But as with so many other statistics, it takes a deeper look at the numbers to get a fuller picture of the overall landscape. The Bureau of Economic Analysis (BEA) released its February Personal Income and Outlays report (March 31) last week, illustrating a prime example of this need for detailed examination. The personal income rate for February rose 0.3% month over month, which could be cause for careful optimism, as the rate signals a modest 0.1% increase from the same time last year and a continued upward climb from June 2022’s low.

However, the optimism from this good news begins to dampen when comparing personal income and savings rates to spending and outlays. Although the Bureau of Labor Statistics’ monthly CPI inflation release gains more headlines, the Fed prefers the BEA’s Personal Consumer Expenditure (PCE) price index due to the latter’s more frequently updated weighting and broader focus. The PCE also allows for item substitution in its analysis and tracks both urban and rural prices, while the CPI is limited to price changes in urban areas. It is this climbing rate, which has risen 5% from the same time last year (4.6% excluding food and energy), that has Fed Chair Jerome Powell concerned.

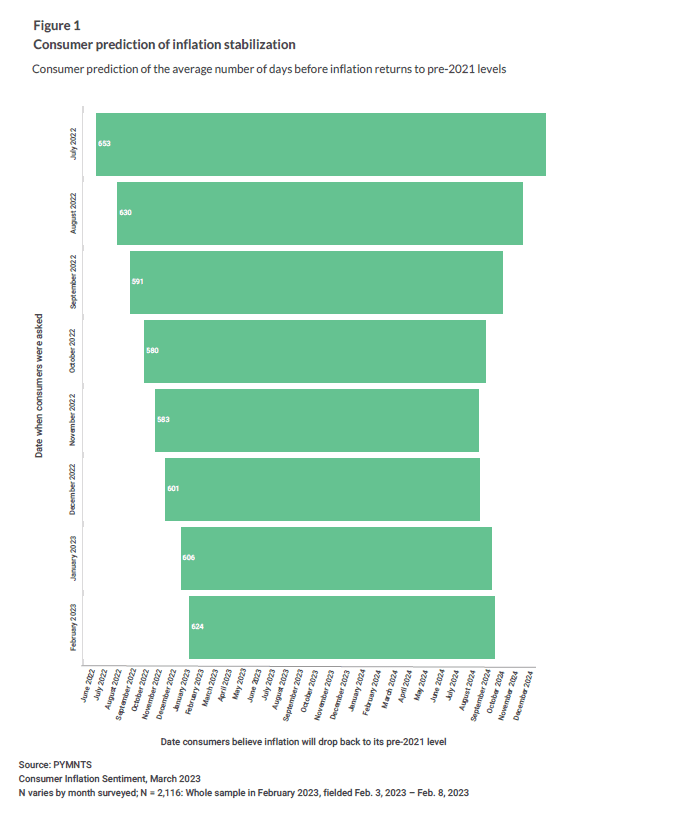

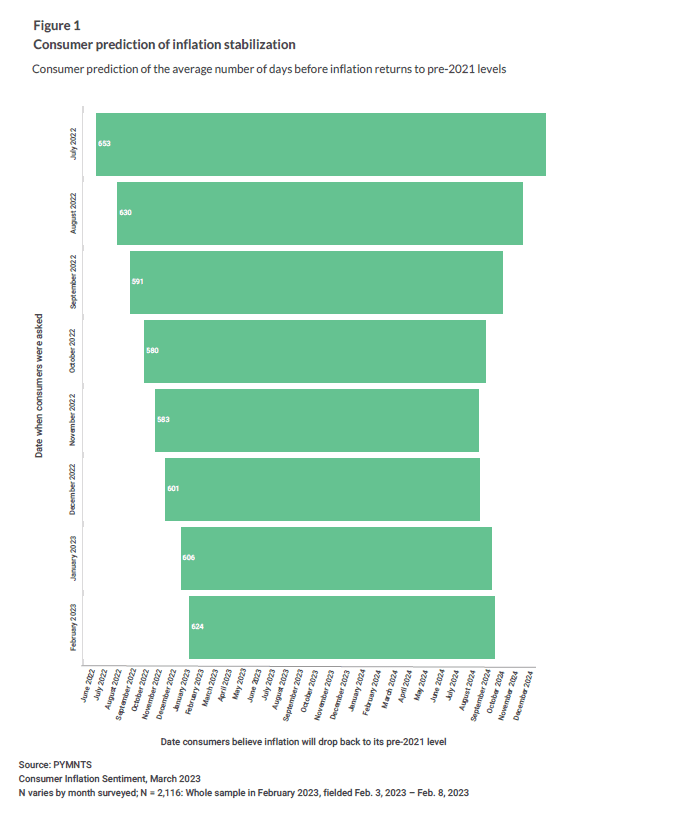

However, this subtle differentiation is important when analyzing consumers’ forecast of when inflation might end, as measured in PYMNTS’ March “Consumer Inflation Sentiment” report. Here, too, a closer look at the numbers is necessary to determine if consumers see the light at the end of the inflationary tunnel anytime soon. When applying those days to predicted dates, the sentiment seems grimmer than at first glance.

At first glance, the average number of days going down seems about right, from a high of 653 days in July 2022 to 624 in February. But that slight drop also means that consumers have ultimately pushed back their forecasted end of inflation by months. In July, consumers predicted inflation would drop back down to 2021 levels sometime in April 2024. By February, that date has been extended to October 2024.

Rather than illustrating a major sentiment of progress, this finding implies that consumers expect inflation to last at least a year and a half. And if high prices on essentials such as food continue through that span, the economic picture will remain turbulent for many.

Advertisement: Scroll to Continue

The PCE and consumers’ inflation stabilization predictions require a deeper look to fully understand. However, that extra examination may be worth the time and effort, as they reveal a more realistic — if more pessimistic — sense of consumers’ true economic landscape.