Inflation’s torrid pace is cooling a bit.

But not enough to give paycheck-to-paycheck consumers relief from the everyday pressures of keeping a roof over their heads or the pressures they face when shopping at the local grocery store.

To that end, the latest inflation data from the government – via the Consumer Price Index – showed that inflation’s pace was 0.4% in February, as measured month over month, and 6% year over year, slowing from a respective January pace of 0.5% and 6.4%.

And while the 6% annual reading is the slowest increase since September of 2021, drilling into the numbers shows that only a few categories of spending saw actual declines.

Fuel oil prices were down 7.9% in February from January but were still up 9.2% year on year. The prices of used cars and trucks slid by 2.8% in the latest monthly data and were down 13.6% year on year. So, getting from point A to point B is perhaps a bit less stressful on household finances.

But pretty much everywhere else you look — well, inflation’s still proving to be stubborn. Take food, for example. The CPI Index shows that, as an overall category, food prices were up 0.4%.

Food prepared/consumed at home saw inflation rise by 0.3%, down from 0.4% at the beginning of the year — and up 10.2% annually. Food consumed away from home showed the same rate of inflation that’s been in place since January, at 0.6% month on month and a quickened pace since the end of last year. We note that quick-service restaurants (QSRs) and other establishments might be adversely affected as consumers make tradeoffs — perceiving that it’s relatively cheaper to eat at home than out.

But in doing so, some choices are being made by necessity. Consumers are trading between quality and quantity, affecting 69% of consumers surveyed by PYMNTS. Among grocery shoppers who say they have noticed price changes, 59% have cut down on nonessential grocery items, while 35% are buying cheaper alternatives.

As for the homestead itself, the cost of shelter — even stripping out energy services — is more expensive, too. The CPI data show that this metric was up 0.6% in February vs. January, and up from 0.5% increases seen into the end of last year, while logging a 7.3% gain from a year ago.

At this writing, the stock market is up 1.5%. Investors are betting with the CPI data and a spate of bank failures last week, the Fed will opt not to raise interest rates, at least not this month.

But for the paycheck-to-paycheck consumer, the inflation data, as noted above, signals that everyday expenses are expensive enough. And a cooling of inflation’s pace still represents an uncomfortable truth: Prices are still rising, and PYMNTS’ own data show that a significant percentage of consumers are already pinched by credit card debt already in place. Consumers with issues paying their monthly bills, on average, carry balances of 157% of their available savings. They have been dipping in those savings to chip away at monthly credit card obligations or at least remain current.

The issue is widespread, as even those consumers with no issues paying their debts have credit card balances that are equivalent to more than a third of their available savings.

Nearly four in 10 (38.3%) of consumers living paycheck to paycheck with issues paying bills have already pulled money from their savings or investments to help manage their credit card debt load.

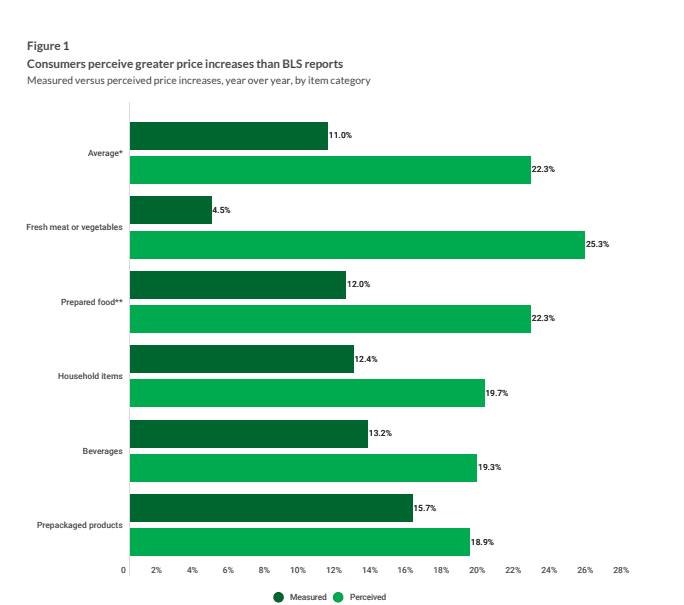

We’ve noted in the past that there’s a gap between what the government reports and what we, as consumers, observe and feel as we shop daily. The gap is significant as seen in the chart below and as recorded in January of this year. And that disconnect seems likely to widen if inflation continues its upward trend, regardless of whether it is slowing.

Wall Street may cheer, but for many consumers, the struggle against inflation is real and set to continue.