Slowed consumer spending led to a recession for the eurozone, stoking speculation of a global pullback.

One consequence of a global economy is that when one country runs into economic challenges, it may impact the financial health of other geographical regions doing business with it.

This seems to be the case right now in the eurozone, as The Wall Street Journal (WSJ) reported this month that the region has collectively slipped into a recession. This is due to a sharp consumer spending pullback in Germany, the strongest economy in the zone, and despite strong growth in other member countries such as Spain and France.

Coupled with higher interest rates, the spending slowdown may signal a longer-than-expected economic recovery for Europe, and through consumers’ cross-border spending, imports and other international transactions, such a pullback can itself have impacts across borders.

When it comes to the same situation happening in the United States, experts are split. While consumers across income demographics are undoubtedly cutting back to essential spending — much like Germany’s consumers — some economists say it would be comparing apples to oranges. They say the greater strength of the U.S. economy can better withstand the same shifts.

It may help to look to the mindset of both Main Street small- to medium-sized businesses (SMBs), which operate on tighter margins than larger competitors, as well as consumers for their view on the economic landscape’s health. After all, these groups collectively keep many economies, including that of the U.S., afloat.

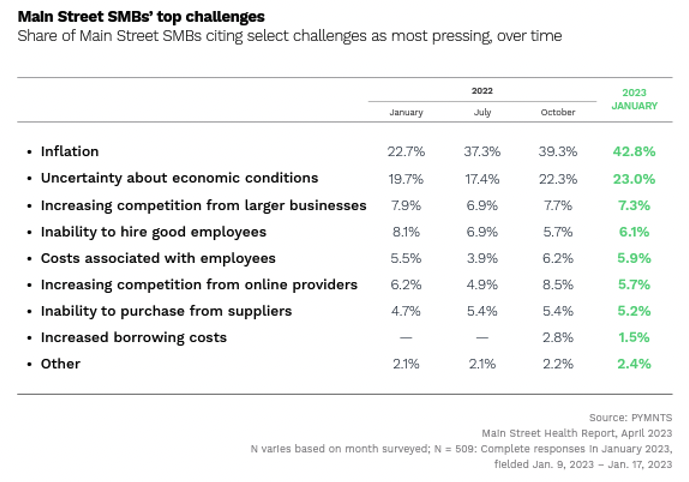

SMB sentiment on pressing economic challenges is most recently detailed in PYMNTS’ April “Main Street Health Report.”

Main Street SMBs reported that their financial challenges have been increasing since January 2022. The share of Main Street SMBs citing inflation concerns as most pressing nearly doubled within a year to 43%. A further 23% in January 2023 cited uncertain economic conditions as their greatest concern. This growing share of SMBs highly concerned about near-future challenges may signal a deepening pessimism about consumers’ ability to keep spending, and therefore the country’s general economic health.

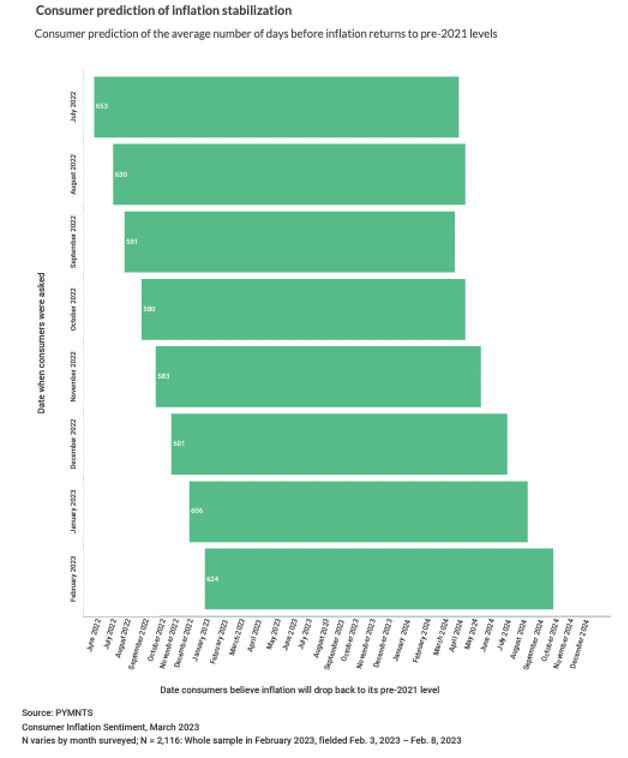

Consumer sentiment when it comes to broad economic health seems equally as gloomy, highlighted in PYMNTS’ March “Consumer Inflation Sentiment” report.

With consumers pushing their expectations of inflation to finally stabilize further and further out, it seems that their concerns may echo Main Street SMBs. And if consumers believe there may be more economic hardship on the horizon, they could be even more reluctant to spend as they hunker down, possibly leading to a larger slowdown and longer recovery, similar to the situation the eurozone is facing.

While the U.S. faces economic headwinds, the country’s financial future certainly could still lead down a different recovery path. However, as other nations and regions increasingly face financial uncertainty due to decreased consumer spending, domestic sentiment may hint toward a similar cycle.