Consumer spending and private inventory investment are driving an increase in real gross domestic product (GDP), the Bureau of Economic Analysis (BEA) said Thursday (Aug. 29).

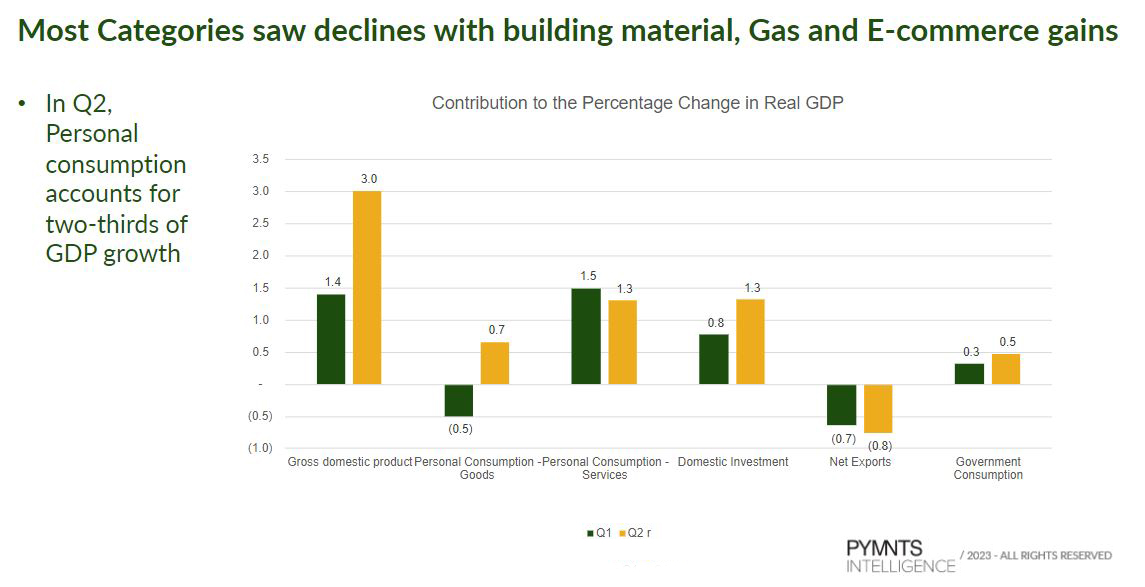

Real GDP increased at an annual rate of 3% in the second quarter, according to the BEA’s second estimate released Thursday. That figure is up from the agency’s advance estimate of 2.8%, which was issued in July, and the 1.4% increase that was seen in the first quarter.

Compared to the advance estimate for the second quarter, the second estimate is based on more complete source data, the BEA said in the release.

“The update primarily reflected an upward revision to consumer spending,” the agency said.

Consumer spending on both services and goods contributed to the upward revision, according to a technical note released Thursday. Spending at nonprofit hospitals and other nonprofit institutions serving households led the increase in services, while spending on gasoline and other energy goods was the greatest contributor to the growth in goods.

When it comes to the growth rates of disposable personal income and personal saving, however, there were slowdowns in the second quarter compared with both the BEA’s advance estimates for the quarter and the figures reported for the first quarter.

Disposable personal income increased $183 billion, or 3.6%, in the second quarter. Compared to the previous estimate, the revised figure is $3.2 billion lower. It’s also down from the increase of $240.2 billion, or 4.8%, recorded in the first quarter.

Real disposable income — which would be adjusted for inflation — increased 1%, unrevised from the previous estimate and lower than the 1.3% increase seen in the first quarter.

Personal saving was gauged at $686.4 billion in the second quarter. Compared to the previous estimate for the same quarter, that figure was revised downward by $34.1 billion. It was also down from the $777.3 billion recorded in the first quarter.

The personal saving rate — defined as personal saving as a percentage of disposable personal income — has also slowed. The BEA’s second estimate of 3.3% for the second quarter is 0.2 percentage points lower than its advance estimate of 3.5% and 0.5 percentage points less than the 3.8% seen in the first quarter.

Consumers have managed to keep spending, or at least keep their intent to spend intact, even though most of their collective paychecks are earmarked to meet expenses, with little left over to put into savings, PYMNTS reported in June.

In many cases, that spending is being confined to essential goods and services. Among consumers who expect to have to dip into their savings this year, most expect to do so to afford things they need, rather than things they only want, according to the PYMNTS Intelligence report “New Reality Check: The Paycheck-to-Paycheck Report: Pessimism About Pay Rises Offsets the Effect of Falling Inflation.”

Retailers have noted this trend in earnings calls. In June, for example, Joel Anderson, who was CEO of Five Below at the time before moving to Petco, said consumers are being “more discerning with their dollars, increasingly buying to need.”