Consumers are anticipating another year of cutbacks, traded downs, and forgoing a variety of purchases as inflation continues to impact retail decisions.

For insights into these trends, we look to “New Reality Check: The Paycheck-to-Paycheck Report: The Economic Outlook and Sentiment Edition,” a PYMNTS and LendingClub collaboration, and the latest in this long-running series documenting how American workers choose where and where not to expend their reduced buying power.

While true that inflation dropped to 6.5% in December 2022 after hitting a high of 9.1% last July, holiday receipts were not as healthy as some expected, and based on the sentiment of a panel of over 4,000 consumers surveyed for this report, 2023 will see more of the same.

Core expenses like rent and mortgage, food, fuel and utilities are overtaking household earnings, as we found 9.3 million more U.S. consumers living paycheck to paycheck at the end of 2022 than the prior year. For added context, 8 million of them earn over $100,000 annually.

As to how this will be reflected in retail spending, there’s an expectation among respondents that big-ticket discretionary items they considered buying in 2022 are off the table in 2023.

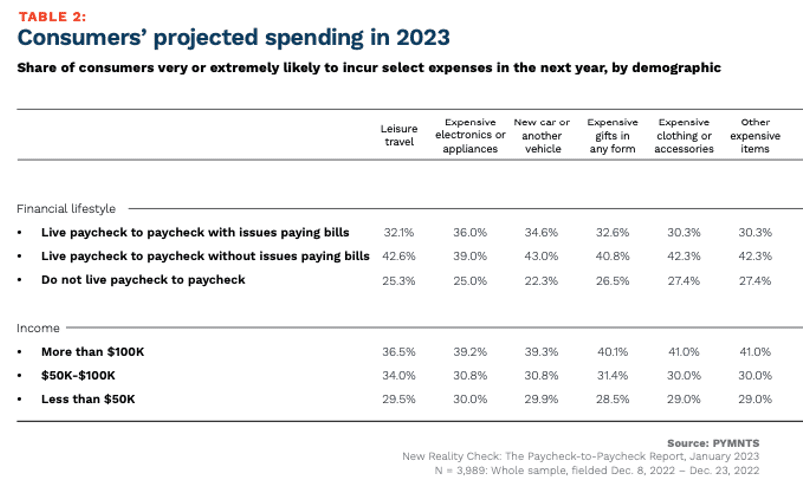

“With inflationary pressures dampening their optimism, many consumers are likely to shy away from large purchases in 2023, primarily electronics, appliances, and leisure travel. Only 35% of consumers said they will incur leisure travel expenses in 2023, and just 24% plan to purchase expensive electronics or appliances in 2023,” the study states.

Leisure travel was one area where consumers spent in 2022 almost regardless of the paycheck-to-paycheck status, as spending in the category was perhaps the most optimistic sign of a post-pandemic recovery in certain types of spend. That performance may not repeat this year.

Per the new study, “Among paycheck-to-paycheck consumers, regardless of whether they struggle to pay their monthly bills, 30% plan to spend on leisure travel,” even though we found that 8.7% of respondents who spent on leisure travel in 2022 say they won’t in 2023.

This effect extends to costlier home goods as well. “New Reality Check: The Paycheck-to-Paycheck Report: The Economic Outlook and Sentiment Edition” found that “22% of those living without difficulty and 29% of those struggling said they will purchase expensive electronics or appliances. Less than 20% of consumers in the middle-income bracket — those earning $50,000 to $100,000 annually — expect to purchase big-ticket electronics, clothing, or gifts in 2023.”

Digging into purchase intent figures, we see almost 55% (54.8%) of consumers didn’t buy expensive clothing or accessories last year and don’t plan to this year.

It’s much the same story with vehicles, as 55% of those surveyed did not buy a car in 2022 and say they likely won’t this year.

Broadly speaking, when asked about their outlook and sentiment in more generalized terms like “expensive gifts in any form” or nonspecific “other expensive items” survey respondents still plan to shy away in 2023, with 54.9% of consumers saying they’ll skip the former and fully 55% saying they’ll forego the latter, whatever form those “expensive” retail purchases take.

Get the Study: New Reality Check: The Paycheck-to-Paycheck Report: The Economic Outlook and Sentiment Edition