New Jobs for Better Wages Not a Panacea for Paycheck-to-Paycheck Households

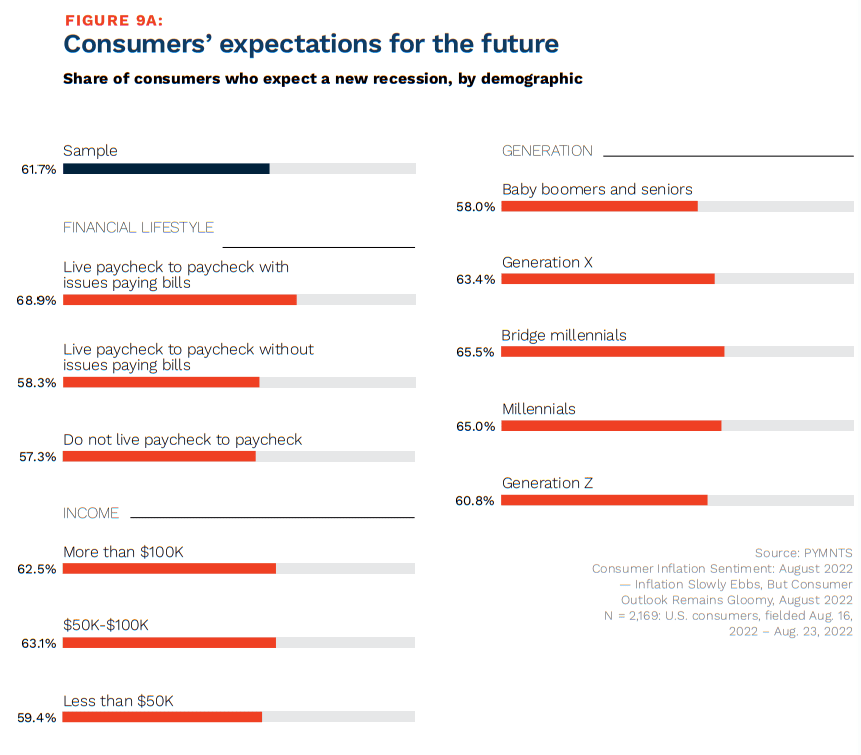

The household economics of 2022 continues to confound, as consumers who are fearful of recession and whose wages are also not keeping pace with inflation have been shown to be equally concerned about finding a new, better-paying job.

We see this spelled out in the latest study in the long-running New Reality Check series, October’s “New Reality Check: The Paycheck-To-Paycheck Report: The Employment Edition,” a PYMNTS and LendingClub collaboration, found that while 62% of consumers are dissatisfied with their pay, only one-third think they could switch jobs and work in a position that would fit their qualifications and satisfy their wage demands.

“We’ve got very low unemployment rates, we’ve got record inflation, and we haven’t seen wages move [much] to catch up,” LendingClub Financial Health Officer Anuj Nayar told PYMNTS, noting that the 4.9% increase in average hourly earnings over the past 12 months is not keeping up with inflation that is running between 8% and 9%.

“We’re in a weird situation where the economy should be doing something different,” he said.

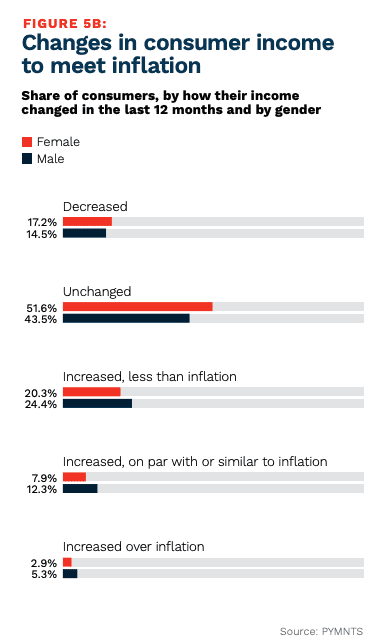

It should be, but it’s not. Citing a Moody’s stat that average household expenses have gone up $445 a month on average this year, millions of consumers are relying on dual incomes to make ends meet, but the persistent gender pay gap is sapping effectiveness from those efforts.

“Women were less likely to say that their earnings grew on par or above inflation than men. I think it was 11% to 18%, respectively. It shows we’re still working in a male-dominated economy, and this gender wage gap is still very prevalent.”

Get the study: New Reality Check: The Paycheck-To-Paycheck Report: The Employment Edition

The Devil You Know

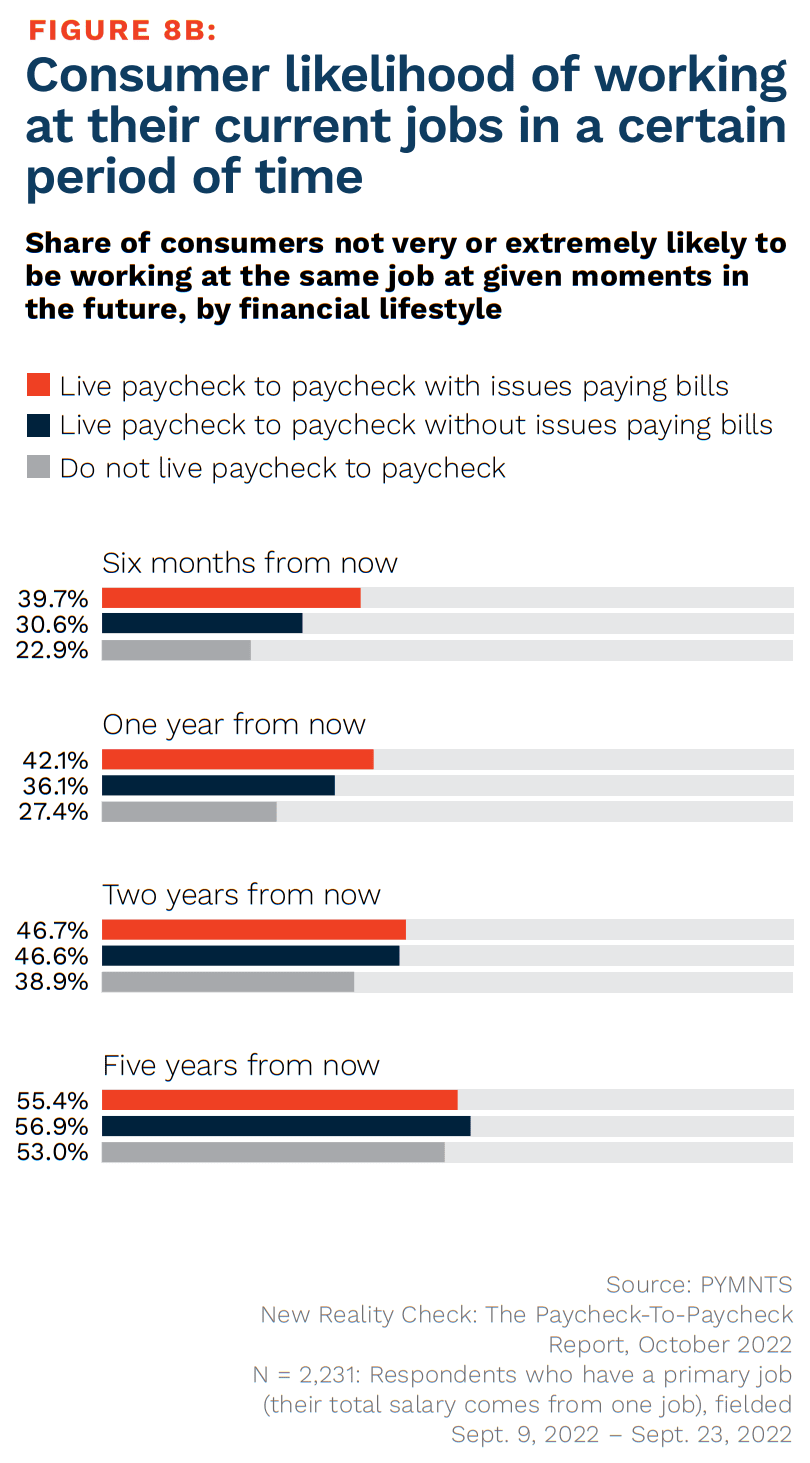

Under-earning consumers typically look to trade up jobs, but they have doubts about their ability to actually increase their income given the 10+ million positions sitting unfilled.

“People are looking at it and thinking, are they better with the devil they know as opposed to jumping into what could be another minefield they don’t understand?” Nayar said, noting that white-collar workers were typically less concerned than lesser-paid peers.

“Paycheck-to-paycheck consumers who are financially struggling are concentrated in those areas with very high employee turnover rates, particularly the retail and services industries, and are therefore more vulnerable to labor swings,” he said.

Job tenure of five or more years was also shown to have a positive effect on both credit scores and savings rates, he said, versus that same population that is reliant on retail and service sector jobs and has been hardest hit for the past three years.

“Inflationary pressures are hitting those sectors the worst,” Nayar said.

See also: LendingClub’s Digital Bank Deposits Soar 80% as Interest Rates Rise

ReFi Takes on New Meaning

As for strategies among paycheck-to-paycheck households at various ends of that spectrum from struggling to comfortable, the wage issue is also bringing about some novel buying behaviors.

“People are trying everything,” Nayar said, but are especially focused on reducing everyday bills, bringing down debt and trying to increase their savings cushions.

“I heard an interesting stat about how people are increasingly shopping more at gas stations,” he said, pointing to the recent rise in non-gas purchases at many convenience stores, suggesting that people are going to buy a frozen pizza and a Gatorade rather than more expensive items at the grocery store.

The impact of rising interest rates is especially noticeable on mortgages and other real estate-linked borrowing, he said, but suggested consumers capture that move and “refinance their savings” instead.

As a recession approaches, he said, now is the time for cusp-consumers to deploy some financial survival strategies, especially since the end of the year typically brings additional stress on consumers’ finances. If history is a guide, the study found, two out of three U.S. consumers could be living paycheck to paycheck by December.