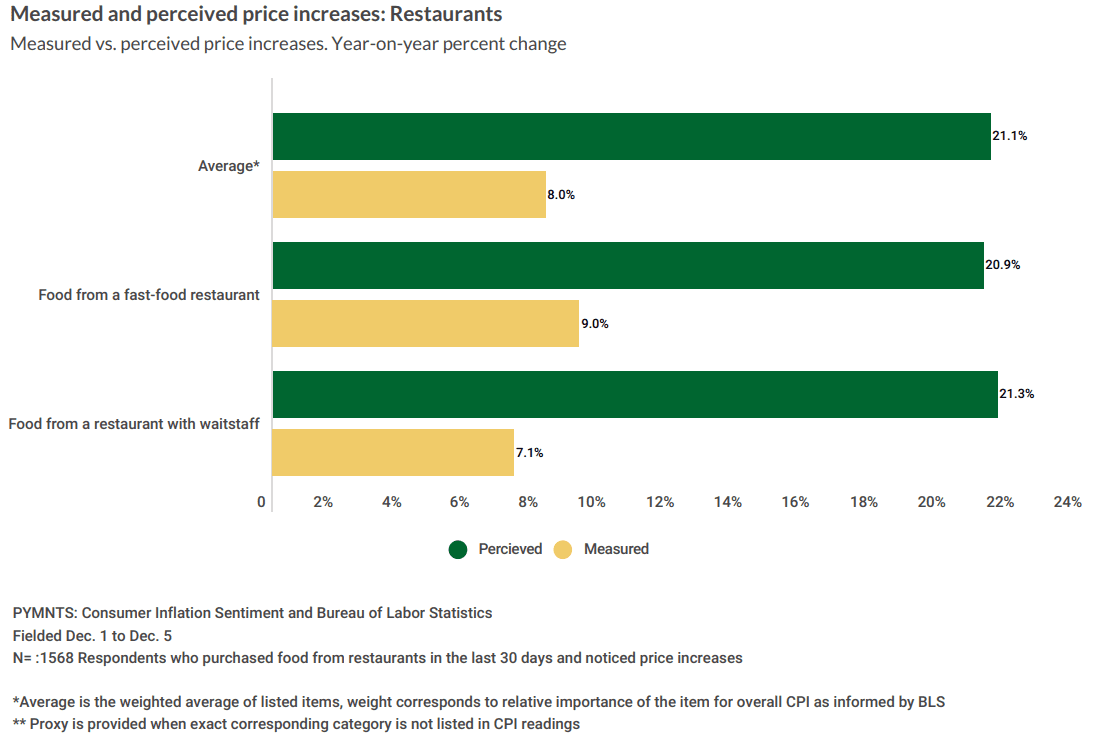

CPI data reports an increase of 8 percent in food prices at restaurants, a third less than the 12 percent increase reported for groceries. When looking strictly at government data, one might assume that eating out is more financially compelling than buying groceries and cooking food at home when compared to 2021.

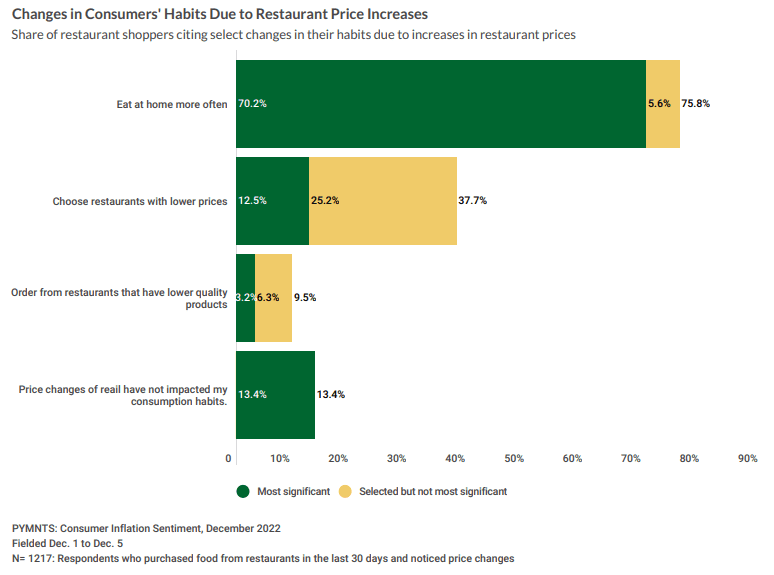

However, according to PYMNTS data, three quarters of consumers say they are eating at home more often than they once did. More than a third are switching to cheaper restaurants when they do dine away from home.

Overall, restaurant customers say prices have jumped 21 percent, triple what CPI pegs as the increase and double the CPI’s measure of the upswing in food expenses. This is true wherever consumers report eating out — across cities, suburbs and small towns — and whether they eat at table service restaurants where a waiter takes their order or pick up a cheeseburger and fries at the drive-thru window.

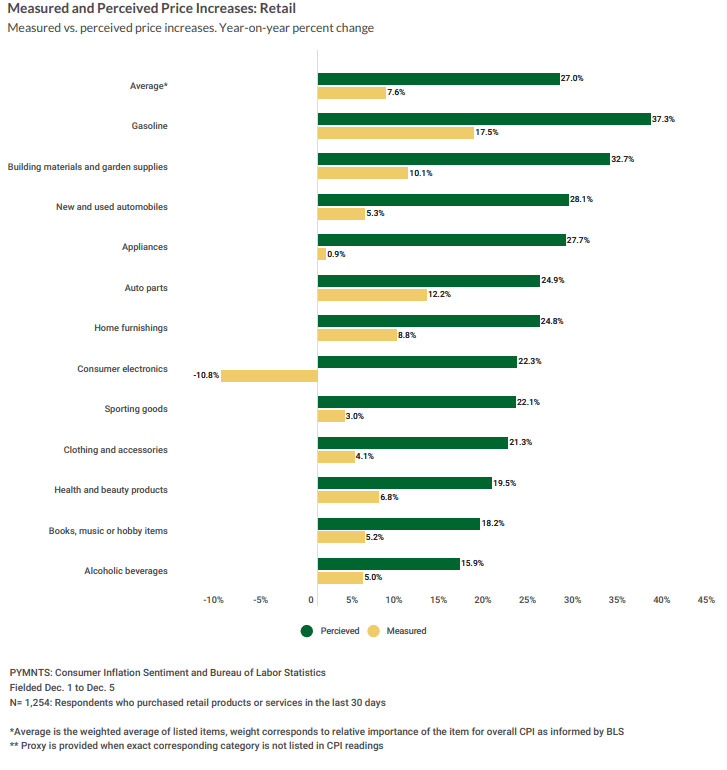

Then there’s retail, where consumers report paying prices that are about four times higher than CPI reported data: 7.6 percent is the average increase in retail prices, according to government data, compared to the 27 percent consumers report across all retail categories.

Included in that total is gasoline — despite lower gas prices, consumers still report what they pay for gas to be twice as high as what CPI reports.

Clothing prices, consumers say, are 21 percent higher; CPI reports an increase of 4 percent — a gap of seven times. The only reason that there is a decrease in consumer electronics prices is that CPI data controls for the quality of product; the “same” product gets cheaper each year even as technology improves the quality.

So, what gives?

The classic perception/reality disconnect?

Or perhaps the timing of the payment to the point of consumption, which defines the consumers’ reality and determines what they buy.

For the consumer, it’s their basket, not the government’s, that matters. And, as the Fed well knows, it is consumers’ perceptions and expectations that can drive the wage-price spiral behind the inflation dynamics.

Trading Down and Down Even More

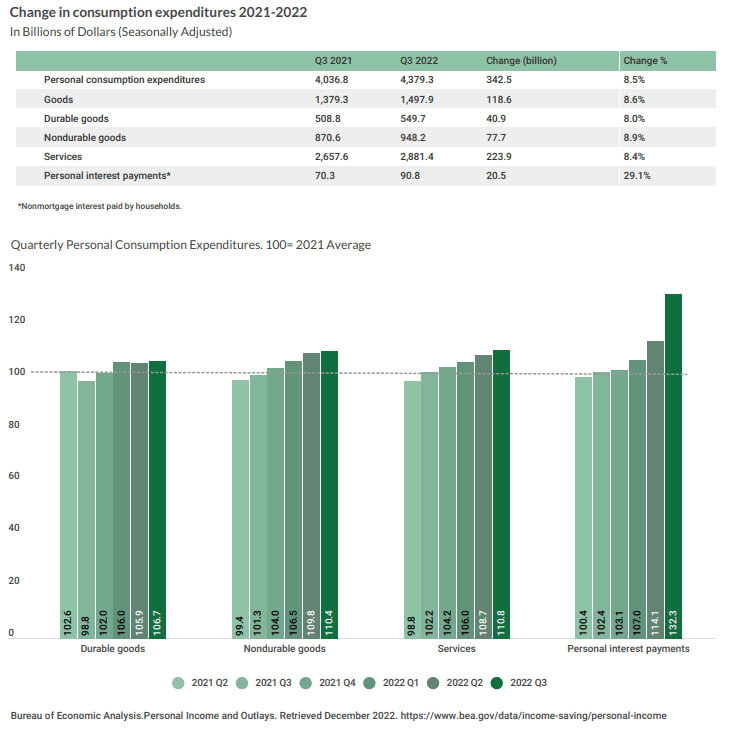

As of Q3 2022, according to BEA estimates, U.S. consumers spent 98 billion dollars more in everyday goods and interest payments than Q3 2021. That number is expected to climb as prices remain high, interest rates rise and more consumers take on debt and revolve those balances.

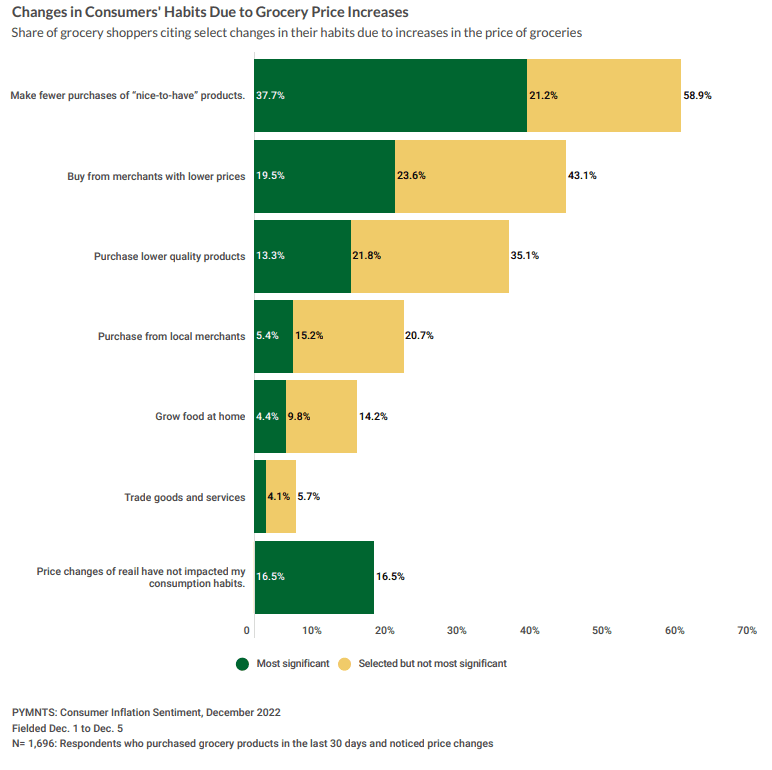

Today, nearly all U.S. consumers — 85 percent — say inflation has changed their spending habits. Not surprisingly, consumers who say their paychecks lost the greatest amount of purchasing power are the most likely to cut back on nonessential spending and switch to cheaper merchants and products.

Paycheck-to-paycheck consumers, who struggle to pay bills and are dipping more into savings to make ends meet, have made the most severe adjustments. They also remain the most pessimistic about their overall financial prospects and the state of the U.S. economy.

Yet even 59 percent of those who say their spending power hasn’t taken any or as much of a hit are cutting back on non-essential purchases. The same consumer with a good job and a steady paycheck who may have felt flush last year when housing prices were up and investment accounts were growing double digits may not be as willing to spend right now, even if they can.

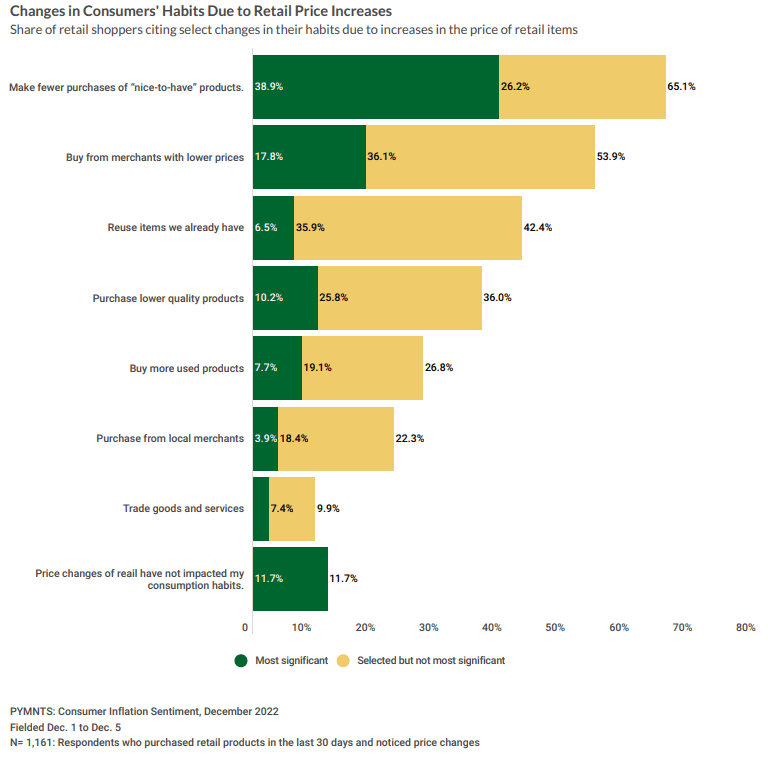

Regardless of why, all consumers are adjusting. Most are trimming the things that they don’t consider essential to some degree. Consumers who buy retail and grocery products are three times more likely to eliminate the nice-to-haves than buy lower-quality substitutes.

More than half of consumers (54 percent) are hunting for deals, with many more willing to leave their favorite merchants for those with lower prices when buying retail products. Consumers are also more inclined to use what they have or buy lower quality than buy used items when purchasing retail products — interesting when examining the financial pressure now experienced by reCommerce players

When it comes to eating out, nearly four in ten consumers say they are trading down to restaurants with cheaper prices. Even more (76 percent) are eating more at home where consumers have much more control over how much they spend on food, in total.

The Case for Consumer Certainty

Walmart is running a holiday commercial whose hero image is an itemized grocery receipt for Christmas dinner with all the trimmings.

The receipt has two columns: 2021 and 2022. The commercial scrolls down the receipt comparing the cost of specific products at a line-item level — with some higher than last year, and some lower. The commercial ends with the receipt total identical to what was spent in 2021, maybe 50 cents cheaper.

It would be hard to imagine an outcome any different — after all, why would Walmart show an itemized list with prices that wouldn’t reflect an outcome in Walmart’s favor? Especially when all of the data shows a consumer very much aware of grocery prices.

The Walmart commercial seems to tap into the consumer’s desire for predictability and certainty, where the stakes are high — the holiday dinner at home with family.

That’s consistent with PYMNTS data that show a U.S. consumer who would rather cut out or cut back than cut quality, a consumer who can control both her spend and the outcome of her spend without creating uncertainty about whether what is purchased will meet her expectations.

The Long Road to June 2024

The consumer attitudes that we report about inflation and its duration should give everyone pause.

Consumers are beginning to really cut back in response to the perception — and maybe the reality — that prices keep climbing. And they don’t think the Fed is going to get those price increases back down to a normal 2 percent or so a year until mid-2024.

But then the Fed may have to step up its efforts to tamp down these expectations.

If consumers cut back on purchases, in inflation-adjusted dollars, and the Fed feels it has to keep ratcheting up interest rates, 2023 could be a rough economic year for retailers.